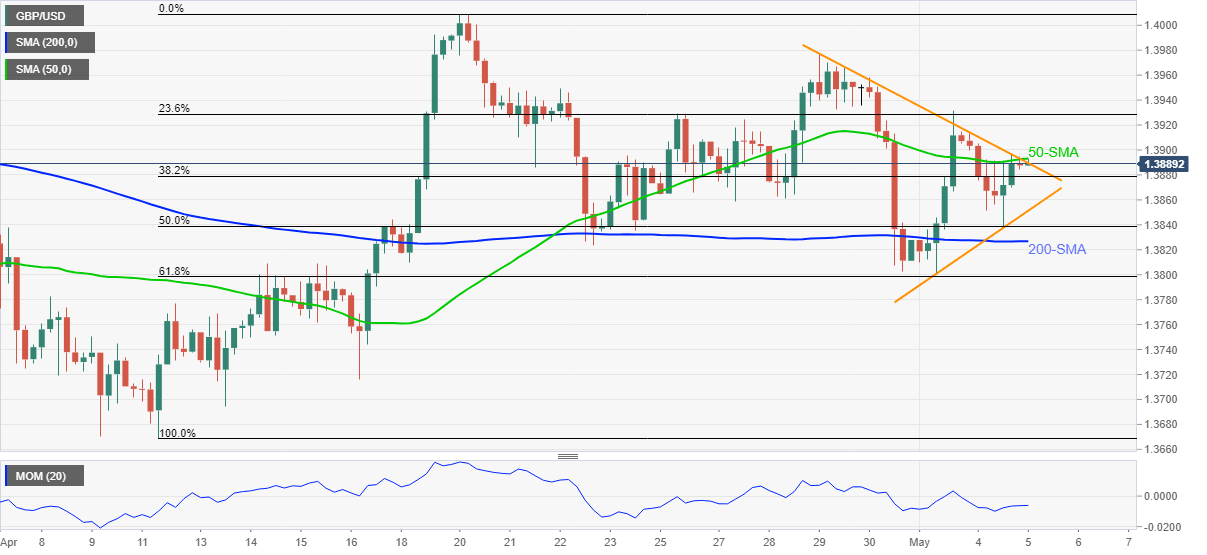

GBP/USD Price Analysis: Teases upside break of immediate triangle around 1.3900

- GBP/USD holds onto latest recovery as bulls attack 50-SMA, upper line of the one-week-old symmetrical triangle.

- Momentum indicator suggests no movement but sustained trading beyond 200-SMA, the key Fibonacci retracement levels favor bulls.

GBP/USD picks up bids around 1.3895, up 0.05% on a day, during Wednesday’s Asian session. In doing so, the cable keeps recent recovery moves to challenge the immediate upside hurdle, namely 50-SMA and short-term triangle resistance.

Although the Momentum line favors steady moves, the GBP/USD pair’s successful recovery from 200-SMA and 61.8% Fibonacci retracement of April 12-20 upside keep buyers hopeful.

However, the 1.3900 threshold adds to the upside barrier, in addition to the immediate 1.3895 key hurdle, before recalling the bulls targeting the 1.4000–4010 strong resistance area including the previous month’s top.

On the flip side, pullback moves need to break the stated triangle’s support line, around 1.3850, before directing GBP/USD sellers to 50% Fibonacci retracement level and 200-SMA, respectively near 1.3835 and 1.3825.

Should the pair remains pressured below 1.3825, 61.8% Fibonacci retracement will challenge the bears around 1.3800 psychological magnet.

GBP/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.