GBP/USD eyes key 1.4115 support amid firmer US dollar

- GBP/USD remains pressured as the US dollar cheers a downbeat mood.

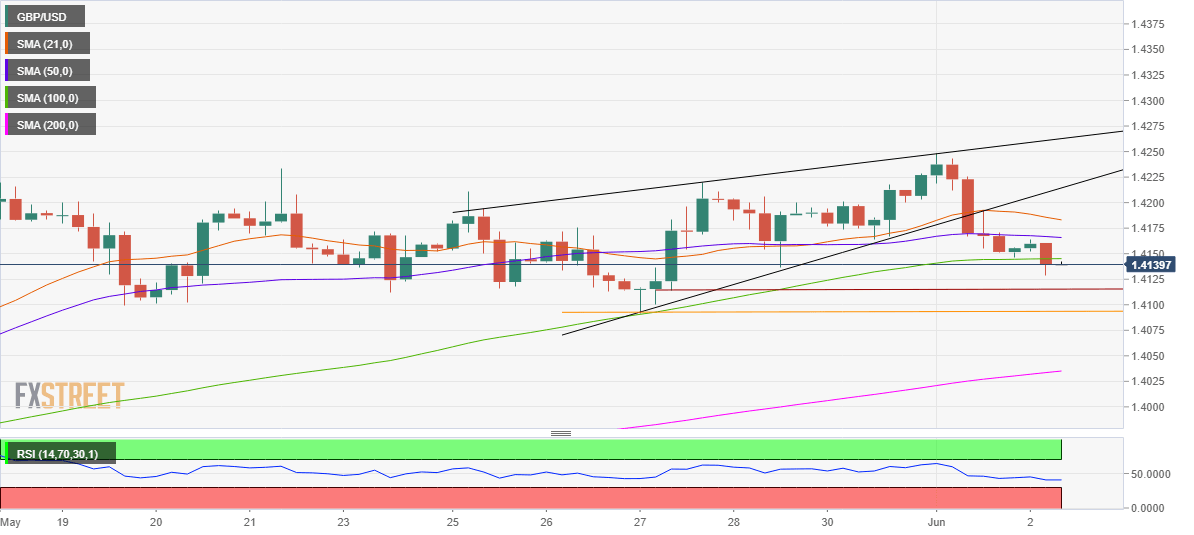

- Rising wedge breakdown confirmed on 4H chart, eyes more downside.

- RSI points south while teasing the central line.

GBP/USD is looking to extend the correction from three-year highs, as the sellers remain in control amid a broadly firmer US dollar and bearish technical setup.

The US dollar continues to trade on the front foot across its major rivals, as the cautious trading seen in the European equities fuels flight to safety in the buck.

Meanwhile, the cable struggles amid macroeconomic divergence between the UK and the US, as investors shrug off the reopening optimism. The downward revision to the UK Manufacturing PMI data adds to the downside in the spot.

From a near-term technical perspective, the spot remains on track to test the immediate support at the horizontal trendline at 1.4115 after it confirmed a rising wedge breakdown on the four-hour chart.

Further south, the next downside target (orange trendline support) awaits at 1.4093

The Relative Strength Index (RSI) is pointing south while below the midline, backing the bearish case.

GBP/USD four-hour chart

On the upside, recapturing a 100-simple moving average (SMA) at 1.4150 on a sustained basis is critical for reviving the recovery towards the 50-SMA at 1.4166.

Buyers will then aim for the 1.4200 round figure.

GBP/USD additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.