GBP/USD Price Analysis: Volatility contracts above 1.2700 despite cheerful market mood

- GBP/USD is showing signs of volatility contraction despite the risk-on mood.

- Cable’s upside is restricted as UK’s high inflation has dampened its outlook while the downside is supported due to USD Index’s correction.

- BoE Bailey is expected to remain hawkish as UK’s core inflation has printed a fresh high of 7.1%.

The GBP/USD pair is trading back and forth in a narrow range of 1.2700-1.2750 in the early London session. The upside in the Cable is restricted as higher inflationary pressures in the United Kingdom have dampened its economic outlook while the downside is supported due to correction in the US Dollar Index (DXY).

The US Dollar Index is hovering near 102.60 as investors are divided about the monetary outlook by the Federal Reserve (Fed). Fed chair Jerome Powell conveyed last week that the central bank will continue tightening interest rates but at a careful pace.

Going forward, the speech from Bank of England (BoE) Governor Andrew Bailey will remain in focus. BoE Bailey is expected to remain hawkish as UK’s core inflation has printed a fresh high of 7.1%.

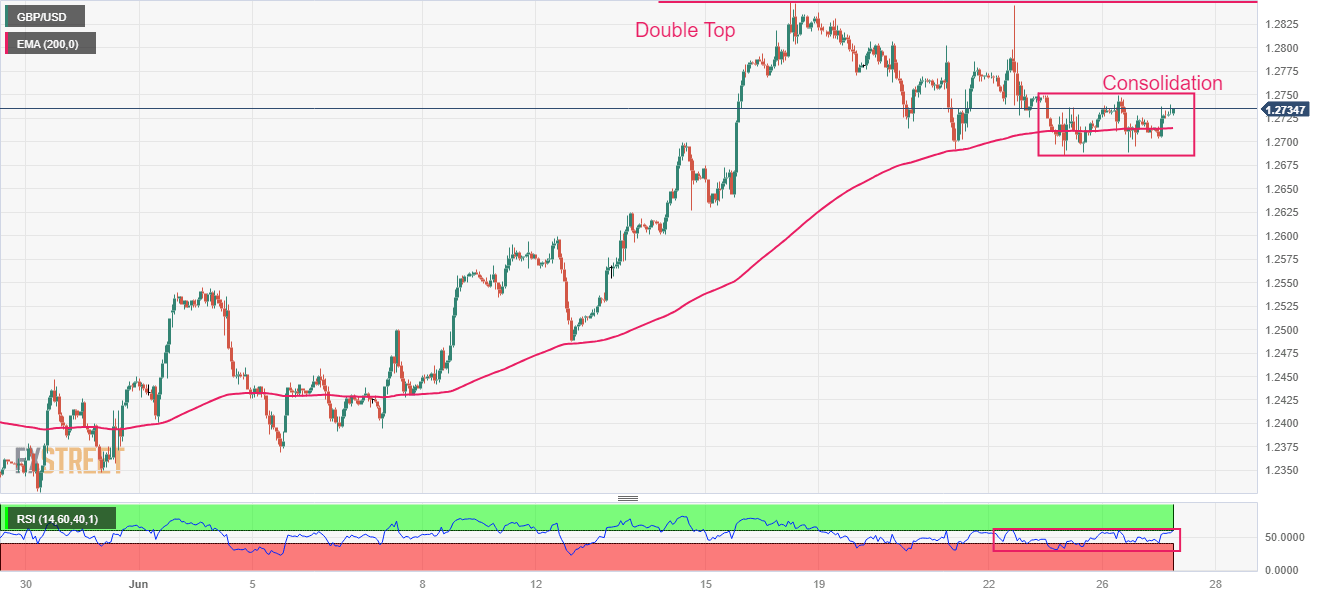

GBP/USD delivered a steep fall after forming a Double Top chart pattern on an hourly scale around 1.2848. The Cable is showing signs of volatility contraction around 1.2750, which indicates non-directional performance but is followed by wider ticks and heavy volume after a breakout move.

The 200-period Exponential Moving Average (EMA) at 1.2723 has turned straight, portraying a lackluster performance.

Also, the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates that investors await a potential trigger for further action.

Bullish bias for the Cable would strengthen if it manages to climb above the fresh annual high around 1.2850. The upside move would expose the asset to 28 September 2020 high at 1.2930 followed by psychological resistance at 1.3000.

The bullish bias could fade if Cable drops below the previous month’s high around 1.2669, which would drag the asset toward June 12 high at 1.2600. A slippage below the latter would expose the asset to June 09 low at 1.2534.

GBP/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.