GBP/USD bulls target 1.3800/20

- GBP/USD bears are stalling at a critical support, bulls eye 1.38 area.

- The US dollar is pausing following the dovish tilt in the FOMC minutes.

GBP/USD is trading on the bid and higher by some 0.2% into the final hour of trade on Wall Street.

At the time of writing, GBP/USD is moving sideways and leaning on 1.3760 after rising from a low of 1.3718 earlier in the session to score a high of 1.3786 that following a knee jerk reaction to the Federal Open Market Committee minutes.

The FOMC minutes had something for both the US dollar bulls and the bears.

The minute of the July 27-28 meeting showed that Officials felt recent inflation readings likely temporary but most they feel it could be appropriate to start tapering the asset purchases this year.

In turn, the US stock market fell towards the lows of the day, US yields and the US dollar were being pressured with the DXY moving in on the psychological round 93.00 level.

However, the US dollar has turned higher again in later trade, capping the advancement in the pound.

In a dovish take on the minutes, it was noted in the market that ''many participants noted that, when a reduction in the pace of asset purchases became appropriate, it would be important that the Committee clearly reaffirm the absence of any mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate,'' as the minutes stated.

Meanwhile, the Jackson Hole remains the US dollar's wild card.

The event will be on the 26-28 Aug where the focus will be on the Fed's chairman Jerome Powell who is anticipated to bring more clarity to the timings of tapering.

Meanwhile, the US dollar has enjoyed a period where the coronavirus concerns have underpinned the risk-off currencies.

The US dollar would be expected to continue to attract a bid if the covid situation deteriorates further for such nations where the spread had been rampant or has just starting to present itself.

Additionally, the divergence between global central banks and the Fed combined with the safe-haven status has underpinned the US dollar in the US dollar smile theory.

Meanwhile, on the domestic front, the UK inflation data showed a sharper slowdown than expected, although the focus was more on Wednesday's strong data from the labour market.

As a key determinant of future inflation, the jobs data was "perhaps more important as it revealed another strong print that in our view reinforces the prospect of a rate hike cycle commencing in the second half of next year," Derek Halpenny at Mitsubishi UFJ Financial Group argued.

Economists polled by Reuters had expected a 2.3% rise in consumer prices following a 2.5% rise in June.

GBP/USD technical analysis

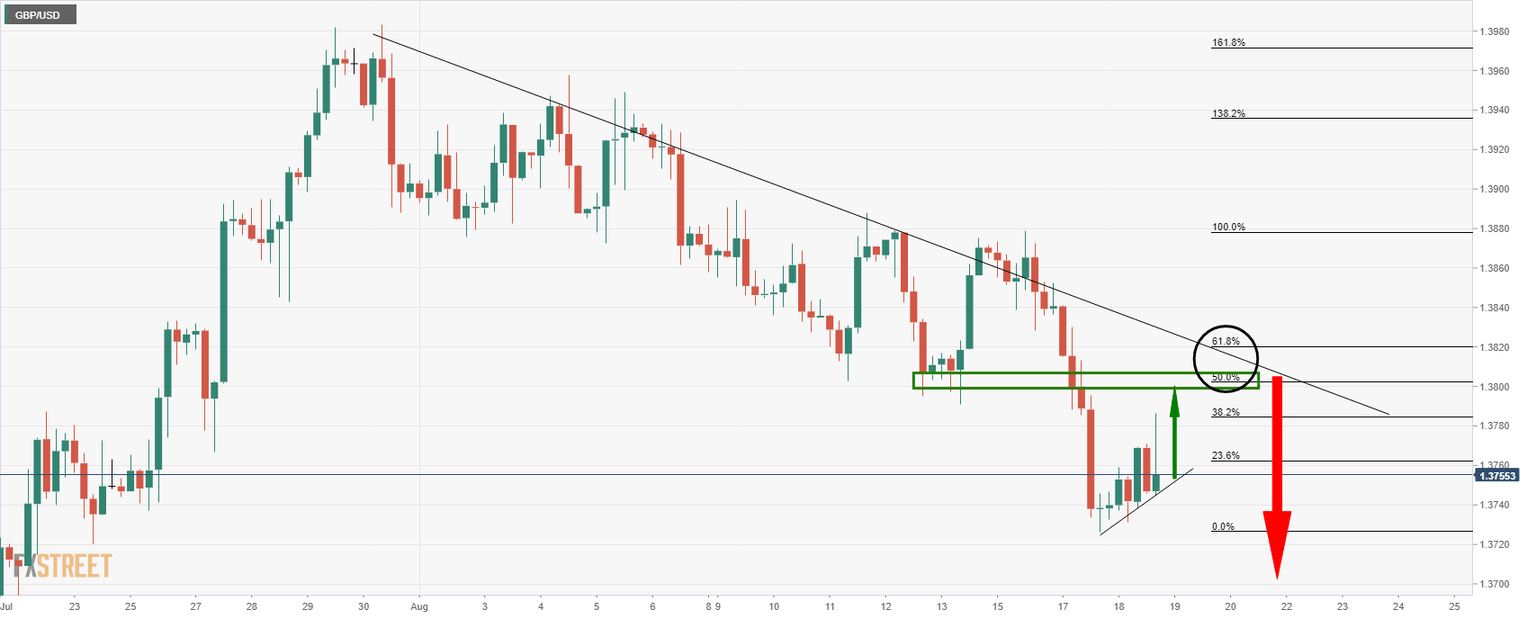

The price has been established at a support structure for which could lead to a temporary upside correction to test the dynamic resistance and 1.38 the figure in the coming days.

This would also have a confluence of a 50% mean reversion of the recent bearish impulse, as per the following the 4-hour chart:

With that being said, even a push to the 61.8% Fibo near 1.3820, the area would be expected to hold and lead to a downside continuation.

This would be in line with the newly formed dominant bear trend with 1.3690 and 1.3665 on the radar.

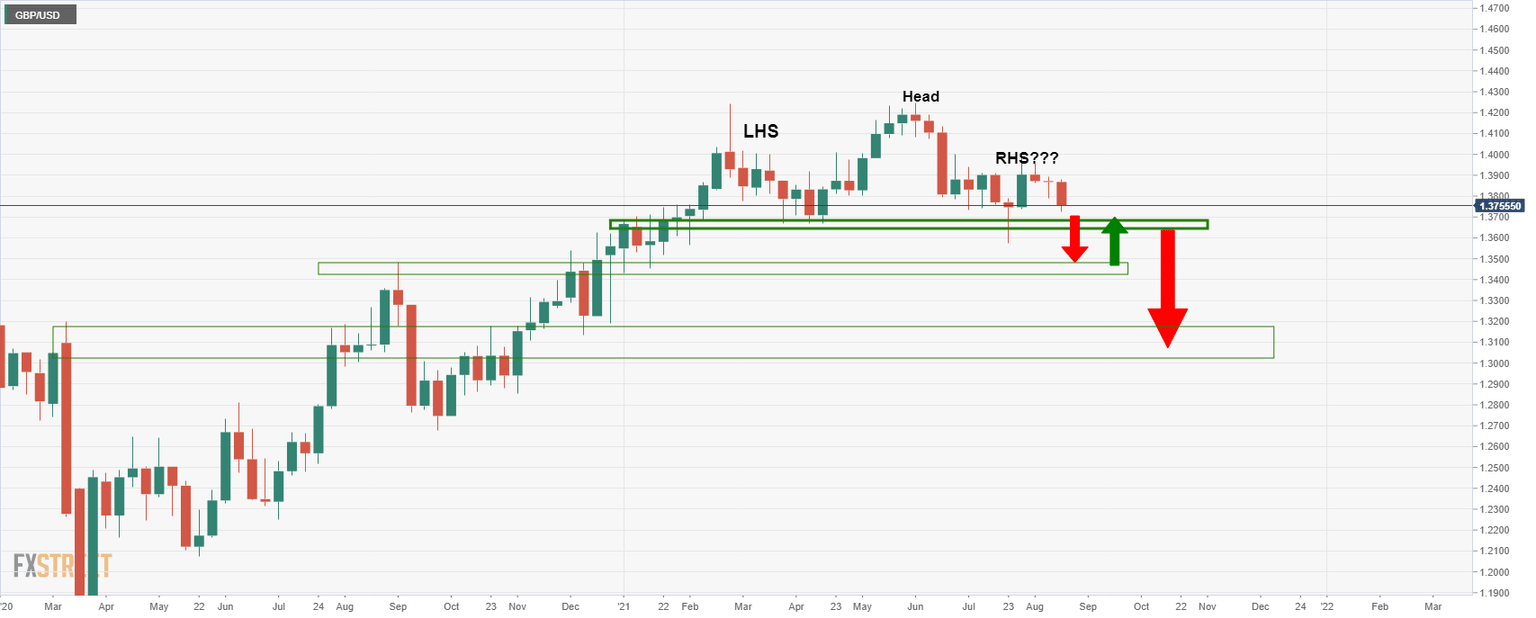

In doing so, it would leave prospects of a full blow bearish breakout on the cards in the completion of a weekly head and shoulders:

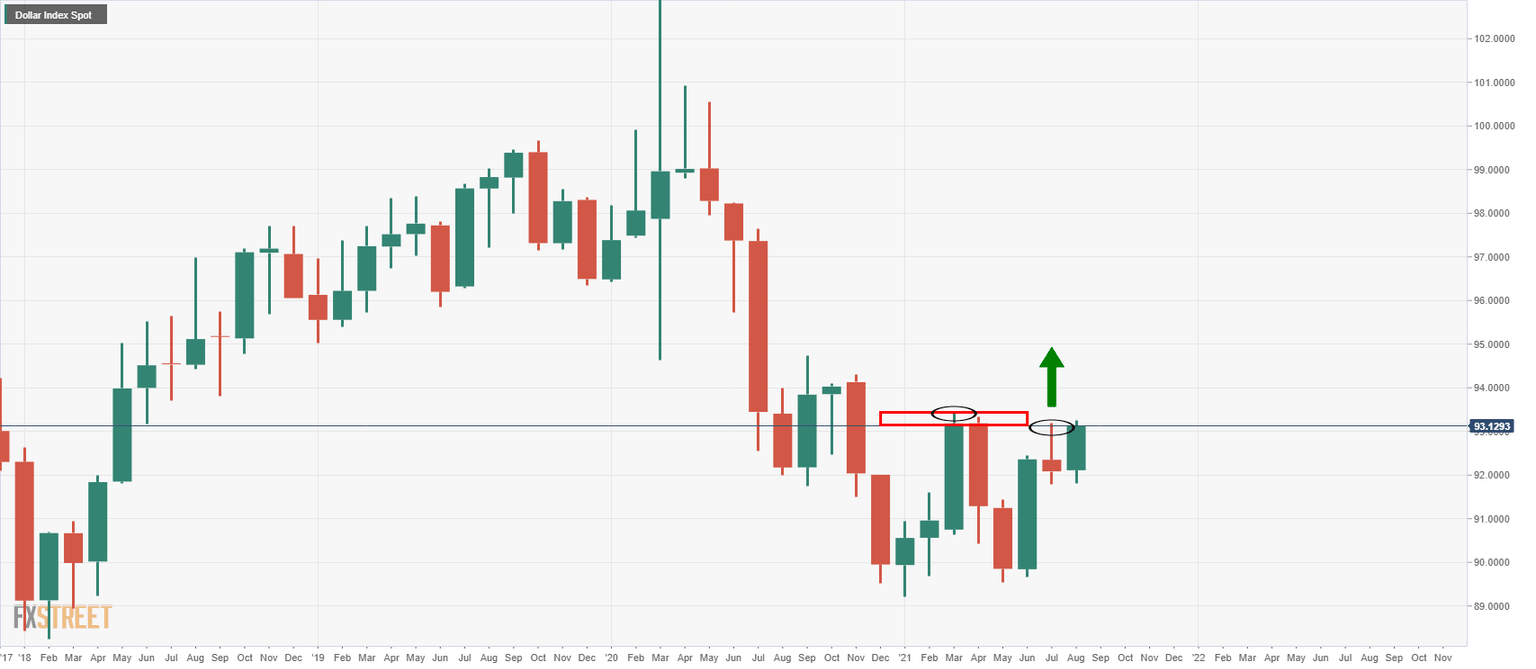

For the downside to play out, the DXY will need to break into fresh cycle highs and beyond a critical resistance zone of confluence above 93.50:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.