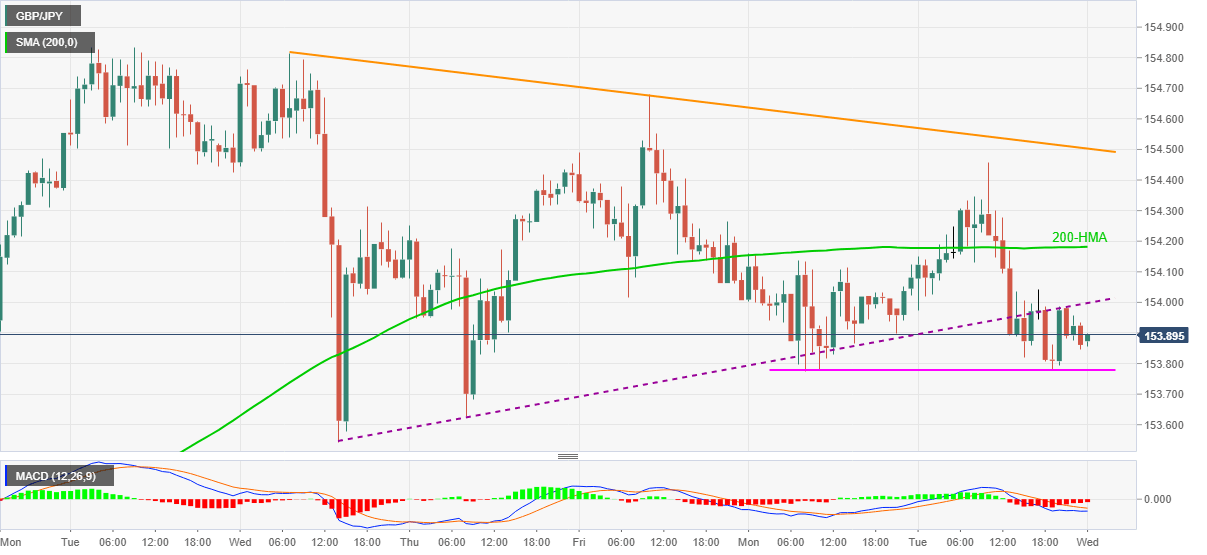

GBP/JPY Price Analysis: Extends weekly trend line breakdown below 154.00

- GBP/JPY remains on the back foot around intraday low.

- Bearish MACD, sustained trading below 200-HMA also favor sellers.

- Descending trend line from last Wednesday adds to the upside barriers.

GBP/JPY holds lower ground near an intraday low of 153.85, down 0.07% on a day, during Wednesday’s Asian session. In doing so, the cross-currency pair extends downside after breaking a short-term support line the previous day.

The support break also joins bearish MACD signals to keep GBP/JPY sellers hopeful unless the quote stays below the 154.00 level comprising the support-turned-resistance line.

Also acting as important upside barriers are 200-HMA and one-week-old falling trend line, respectively near 154.20 and 154.50.

In a case where GBP/JPY crosses the 154.50 hurdle, the multi-month high, flashed last week, surrounding 154.85 and the 155.00 round figure could lure the bulls.

On the flip side, a weekly low around 153.78 and a two-week-old horizontal area near 153.60, not to forget April’s high of 153.40, can entertain intraday sellers.

However, any clear downside below 153.40 will aim for March’s peak of 152.55 during the further weakness.

GBP/JPY hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.