GBP/USD Price Analysis: Tests the upside break of triangle near 1.1350

- An explosion of a neutral triangle results in wider ticks and heavy volume.

- A bull cross, represented by 20-and 50-EMAs, indicates more upside ahead.

- For a confident upside, the RSI (14) is needed to sustain in the bullish range of 60.00-80.00.

The GBP/USD pair is displaying back-and-forth moves in a narrow range of 1.1344-1.1370 in the Tokyo session. The asset has turned sideways following the footprints of the US dollar index (DXY), which is indicating volatility contraction. The risk-off market mood is gaining more traction as S&P500 futures have extended their gains. Also, the 10-year US Treasury yields have surrendered the crucial support of 4% despite firmer bets for hawkish Federal Reserve (Fed) policy.

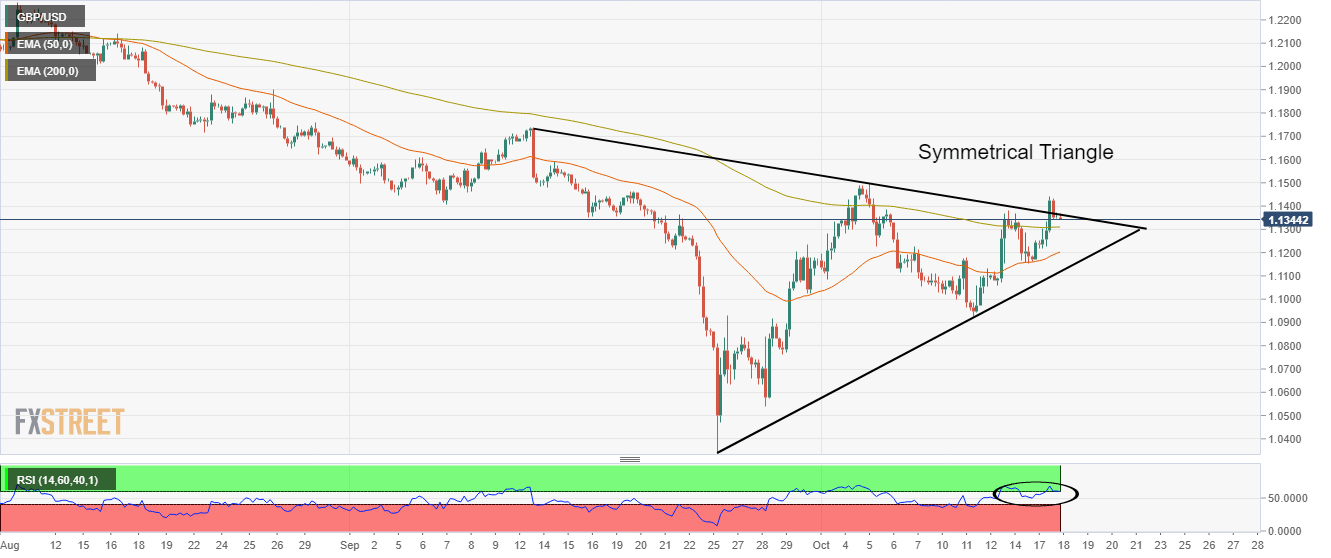

On a four-hour scale, the pound bulls are testing the north-side break of the symmetrical triangle chart pattern. The downward-sloping trendline of the above-mentioned chart pattern is placed from September 13 high at 1.1738 while the upward-sloping trendline is plotted from September 26 low at 1.0339. An explosion of a neutral triangle results in wider ticks and heavy volume.

A bull cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at 1.1125, adds to the upside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bullish range of 60.00-80.00 but requires sustaining in the range comfortably.

Going forward, an upside break of Monday’s high at 1.1440 will drive the cable towards September 14 high at 1.1590, followed by September 13 high at 1.1738.

On the flip side, a drop below the 50-EMA at 1.1200 will drag the asset toward the psychological support of 1.1000. If cable surrenders the psychological support, it will expose to more downside towards October 12 low at 1.0924.

GBP/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.