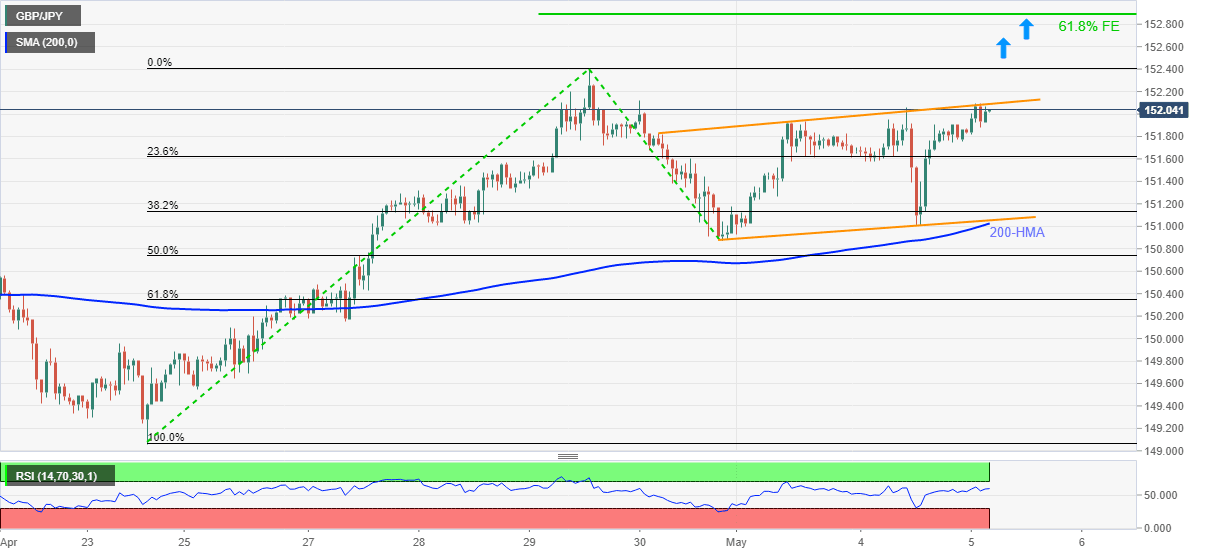

GBP/JPY Price Analysis: Weekly rising channel tests bulls around 152.00

- GBP/JPY prints three-day winning streak, mildly bid around intraday high of late.

- Strong RSI, sustained trading beyond 200-HMA keep buyers hopeful.

- Key Fibonacci retracement levels add to the downside filters.

GBP/JPY picks up bids to 152.05, up 0.11% intraday, ahead of Wednesday’s European session. In doing so, the pair buyers attack the upper line of an upward sloping trend channel from last Friday amid strong RSI.

As a result, the immediate hurdle near 152.10 is likely to be crossed, which in turn should direct the quote towards the late April tops near 152.40.

GBP/JPY upside past-152.40 needs to cross the 61.8% Fibonacci Expansion (FE) of April 23-29 run-up, as well as the following pullback to 151.01 on Monday, near 152.90 before targeting the previous month’s peak close to 153.40.

Alternatively, a convergence of the stated channel’s support and 200-HMA near 151.00 becomes the key to watch before targeting any sell positions.

In that case, 50% and 61.85 Fibonacci retracement levels, near 150.70 and 150.35 respectively, could offer extra filters during the fall.

GBP/JPY hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.