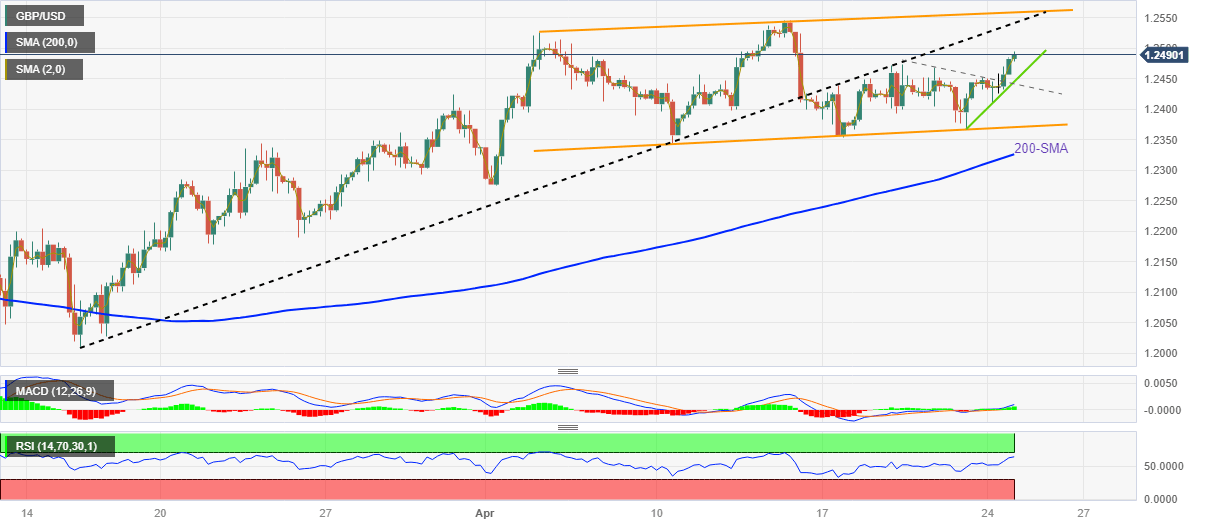

GBP/USD Price Analysis: Renews one-week high around 1.2500 within bullish channel

- GBP/USD extends Friday’s U-turn from three-week-old rising channel’s support.

- Cable buyers cheer upside break of weekly resistance line, bullish MACD signals.

- Previous support from mid-March, channel’s top line to prod bulls.

- Immediate trend lines highlight 1.2440 as short-term key support ahead of stated channel’s bottom, 200-SMA.

GBP/USD marches to the highest levels in seven days as bulls attack the 1.2500 threshold during Tuesday’s Asian session. In doing so, the Cable pair justifies the late Monday’s upside break of a one-week-old previous resistance line, as well as the bullish MACD signals, while staying within a three-week-long ascending trend channel.

With this, GBP/USD appears all set to extend the latest run-up towards the previous support line from March 15, around 1.2540. However, the aforementioned channel’s top line, close to 1.2560 by the press time, could challenge the pair buyers afterward.

It’s worth noting, however, that the RSI (14) is approaching the overbought territory and hence the GBP/USD pair’s upside past 1.2560 appears difficult.

In a case where the quote rises past 1.2560, the 1.2600 round figure and the May 2022 peak of around 1.2665 will be in the spotlight.

On the flip side, a convergence of the one-week-old previous resistance line and an upward-sloping trend line from Friday, close to 1.2440, puts a floor under the GBP/USD prices.

Following that, the stated channel’s bottom line and the 200-SMA, respectively near 1.2370 and 1.2325, could challenge the Cable bears before giving them control.

Even so, the monthly bottom around 1.2275 can act as an extra filter towards the south.

GBP/USD: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.