Gamestop (GME) Stock Price and Forecast: White House monitoring, TD Ameritrade limits trading, also on AMC

- TD Ameritrade has announced restrictions on NYSE: GME and NYSE: AMC due to abnormal trading.

- Other hot stocks such as NASDAQ: CCIV, NYSE:NOK and NYSE: BB still garner interest.

- Concerns about market exuberance may cause further steps by brokerages and regulators.

GameStop Corp.(NYSE: GME) has been the sensation of Reddit's WallStreetBets, of hedge funds and also of the financial press. Bloomberg and CNBC are focusing on these relatively small shares while only mentioning Microfost's robust earnings.

The battle between hedge funds such as Citron and an army of retail traders reflects the new trading world in 2020 – when people stuck at home and as trading applications have become even friendlier.

More: Gamestop (GME): Should I buy or should I sell Gamestop now?

GME News

Jen Psaki, the White House's Director of Communications, said that the Biden administration is monitoring the situation. The developments are also impacting broader markets.

See US Stock Market Today: It's Gamestop (GME) day, again!

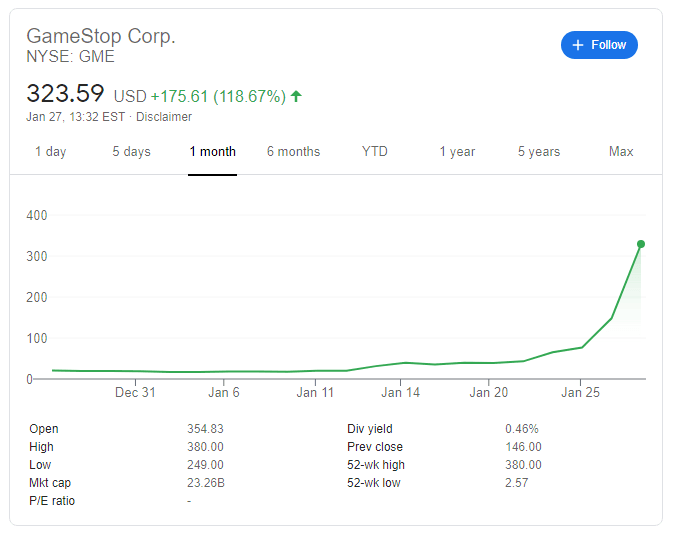

Melvin Capital's closing of shorts on Gamestop was supposed to take some of the air out of the battle, yet prices of the videogame maker continued higher. They hit a peak of $380 before retreating. The action prompted TD Ameritrade, one of the largest brokerages, to restrict trading on NASDAQ: GME. TD Ameritrade also restricted NYSE: AMC.

AMC, which runs movie theaters across America, has completed secondary sales and raised just over $300 million by selling some 63.3 million shares.

See AMC Stock Price: AMC Entertainment Holdings Inc revives after CEO says bankruptcy is off the table

While those trading GME and AMC may run into issues, other stocks that retail traders are interested in have no limits. These include CCIV and BB:

BlackBerry, a blast from the past – Biden's former boss at the White House, Barack Obama, had a BB handheld device, is also receiving attention. While the company has robust fundamentals, some suspect its price has gone too far.

BB Stock Price: BlackBerry Ltd shrugs defies bearish analysts, competes with Gamestop for attention

Churchill Capital Corp IV is a black check company that is rumored to be in touch to buy Lucid Motors – a luxury provider of electric vehicles, often touted as a "Tesla Killer. Elon Musk, the man behind Tesla, has also had an impact on boosting Gamestop shares.

CCIV stock price and news: Churchill Capital Corp IV set to retreat as Lucid Motors SPAC awaits

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.