GameStop Stock News and Forecast: GME stock rallies, but for how long?

- GameStop stock rallies sharply on Thursday to close up 10%.

- GME and other meme stocks stage what looks to be a bear market rally.

- GME stock is still down sharply this year, so a turnaround looks unlikely.

Meme stocks rallied sharply on Thursday as some form of stabilization returned to markets with a strong turnaround into the close. The main indices were looking at another round of 2% losses before a late rally saw most nearly make it back into positive territory. In the end, the Nasdaq lost 0.18%, and the S&P 500 only 0.13%. The most notable feature though was the performance of the riskier side of the market. GameStop (GME) was up 10% but was not alone. Other notable meme stocks also made similar advances: AMC +8%, LCID +13%, RIVN +18%, RBLX +19%, etc.

GameStop Stock News

"Buy the dip" worked so well for the past two pandemic field years that it is hard to let a good thing go. This is exactly what happened on Thursday across the meme stock space with retail investors flooding back into the market. We must urge caution though. This is not 2020 or 2021. The Fed no longer has your back. The Fed wants equity markets and risk assets lower. It has more or less explicitly said so, and rallies are to be used for quick in-and-out swing trades, not to buy and hold again. Those days are long gone. Financial conditions are tightening and will continue to tighten. Bear market rallies can be powerful, but they are bear market rallies.

We alluded to this move in our GME piece on Thursday: "There may be some element of a silver lining as GME is oversold on both the Relative Strength Index (RSI) and the Money Flow Index (MFI). We may get a pop or bear market rally, but make no mistake, this is not going to the moon any time soon."

We stand by that assessment. This rally should extend for most of Friday, but the weekend is no time for holding a long position in this current environment. Mondays are one of the worst days in stock market performance, and this bear market is set to resume shortly.

GameStop Stock Forecast

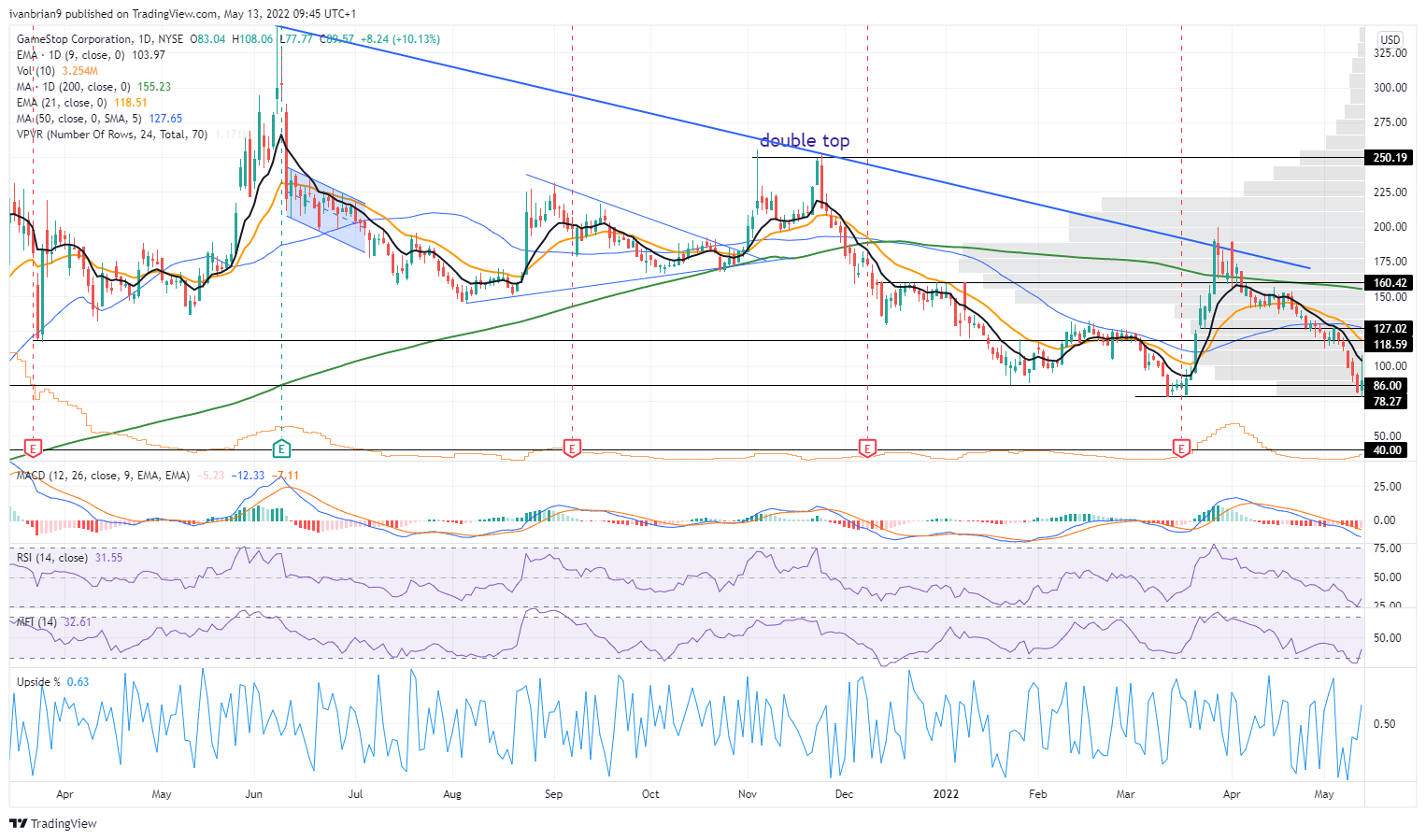

Another feature that we noticed from a lot of meme stocks on Thursday was that they put in a much higher high than the closing price. This is the complete opposite of what the main indices did. GameStop stock spiked up to $108 but closed at $89. That is a bit concerning. Momentum was not maintained. We expect the stock to rally again on Friday though as overall the main indices should recover some ground. $108 is the 9-day moving average, and above $118 is strong resistance going back to April 2021. We would not expect the rally to extend beyond here.

GME stock chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.