GBP/USD bears step up the pace, eye break of 1.2150s

- GBP/USD slides in a risk-off environment at start of week US session.

- The British Pound is vulnerable to soured UK politics and economy.

- The US Dollar bulls are moving in on the face of stronger US economic data.

- Federal Reserve terminal rate is the driver for the US Dollar.

The British Pound is under pressure in the North American session as risk appetite drops on Wall Street. US major indexes have fallen following better-than-expected service-sector activity that has added to jitters that the US Federal Reserve might continue on its aggressive policy tightening path despite fears of a recession next year.

At the time of writing, GBP/USD is down 0.78% after falling from a high of 1.2344 to a low of 1.2162 so far. The US Dollar is climbing in a risk-off environment as an initial boost of investor enthusiasm over signs of possible loosening in COVID restrictions in China faded and on some speculation that the Federal Reserve may not be able to pivot as soon as December.

US economic data improves outlook for US Dollar

The Institute for Supply Management (ISM) said its Non-Manufacturing PMI rose to 56.5 last month from 54.4 in October, indicating that the services sector, which accounts for more than two-thirds of US economic activity, remained resilient in the face of rising interest rates. The data beat forecasts that the Non-manufacturing PMI would fall to 53.1. This data combined with Friday's surprisingly strong Nonfarm Payrolls and wage growth data in November as well as news that consumer spending had accelerated in October gives has raised optimism that a recession could be avoided in 2023.

Eyes on the Federal Reserve

The data comes in contrast to a recently weaker Consumer Price Index, prior ISM data and dovish Federal Reserve chairman Jerome Powell's comments that combined had started to weigh on the market's pricing of the terminal rate that had declined to below 5%. Before the Nonfarm Payrolls report, the rate was seen topping out at 4.75%-5% before the report. However, the Fed is now seen raising its policy rate, currently in the 3.75%-4% range, to 4.92% by March of next year and more likely than not into the 5%-5.25% range by May, based on futures contract prices and the CME Fed watch tool.

Nevertheless, in the near term, Fed Chair Jerome Powell said last week that the US central bank could scale back the pace of its rate increases "as soon as December." Futures contracts tied to the Fed policy rate still imply a 70% chance that central bankers will slow the pace of rate hikes when they meet Dec. 13-14, rather than adding to a string of 75-basis-point rate hikes over the past four meetings.

GBP/USD positioning remains bearish

According to the latest weekly data from the Commodity Futures Trading Commission (CFTC), Money managers are still bearish towards the British Pound.

A net short position is, however, reducing and is now more than 50% smaller than the depths seen earlier this year but that is largely due to the US Dollar being trimmed in the improved risk environment. Nevertheless, while there might be less room for strong rallies in GBP, a reversal in risk appetite could leave the currency exposed to a sharp move lower.

''In the spot market the pound has recovered a significant amount of ground vs. the softer USD,'' analysts at Rabobank said.

UK politics in the spotlight

''While the UK political backdrop has retained a calmer air since the start of PM Rishi Sunak’s premiership, neither the economy nor this own party is proving easy to manage,'' the analysts argued.

''Recessionary conditions appear to be taking root, strike action is on the rise and a slew of Tories has already indicated they will throw in the towel at the general election rather than face the possibility that the party could be in opposition for some years,'' the analysts added.

Prime Minister Rishi Sunak, in power for just over a month, faces a raft of problems in the run-up to an election that opinion polls suggest the Conservatives will lose which could ultimately spell more weakness for the pound.

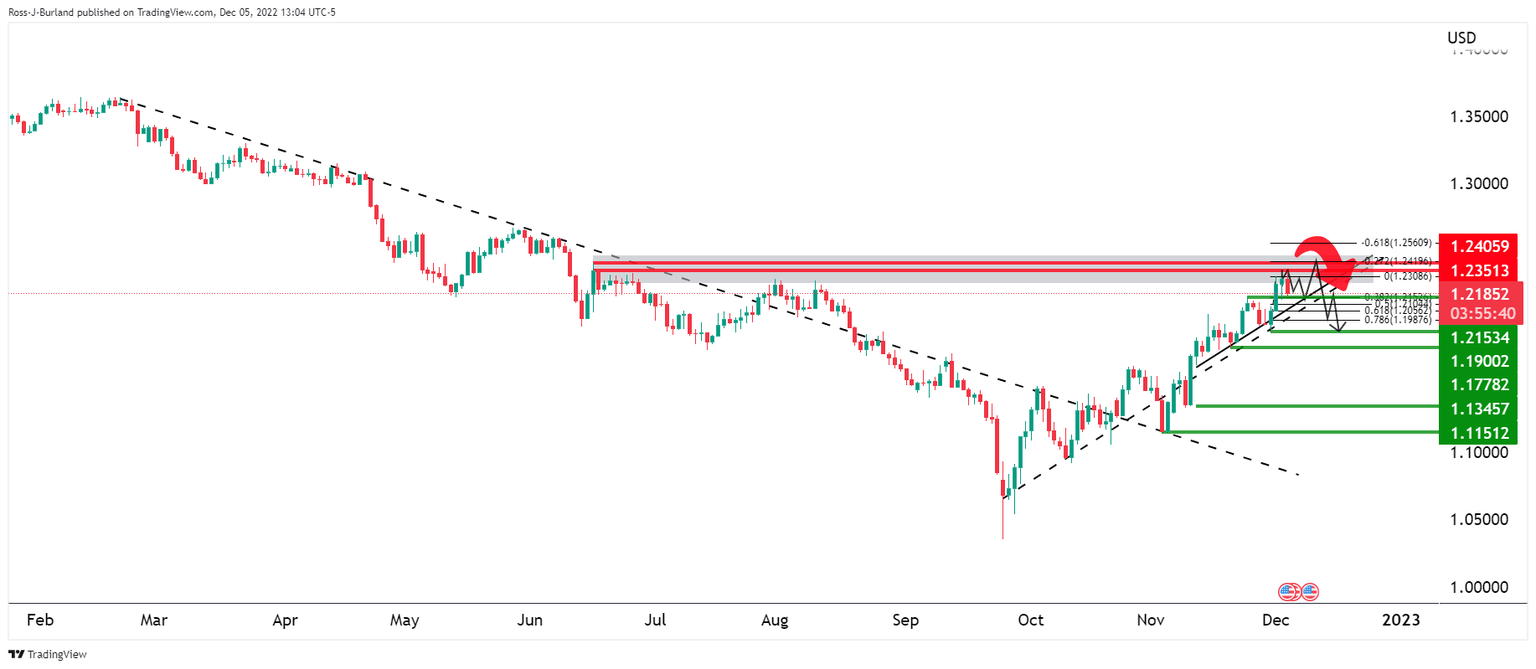

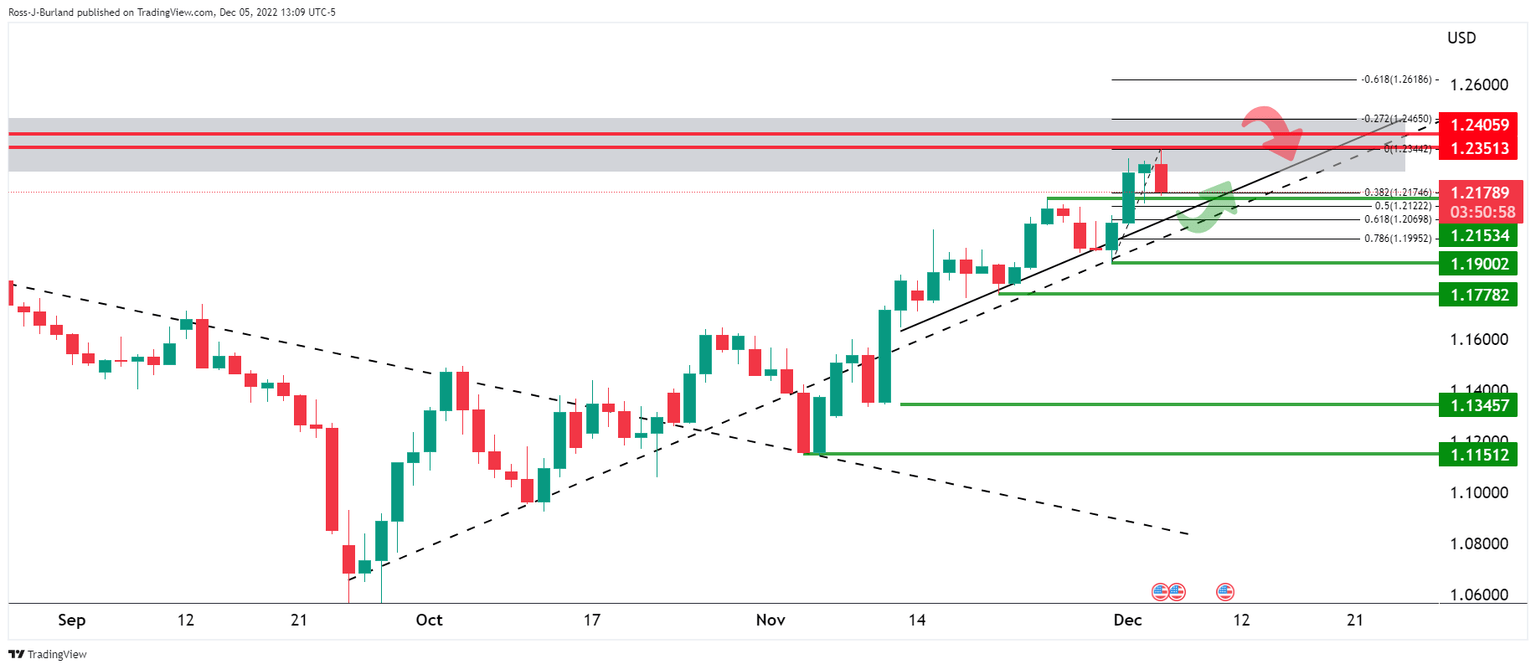

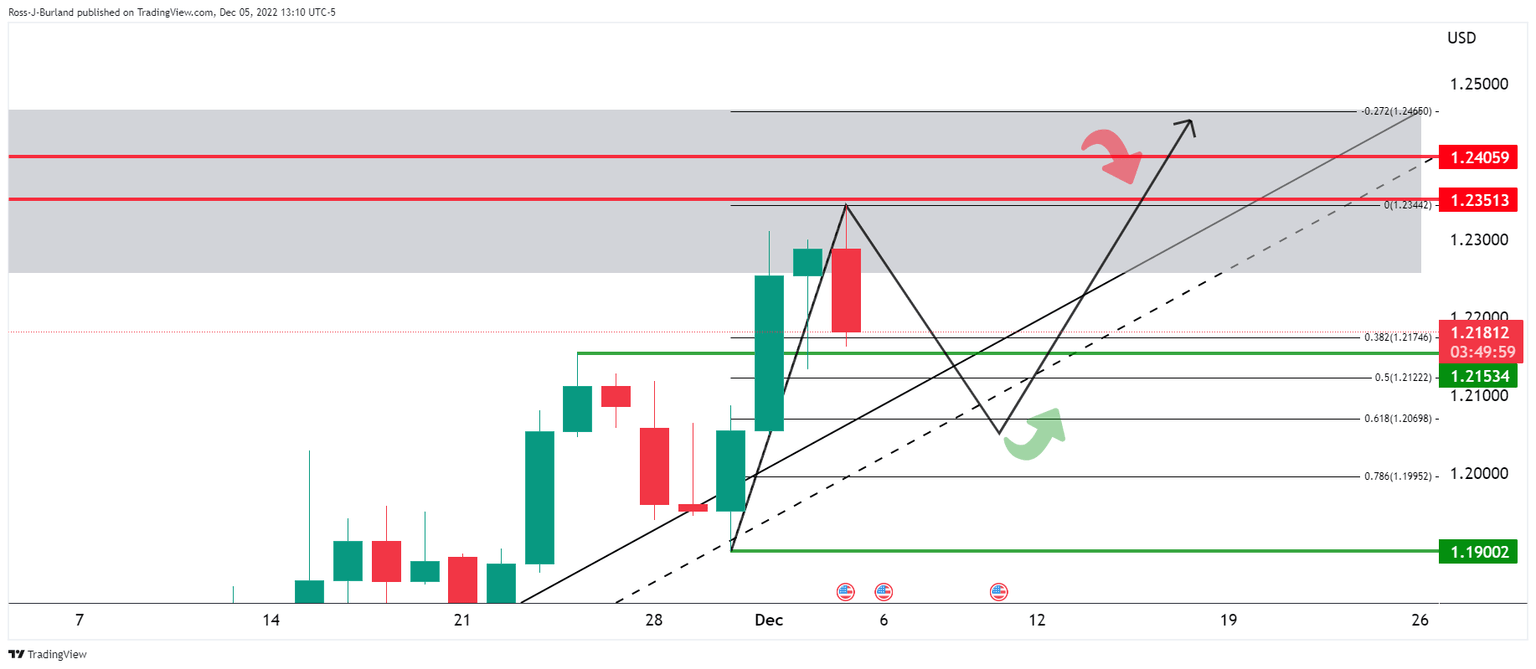

GBP/USD technical analysis

GBP/USD is potentially moving into a phase of distribution below 1.2350, 1,2400 areas on the daily chart as illustrated above. However, the British Pound's bullish trend is still intact while structures 1.2150 and 1.1900 are yet to be broken:

This leaves the focus on the upside in GBP/USD while above 1.1900. A move into test below 1.2150 could result in a deeper correction through the Fibonacci scale with eyes on a 50% mean reversion at 1.2120 and then a 61.8% ratio confluence with the upper quarter of the 1.20 area near 1.2070.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.