GBP/USD Price Analysis: Bulls coming up for their last breath?

- GBP/USD is on the verge of another higher high to stretch the pair towards the psychological 1.40 area.

- The focus should be on 4-hour resistance structure, and a breach will open prospects of another bullish daily impulse.

Further to prior analysis of mid-December 2020, GBP Price Analysis: A a break of critical 1.3514 exposes low volume nodes to 1.3820, the upside towards current levels was forecasted on a daily chart as follows:

Current prospects

With the price moving into supply, then there should be a focus on the downside.

However, given how far the US dollar has rallied against a bearish fundamental backdrop, there could be some more juice left in the market to squeeze on the long side for cable.

This gives rise to the suspicion that the recent correction to daily support in cable is over and that a higher-high, deeper into supply territory is on the cards.

Daily chart

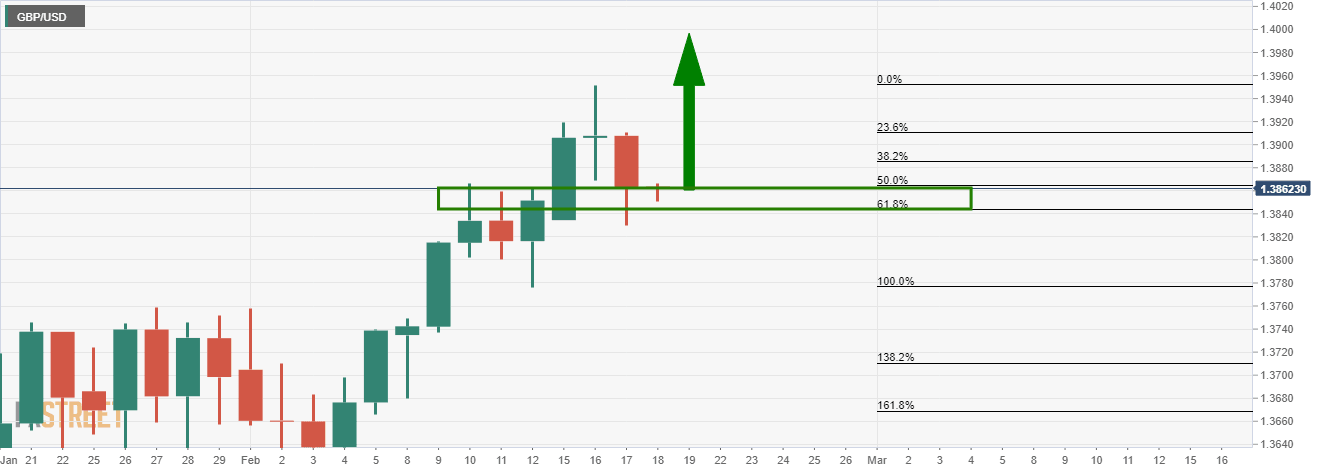

4-hour chart

From a 4-hour perspective, the bulls will want to see a break of resistance that will be then expected to act as support.

This could be the last breath of air that the bulls can muster before a significant sell-off might ensue when considering five uninterrupted months of higher highs and lows.

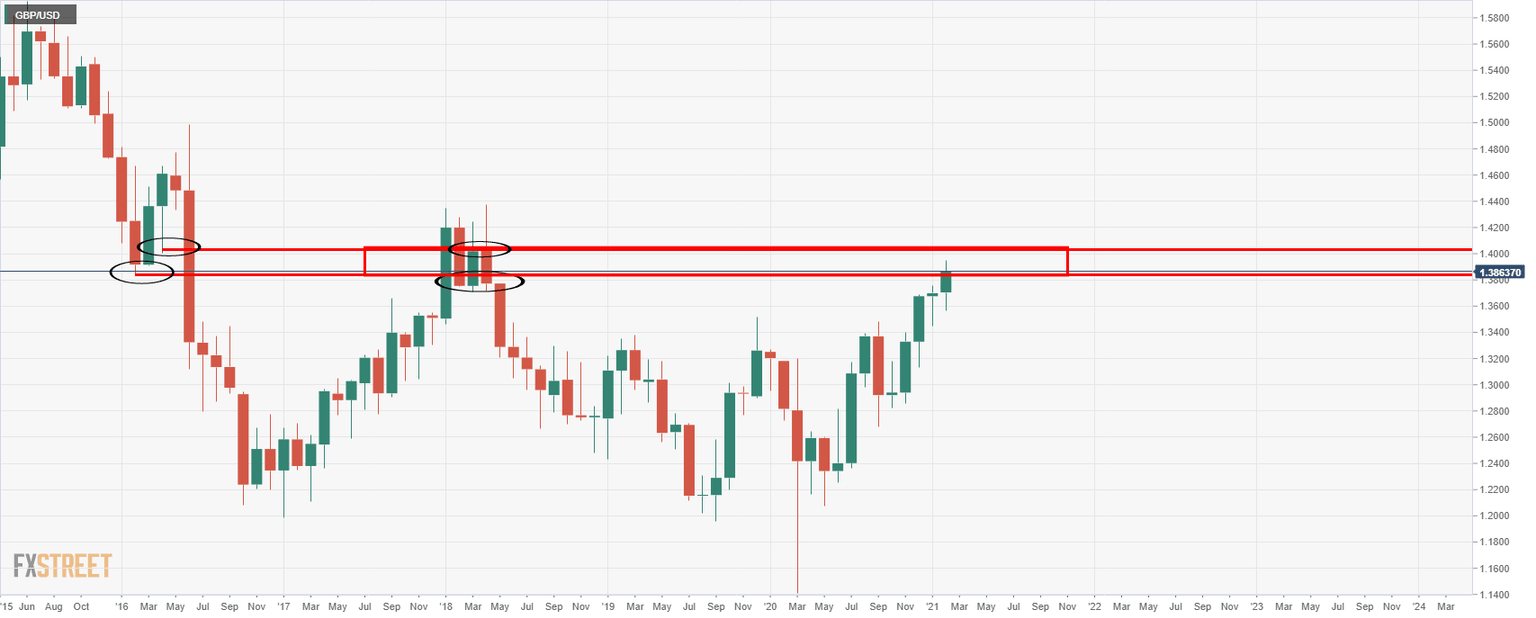

Monthly chart

After such a strong bullish run and meeting what would be expected to be tough resistance, the focus should be on the downside.

However, GBP has been second-best performing G10 for 2021, having risen 1.7% vs the greenback and 2.3% against the EUR.

In the week ending 9 February, GBP positioning jumped, reaching 11-month highs against the dollar as the vaccine rollout kicks-in and Brexit risk kicks-out.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637426285683417321.png&w=1536&q=95)