GBP/USD Price Analysis: Cable justifies downbeat UK retail spending to reverse from 50-SMA to 1.2750

- GBP/USD prints the first daily loss in three, holds lower grounds of late.

- UK BRC Retail Sales suggest the lowest public spending in 11 months.

- 50-SMA precedes 1.2825-30 resistance confluence to test Pound Sterling buyers.

- Upbeat oscillators suggest limited downside room despite presence of three-week-old bearish channel.

GBP/USD takes offers to refresh the intraday low near 1.2755, posting the first daily loss in three amid early Tuesday in Europe. In doing so, the Cable pair justifies downbeat UK data while reversing from the 50-SMA within a three-week-old bearish channel.

The latest survey from the British Retail Consortium (BRC) marked the weakest Retail Sales growth in 15 months as it prints the 1.8% YoY figure for July versus 4.2% prior. Following the data release, the BRC said, per Reuters, that the British retailers suffered from heavy rain in July on top of the impact of high inflation with sales growth dropping to an 11-month low.

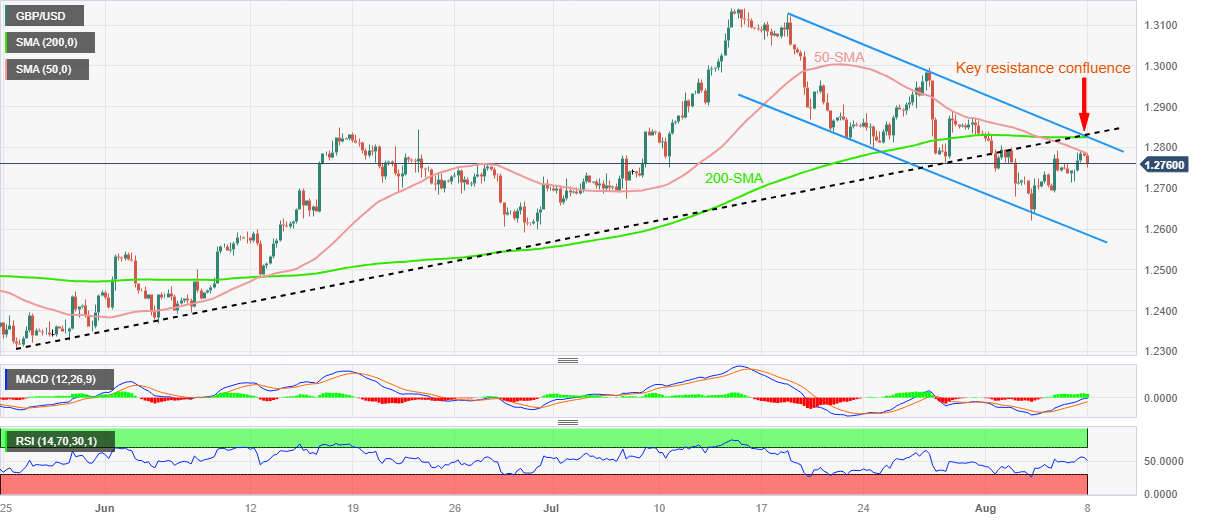

Technically, the Pound Sterling reverses from the 50-SMA hurdle of around 1.2785 as the RSI (14) line retreats. However, the oscillators remain beyond the 50 level suggesting the upbeat momentum and keeping the GBP/USD buyers hopeful amid the bullish MACD signals.

With this, the quote is likely to cross the immediate upside hurdle surrounding 1.2785 with the aim for reclaim the 1.2800 round figure.

However, a convergence of the 200-SMA, the previous support line from May 25 and a top line of the aforementioned descending trend channel highlights the 1.2825-30 as a tough nut to crack for the GBP/USD bulls.

Meanwhile, the 1.2700 round figure and the latest low of 1.2620 can entertain GBP/USD sellers ahead of challenging them with the bottom line of the stated channel, close to 1.2585. It’s worth mentioning that June’s low of 1.2590 can also challenge the Cable bears around 1.2585–90 zone.

GBP/USD: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.