GBP/USD plunges to 18-month-old fresh lows around 1.2820s on weaker UK data and dismal mood

- The GBP/USD plummets to eighteen-month-lows around 1.2828.

- Weaker than expected, UK economic data and market sentiment were the drivers of the British pound fall.

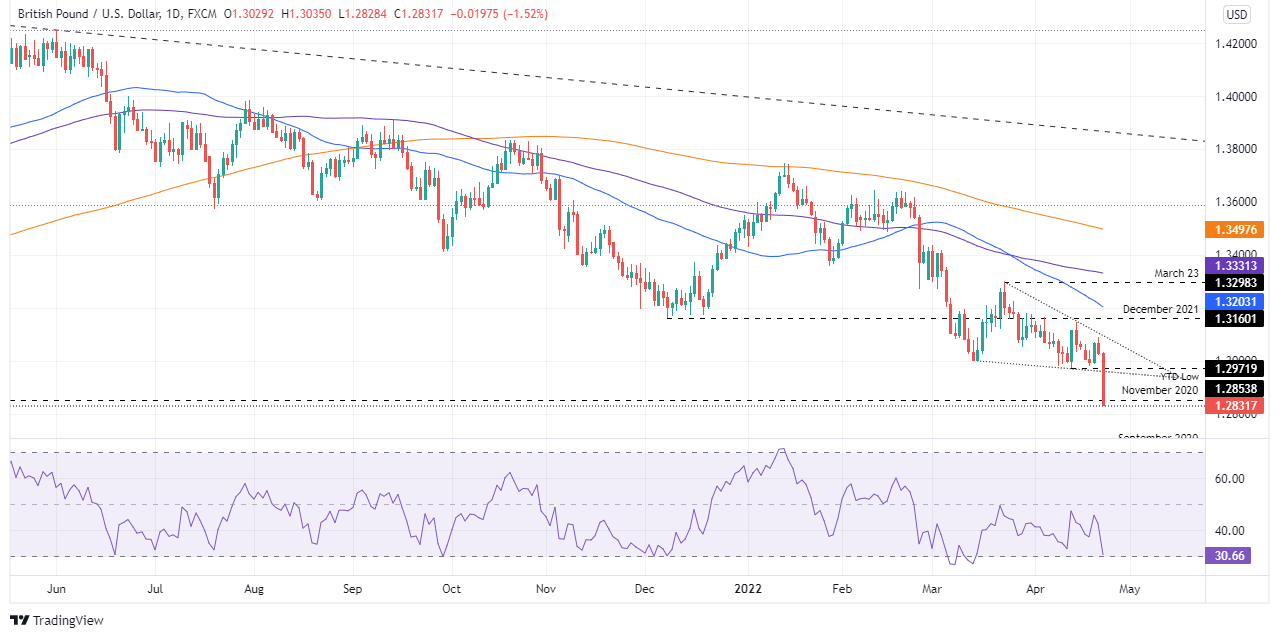

- GBP/USD Price Forecast: Would fall towards 1.2675 if a daily close below 1.2854 is achieved.

The British pound plummets and breaks below 1.3000 and 1.2900 and reaches a fresh eighteen-month low around 1.2828, amidst a dismal market mood and continuing central bank speaking at an IMF event in Washington. At 1.2831, the GBP/USD weakened the most since November 2020.

Global equities are suffering a blood bath in the day. Global bond yields are rising, while the greenback remains buoyant and reaching a fresh YTD high around 101.33, up some 0.61%, as central bankers and finance ministers speak at an IMF panel.

UK economic data and market sentiment weighed on the GBP/USD

The GBP/USD fell on market sentiment and worse than expected UK economic data. The Gfk consumer sentiment hit its worst level since 2008. The UK’s Retail Sales were weaker than foreseen, and S&P Global PMIs for April beat expectations but Services and Composite trailed the previous month’s figures.

Elsewhere, the Bank of England (BoE) Governor Andrew Bailey said inflation would go higher in the UK courtesy of energy prices. Furthermore, Bailey added that the BoE would only make QT active sales in stable markets and cease if conditions change.

In the meantime, on Thursday, Fed Chair Powell added to the hawks in the Fed and said that a hike of 50 bps “is on the table for the May meeting,” while emphasizing that he favors “front-end loading” its tightening cycle. Also, St. Louis Fed President James Bullard admitted that the Fed is behind the curve but not as everybody thinks, while adding that the Fed has hiked 75 bps before without the world coming to an end.

Meanwhile, the US economic docket featured the S&P Global Flash US Manufacturing PMI for April, which rose by 59.7, higher than the 68.2 estimations, and smashed March’s figures. Regarding the Services and Composite component, both readings were shorter than the previous month’s reading.

GBP/USD Price Forecast: Technical outlook

The GBP/USD tumbled of late, below the former YTD high at 1.2972 and is trading below November 2020 lows at 1.2853, as the Relative Strength Index (RSI) aims aggressively towards bearish territory at 31.34 after the GBP/USD dropped 200-pips.

Despite the aforementioned, the GBP/USD has enough room for further losses, and a daily close below November 2020 lows would open the door for a test of September 2020 lows.

With that said, the GBP/USD first support would be 1.2800. A breach of the latter would expose September 28, 2020, lows at 1.2751, followed by 1.2700, and then September 23 swing low at 1.2675.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.