Gold: Central banks turn sellers for first time in a decade – WGC

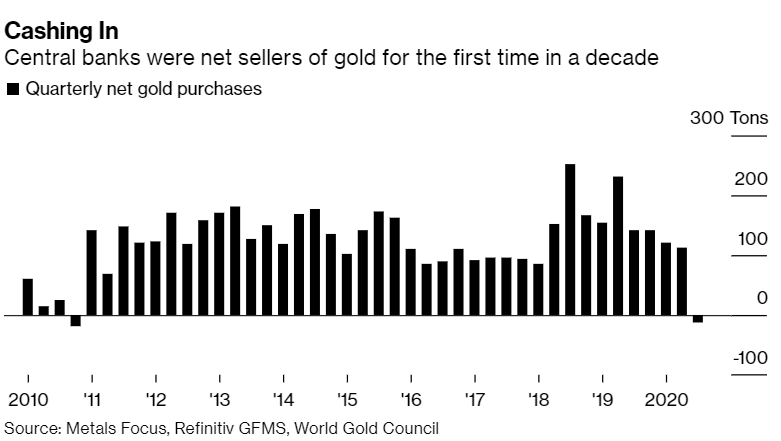

Taking advantage of the near-record high prices in order to cushion the economic shock from the coronavirus pandemic, central banks have turned into gold sellers for the first time in a decade, Bloomberg cites a report published by the World Gold Council (WGC).

Key takeaways

“Net sales totaled 12.1 tons of bullion in the third quarter, compared with purchases of 141.9 tons a year earlier.”

“Selling was driven by Uzbekistan and Turkey, while Russia’s central bank posted its first quarterly sale in 13 years”.

“It’s not surprising that in the circumstances banks might look to their gold reserves. Virtually all of the selling is from banks who buy from domestic sources taking advantage of the high gold price at a time when they are fiscally stretched.”

“The central banks of Turkey and Uzbekistan sold 22.3 tons and 34.9 tons of gold, respectively, in the third quarter.”

Related reads

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.