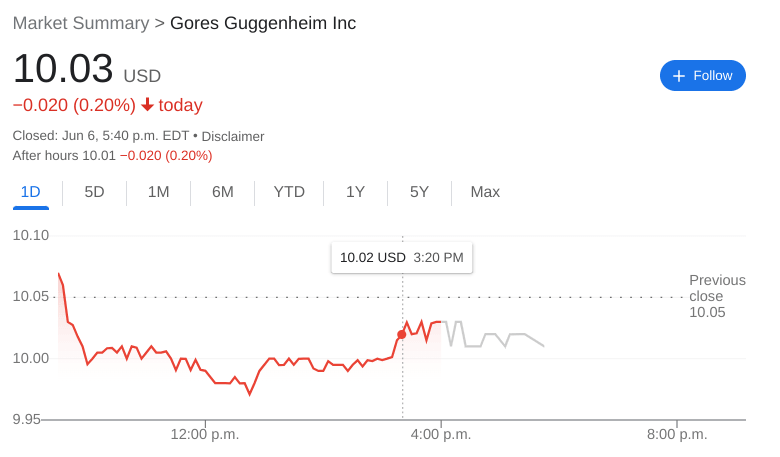

GGPI Stock Forecast: Gores Guggenheim inches lower during flat trading session for US markets

- NASDAQ:GGPI fell by 0.20% during Monday’s trading session.

- Polestar has introduced a referral system for customers.

- Tesla CEO Elon Musk backtracks on his comments cutting 10% of the workforce.

NASDAQ:GGPI remains anchored to the $10.00 pre-SPAC NAV price less than three weeks out from the vote for its merger with Polestar. On Monday, shares of GGPI edged lower by 0.20% and closed the trading day at $10.03. US markets had difficulty finding direction on Monday, although all three major averages managed to close the day higher to start the week. The Dow Jones inched higher by 16 basis points, while the S&P 500 and NASDAQ added 0.31% and 0.40% respectively during the session.

Stay up to speed with hot stocks' news!

Polestar has announced that it will be introducing a customer referral program similar to the one Tesla (NASDAQ:TSLA) had for its early adopters. Unfortunately for Polestar owners, it won’t be as lucrative as the $1,000 or even free vehicles that Tesla offered in its early days. Polestar’s referral program will mostly be in the form of charging credits for existing users, although US owners look like they will be receiving a bundle of Google products to use at home. While it’s hard to compare with what Tesla once offered, it is certainly a step in the right direction for Polestar who are trying to penetrate the US market which has so far been dominated by Tesla.

GGPI stock price

Speaking of Tesla, CEO Elon Musk backtracked on his comments of reducing his workforce by 10% last week. The comments on Friday caused shares of Tesla to drop by nearly 10%. Since then, Musk corrected the claim, citing that Tesla will be actually adding workers this year but potentially reducing its total salary count. This means it is likely executives and office workers that will be cut from the company.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet