GME Stock News: GameStop Corp edges higher as SEC readies meme saga report

- NYSE:GME gained 0.82% on Friday during October’s first trading session.

- The SEC is getting ready to release its report on the short squeeze saga.

- A new survey shows that retail investors have no clue about stock research.

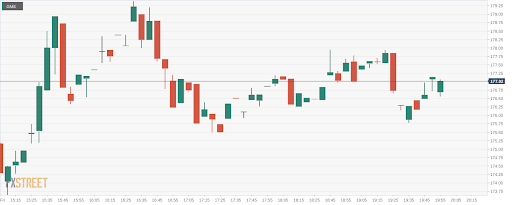

NYSE:GME is once again at the center of headlines on Wall Street, but this time the stock price has been mostly unaffected. In fact, since its last small surge in June alongside AMC (NYSE:AMC), GameStop largely hasn’t been acting like a meme stock at all. This could have to do with the stock being added to the Russell 1000 small-cap index back at the end of June. On Friday, to kick off the fourth quarter of 2021, shares of GameStop gained 0.82% and closed the session at $176.91. GameStop shareholders are ready to put September behind them as the stock lost over 17% during the past month.

Stay up to speed with hot stocks' news!

The short squeeze saga from January simply will not go away, but thankfully for shareholders, GameStop shares aren’t paying the price this time. The SEC is preparing to release its report on the meme stock saga, and the results could forever change the way brokerages, market makers, and investors interact with each other. At the top of the list of things that will be addressed is the gamification of investing with zero-dollar fees for trades, payment for order flow, and short selling disclosures.

GME stock forecast

A recent Survey Monkey survey has some shocking and revealing data about how retail investors are approaching the stock market. Nearly 40% of investors who started trading in 2020 or later, rely on social media platforms like Twitter (NYSE:TWTR) or Reddit to choose which stocks to buy. This is compared to only 12% of people who started investing before 2019. It seems as though the meme stock phenomenon has super charged investor reliance on discussion forums, rather than through individual research.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet