Gold Price Analysis: XAU/USD could fall to $1,849 as covid fears dominate – Confluence Detector

XAU/USD has been extending its decline, trading at around $1,865 at the time of writing. Markets are becoming more concerned about the rapid spread of COVID-19 in Europe and growing in the US. While that could eventually lead to a larger fiscal stimulus from the US government, Congress has adjourned without taking any decisions.

The elections are also causing a high level of uncertainty and it could move gold in all directions.

See Gold Price Analysis: XAU/USD has three ways go in response to the 2020 Presidential Elections

In the meantime, how are technicals looking for XAU/USD?

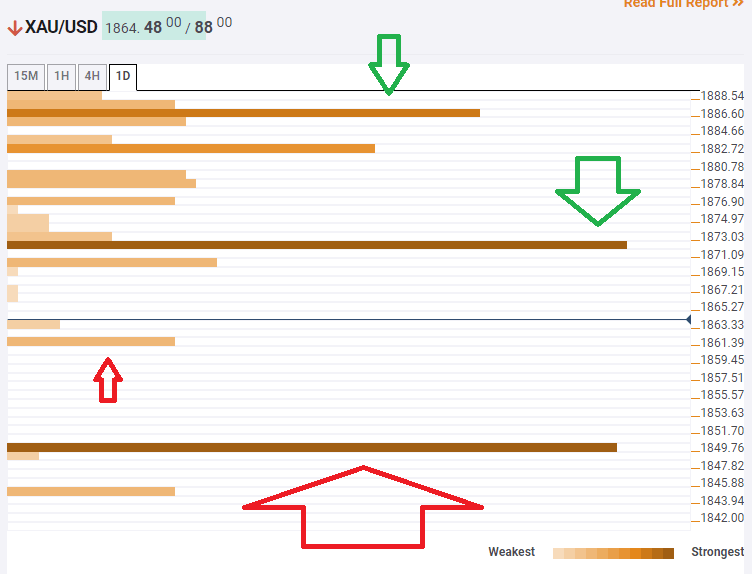

The Technical Confluences Indicator is showing that gold only has weak support at $1,861, which is the meeting point of the Pivot Point one-day Support 1 and the Bollinger Band 15min-Lower.

A critical cushion awaits at $1,849, which is the convergence of the previous monthly low and the Pivot Point one-week Support 3.

Looking up, strong resistance is at $1,872, which is the confluence of the Fibonacci 161.8% one-week, the previous 4h-low, and the PP one-week Support 2.

The upside target, in case of a recovery, awaits at $1,886, which is a juncture of levels including the BB 1h-Upper and the PP one-week S1.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.