Pound Sterling Price News and Forecast: GBP/USD bulls continue to show resilience near 1.4100 mark

GBP/USD Forecast: Boris's caution and Fed's taper touches may send sterling down

"At the moment" – UK Prime Minister Boris Johnson has denied there is a need to delay the last stage of the UK's reopening but said that more information is needed. The usually confident PM has seemed more cautious after daily COVID-19 cases topped 4,000 and continue their uptrend.

While Britain's vaccination campaign is well-advanced – and continues at full speed – the new increase in infections is becoming more worrying. The Delta variant, originally identified in India, remains of worry to the UK and its neighbors, which wary receiving people arriving from Britain. The reopening – dubbed "Freedom Day" is due on June 21. Read more...

GBP/USD Analysis: Bulls continue to show resilience near 1.4100 mark

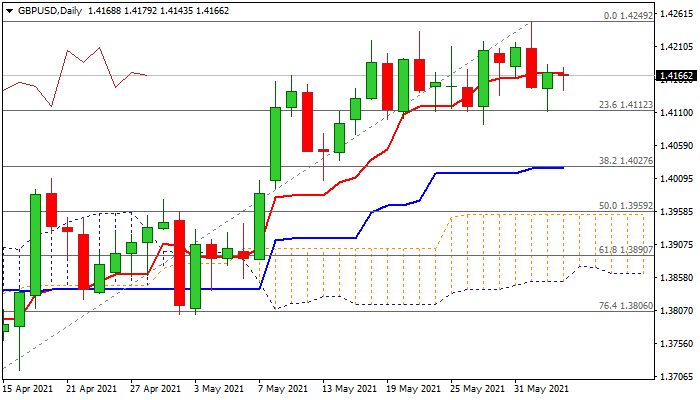

The GBP/USD pair stalled this week's retracement slide from the highest level since April 2018 and staged a goodish bounce from the vicinity of the 1.4100 mark on Wednesday. The British pound remained well supported by the optimistic outlook for the UK economic recovery amid the gradual easing of lockdown measures. In fact, UK Prime Minister Boris Johnson reiterated that there is nothing in the data at the moment that a delay to fully end restrictions from June 21 would be necessary. Adding to this, indications that the Bank of England could raise rates well into next year further acted as a tailwind for the sterling. Read more...

GBP/USD outlook: Extended sideways mode eyes US jobs data for fresh direction signal

Quiet trading within the 25-pips range suggests traders are on hold and awaiting stronger signals, with a focus on today’s UK PMI’s (services and composite) US ADP private-sector labor report and the most significant US non-farm payrolls on Friday.

Today’s action remains biased lower despite Wednesday’s strong bounce as daily Tenkan-sen (1.4170) continues to cap. Fading bullish momentum and south-heading stochastic on daily chart add to negative signals as next week’s daily cloud twist (1.3925) is expected to attract. Read more ...

Author

FXStreet Team

FXStreet