Pound Sterling flattens against US Dollar ahead of key US data releases

- The Pound Sterling trades slightly lower against the US Dollar ahead of key US employment and Services PMI data.

- This week, the notable release will be the US NFP data, which is scheduled for Friday.

- Investors expect the BoE to maintain a monetary easing approach amid weak job market conditions.

The Pound Sterling (GBP) edges lower near 1.3490 against the US Dollar (USD) during the European trading session on Wednesday. The GBP/USD is mildly under pressure as the US Dollar ticks up ahead of an array of United States (US) economic data, including ADP Employment Change and ISM Services Purchasing Managers’ Index (PMI) data for December, and the JOLTS Job Openings data for November, releasing in the North American session.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges higher to near 98.70.

Investors will closely monitor US employment-related data to get fresh cues on the Federal Reserve’s (Fed) monetary policy outlook.

Economists expect the US ADP to show that private employers added 47K fresh workers after firing 32K in November. Meanwhile, new job postings by overall employers, as measured by the JOLTS Job Opening, are expected to come in at 7.64 million, almost in line with October’s reading of 7.67 million.

Signs of improving US job market conditions would weigh on expectations for more interest rate cuts by the Fed in the near term. On the contrary, soft numbers would prompt them.

The US ISM Services PMI is expected to come in lower at 52.3 from 52.6 in November, indicating that the service business activity continued to expand, but at a moderate pace.

Weak UK job market to keep BoE on downward monetary path

- The Pound Sterling trades broadly stable against its major currency peers during European trading hours. The British currency remains steady while investors brushed off market jitters driven by the US military action in Venezuela during the weekend.

- Earlier this week, market sentiment turned risk-averse after the US attacked Venezuela and captured its President, Nicolas Maduro, over drug-trafficking charges.

- Domestically, the United Kingdom (UK) economic calendar is light; therefore, market sentiment will remain the key driver for the Pound Sterling.

- On the monetary policy front, the Bank of England (BoE) is unexpected to ease monetary conditions aggressively this year as inflation is well above the central bank’s 2% target. However, the monetary policy path will remain downwards as labor market conditions are weak. In the three months ending October, the UK Unemployment Rate jumped to 5.1%, the highest level seen since March 2021.

- This week, the notable event for the GBP/USD pair will be the Nonfarm Payrolls (NFP) data for December, which will be released on Friday. Investors will pay close attention to the US official employment data to get fresh cues on the current state of the labor market. In 2025, the Fed delivered three interest rate cuts of 25 basis points (bps) and pushed them lower to the 3.50%-3.75% range due to weak job market conditions.

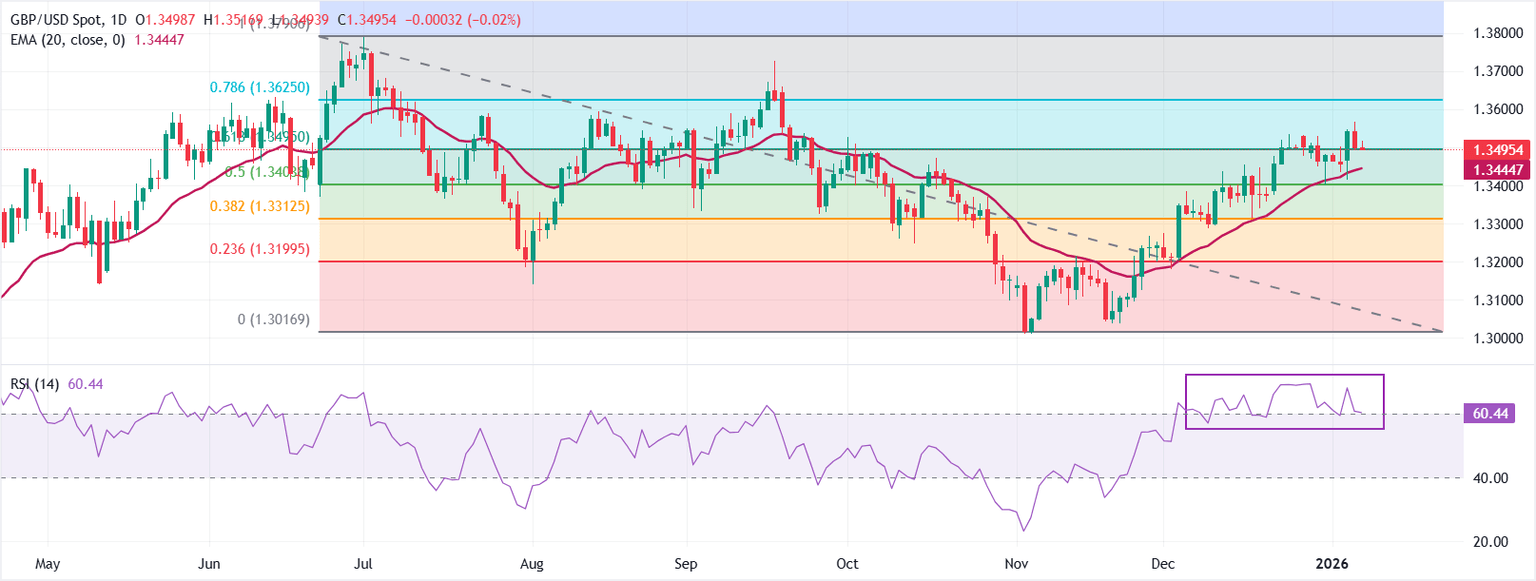

Technical Analysis: GBP/USD sees more upside if it holds above 1.3500

GBP/USD trades at 1.3495 at the time of writing. The 20-day Exponential Moving Average (EMA) rises and sits at 1.3445, underpinning the immediate bullish bias. Price holds above the 20-day EMA, keeping the short-term uptrend intact.

The 14-day Relative Strength Index (RSI) at 60 (neutral-to-bullish) confirms firm momentum without overbought conditions.

Measured from the 1.3791 high to the 1.3017 low, Fibonacci retracements could signal interesting support and resistance zones. The 61.8% Fibonacci retracement at 1.3495 acts as an immediate support. A decisive close above it could open the way toward the 78.6% Fibonacci retracement at 1.3625. On the contrary, a failure to hold 1.3495 would leave scope for consolidation, with the rising EMA at 1.3445 providing a near-term floor.

(The technical analysis of this story was written with the help of an AI tool.)

(This story was updated on January 7 at 11:00 GMT to reflect a last-minute consensus change in the ADP Employment Change for December to 47K.)

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Jan 07, 2026 13:15

Frequency: Monthly

Consensus: 47K

Previous: -32K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.