Pump.fun Price Forecast: PUMP prepares for early-year rally as DEX volume skyrockets

- Pump.fun rises for the eighth consecutive day as attention shifts toward meme coin trading.

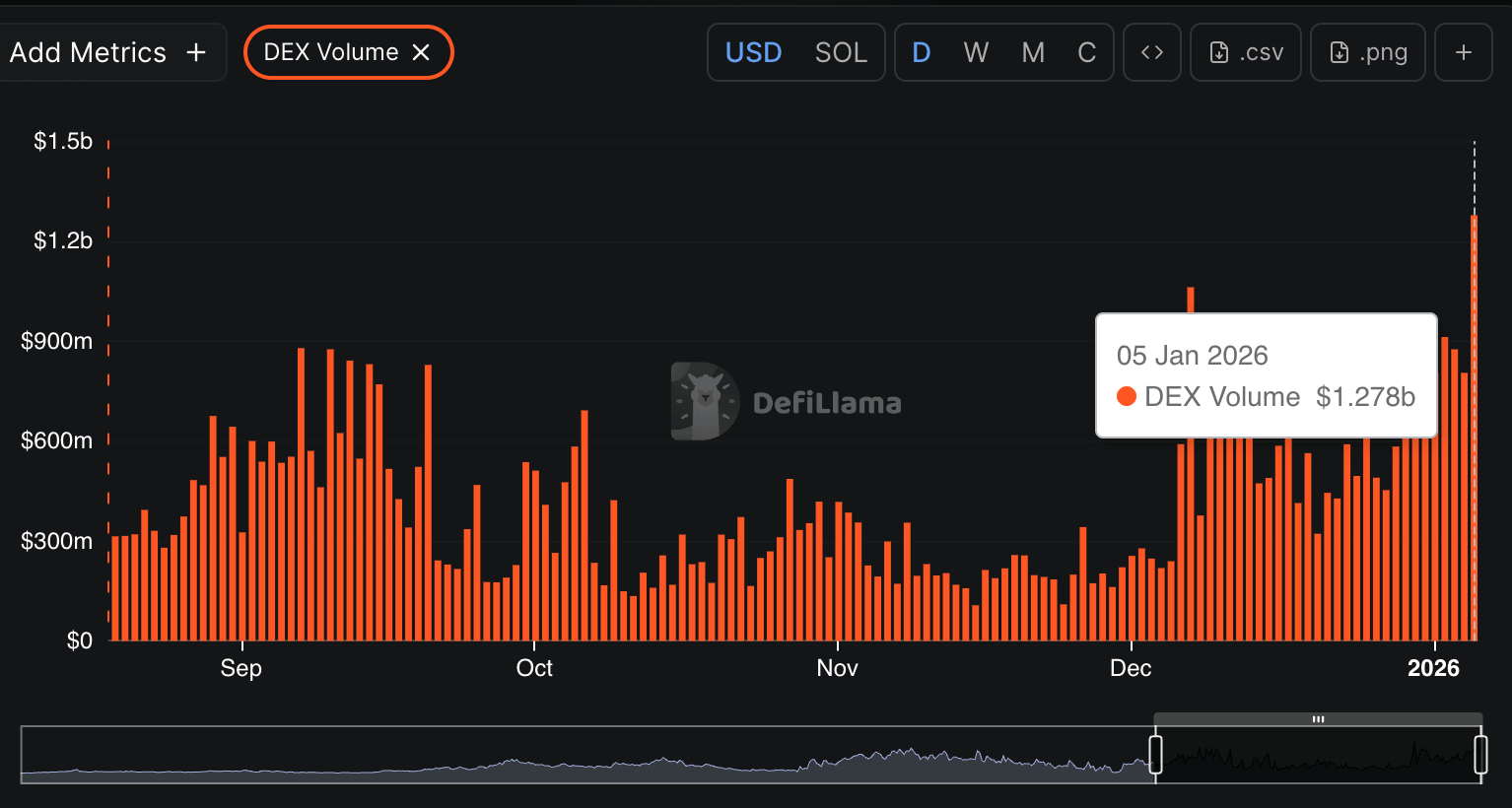

- Pump.fun DEX volume hits a monthly high of $1.28 billion, reflecting improving sentiment around meme coins.

- The PUMP derivatives market holds the price increase, as futures Open Interest exceeds $230 million.

Pump.fun (PUMP) is rising alongside crypto majors such as Bitcoin (BTC) and is trading above $0.002400 at the time of writing on Tuesday. The Decentralized Exchange (DEX) native token outlook builds on a bullish tone developed since December 30.

PUMP may extend its uptrend this week if meme-driven trading activity continues to increase. Pump.fun is a leading meme coin trading platform with a DEX volume exceeding $1.28 billion.

Rising meme coin demand strengthens PUMP’s recovery outlook

Meme coin trading activity has surged over the past few days, pushing the DEX volume on Pump.fun to $1.28 billion as of Monday, up from approximately $805 million the previous day.

PUMP benefits from meme coin-driven trading activity in several ways, including token buybacks that depend on revenue generated. Pump.fun allocates nearly 100% of revenue to the token buyback program, which is expected to build long-term value for PUMP. PUMP is also used as a governance token, allowing holders to participate in decision-making.

Meanwhile, retail interest in PUMP has increased, albeit gradually, since the start of the year. CoinGlass data shows futures Open Interest (OI) averaging $231 million on Tuesday, up from approximately $207 million on Monday and $150 million on last Thursday.

A steadily rising OI indicates that traders are confident PUMP has the potential to sustain a short-term recovery. This confidence encourages retail investors to lean into risk, which contributes to buying pressure.

Technical outlook: PUMP eyes short-term breakout

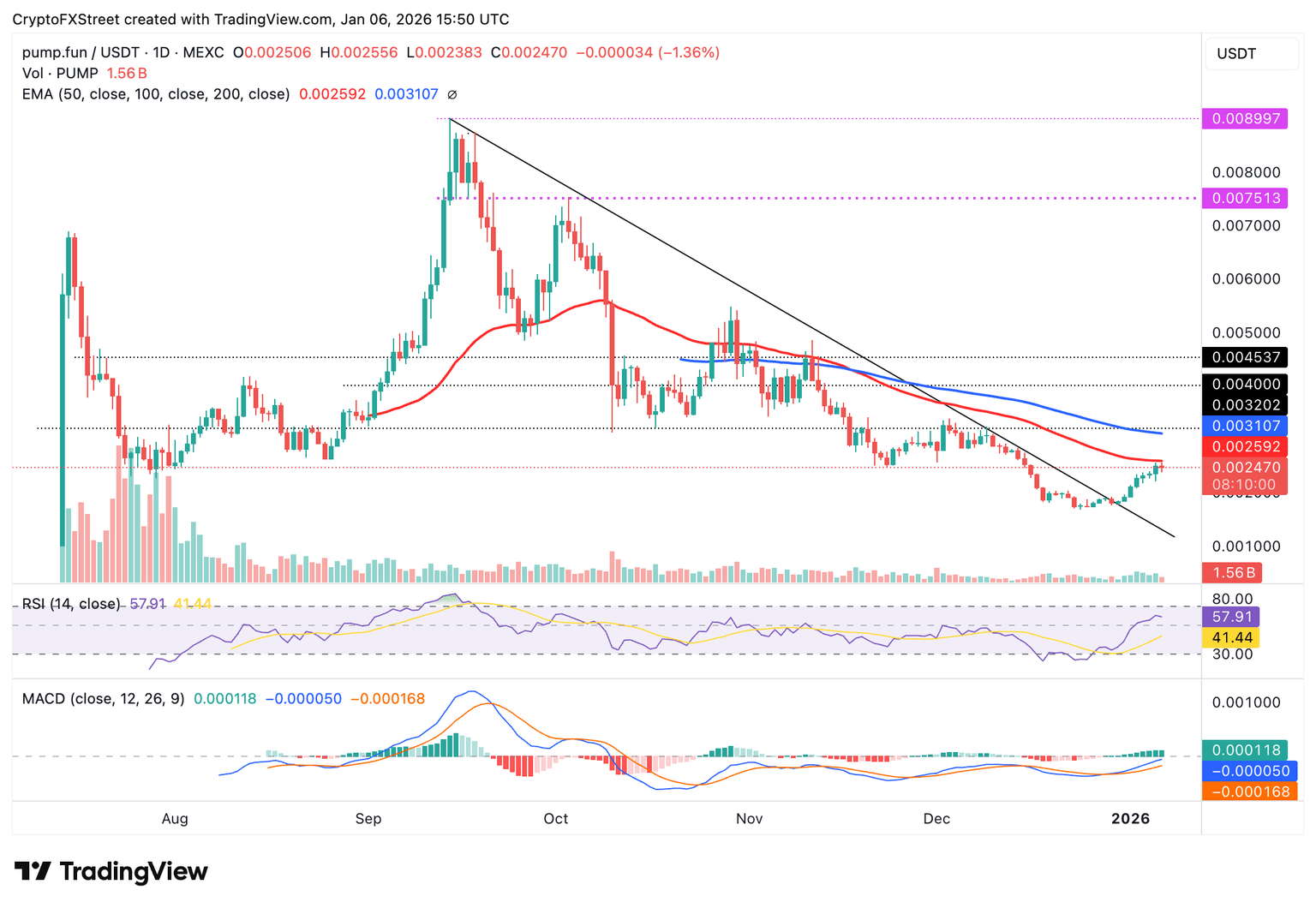

PUMP is trading above $0.002400 at the time of writing on Tuesday, with the Moving Average Convergence Divergence (MACD) indicator on the daily chart, supporting the token’s short-term bullish outlook.

The blue MACD line has maintained a positive divergence above the red signal line since December 31, while the expanding histogram bars above the mean line indicate that bullish momentum remains intact.

However, PUMP should close above the 50-day Exponential Moving Average (EMA) at $0.002992 to ascertain its recovery potential and encourage traders to increase exposure. Above this level, the 100-day EMA caps the upside at $0.003107.

Still, the Relative Strength Index (RSI) at 58 indicates weakness and may decline toward the midline. A weak RSI signals PUMP is losing support from buyers as profit-taking ramps up. The buyer concentration around $0.002000 could be worth watching for fresh entries if the price corrects further.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren