GBP/USD: The calm before the storm below critical daily trendline resistance

- The calm before the storm could be playing out in holiday markets ahead of key US events.

- Cable is making hard work of the late summer recovery.

- GBP/USD bears are lurking below a critical 38.2% Fibo and trendline resistance.

- Chart of the Week: GBP/CAD is ripening for a short below 1.7350

GBP/USD is stuck in the mud on Monday trading for the entire day between a narrow range of between 1.3734 and 1.3775 and at the lowest ATR for 2021 so far at 0.00796.

Domestically, the UK has a very quiet week ahead, starting off with a bank holiday Monday, hence the calm in markets as London traders soak up their last rays of summer sunshine.

Meanwhile, cable has struggled to hold onto its top spot this month, capped below 50% of the August drop.

More on that below. In the meantime, the focus is on the US dollar.

There was a long build-up to Friday's speech from the Federal Reserve's Jerome Powell, chairman of the central bank.

From a virtual annual Jackson Hole Symposium 2021, there was anticipation in the markets for more clues of the timings of a taper of the Fed's Quantitative Easing.

However, nothing new came from the event which resulted in an unwinding of additional speculative long US dollar positions, at least in the spot market.

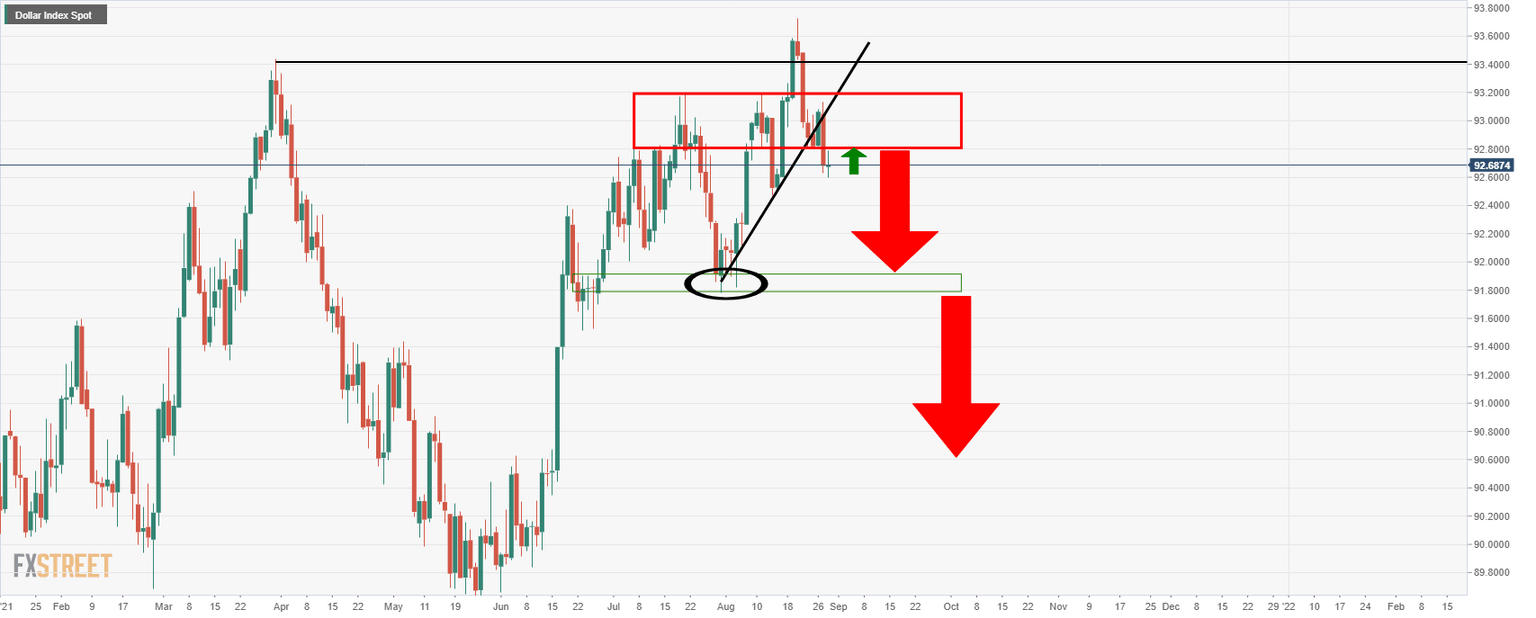

DXY, an index that measures the US dollar against a basket of six major rival currencies, suffered an outside down day on Friday as a result.

The index is now on track to test the August 13 low near 92.471 with a low on Monday scored at 92.598 so far.

A break below would set up a test of the July 30 low near 91.782:

(Daily chart)

There could be more to go to the downside considering the outcome of the event and how speculators increased their net long US dollar positions in the prior week, according to calculations by Reuters and US Commodity Futures Trading Commission data released on Friday.

The value of the net long dollar position jumped to $8.50 billion in the week ended Aug. 24, compared with a net long of $1.06 billion the previous week.

This was the largest long position since March 2020.

Markets are still going to be digesting Jackson Hole considering the divergence between the Fed chair's rhetoric to that of some of his colleagues.

Many of Powell's colleagues, such as James Bullard and Robert Kaplan, Esther George had been making the case for an imminent taper in the runup to the event.

Markets had been positioning for an announcement to come as soon as September with expectations of tapering to start in October and concluding in late 1Q 2022/2Q 2022.

However, Jerome Powell merely suggests it “could” be appropriate to begin the taper this year.

He gave no hint as to actual timings and instead explained that the decision-making process would involve a delicate balancing act between the data and the spread of the Delta Covid variant.

Powell stressed that while the Fed has probably got to the point where “substantial further progress” has been made on inflation “we have much ground to cover to reach maximum employment”.

He explained that an “ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired”. In an environment of “substantial” labour market slack, this could be “particularly harmful”.

Even more dovish, he made clear of the disconnect any QE tapering from eventual interest rate rises.

Powell stated that “the timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff”.

The data remain key

This makes the August Nonfarm Payrolls a key event at the end of this week and Monday/Tuesday will potentially be the clam before the storm in markets.

''If the outlook changes and the U.S. economy slows significantly, then it would be a likely game-changer for the dollar,'' analysts at Brown Brothers Harriman stressed.

''The Fed would have no choice but to adjust its expected tapering path significantly. Yet even then, the dollar may hold up better than expected since a US recession would likely be part of a broader global downturn. It all goes back to relative performances.''

Of course, jobs data Friday is the main event, but Wednesday's PMIs will be critical, and the ADP jobs report and Jobless Claims also have the potential to stir up volatility before Friday's showdown.

In terms of the PMIs, analysts at TD Securities said, '' the surveys that have already been released point to some slowing in activity as the boosts from reopening and fiscal stimulus fade. The latest COVID wave is likely causing some slowing as well. That said, index levels have remained fairly high, consistent with a still-solid pace for growth.''

As for the Nonfarm Payrolls, the analysts said they ''probably slowed sharply after a 943k surge in July.''

''The pattern reflects less help from the seasonal adjustment process, particularly for the government sector, but underlying momentum appears to have faded as well. That is the signal from the Homebase data, even as claims have been falling. Slowing would help the case for no tapering announcement in September.''

Meanwhile, for GBP, after the CAD, the pound remains the second-best performing G10 currency in the year to date.

A less dovish Bank of England, as well as the vaccine rollout, had supported it at the start of the year.

Brexit headlines subsided as well due to a deal that was put in place before the end of 2020 giving some relief to the currency.

The US dollar firmed later in the year on hawkish sentiment at the Fed which capped cable in its tracks towards a break of 1.4250 in June.

Therefore, there is going to be a lot at stake in the coming days weeks for cable traders depending on the US data and inflation expectations, on and off UK shores.

''Whether cable can return to 1.40 before the end of this year likely depends on how the Fed and the BoE perceive inflation risks,'' analysts at Rabobank said recently.

''While we maintain there is scope for GBP to make some headway vs, the EUR by year-end, we see risk that GBP/USD1.40 could remain just out of reach in the months ahead.''

Bullish, the analysts also said ''the fact that the Bank’s asset purchase programme is due to be completed by the end of this year already positions the MPC as less dovish than various other G10 central banks, in particular the ECB.''

''Assuming better UK data for August than July, we continue to expect EUR/GBP to edge towards 0.84 by year end.''

''Assuming the USD holds relatively firm, GBP/USD could struggle to move beyond the 1.38/39 area by year end.''

GBP/USD technical analysis

Meanwhile, sterling is making hard work of its late summer recovery which leaves the monthly head and shoulders still in play:

Daily chart

Monthly chart

''A break above $1.3795 and then $1.3835 is needed to set up a test of the July 30 high near $1.2985,'' analysts at BBH explained.

GBP crosses, technical analysis

At the start of the week, the Chart of the Week forecasted a drop in GBP/CAD which has already started to play out for swing trading opportunities.

More on that here: Chart of the Week: GBP/CAD is ripening for a short below 1.7350

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.