Gold surges after downside US CPI surprise, eyes $4,381 peak

- Gold rebounds after US inflation comes in lower than expected, lifting expectations for Fed easing in 2026.

- Softer US CPI weighs on the US Dollar, offering additional support to Bullion prices.

- Technically, XAU/USD gathers upside momentum above $4,350, with bulls now eyeing the $4,381 peak.

Gold (XAU/USD) rebounds on Thursday, trimming earlier losses after US inflation data surprised to the downside. At the time of writing, XAU/USD trades around $4,368, pushing decisively above this week’s consolidation range.

Data released by the US Bureau of Labor Statistics showed that the Consumer Price Index (CPI) rose 2.7% YoY in November, below market expectations of 3.1% and easing from 3.0% in September. Core CPI, which excludes food and energy, also slowed to 2.6% YoY from 3.0%, missing forecasts of 3.0%.

The softer inflation readings strengthened expectations that the Federal Reserve (Fed) could move toward further monetary policy easing into 2026. Lower interest rates generally favour non-yielding assets such as Gold.

Elsewhere, escalating tensions between the United States (US) and Venezuela support safe-haven flows, keeping the precious metal anchored just below record highs.

Market movers: US CPI and Fed leadership in focus

- Traders see scope for two rate cuts next year, with US rate futures pricing around 62 basis points of easing in 2026 following the softer CPI data. The Fed is still widely expected to keep rates unchanged at its January meeting, with the CME FedWatch Tool showing only a 28.8% probability of a rate cut.

- US labour market data sent mixed signals. Initial Jobless Claims fell to 224K, slightly below expectations of 225K and down from the previous 237K. Continuing Jobless Claims rose to 1.897M, below expectations of 1.94M but higher than the previous 1.83M, while the four-week average edged up slightly to 217.5K from 217K.

- A softer US Dollar (USD) is also lending support to the Bullion. The US Dollar Index (DXY), which tracks the Greenback’s value against a basket of six major currencies, is trading around 98.27, easing after briefly climbing to an intraday high near 98.56.

- Markets are closely monitoring developments around the Fed’s leadership, as US President Donald Trump’s repeated calls for lower interest rates continue to raise questions around the Fed’s independence. Trump said on Wednesday, “I’ll soon announce our next chairman of the Federal Reserve, someone who believes in lower interest rates, by a lot.”

- President Donald Trump told the Wall Street Journal last week that he was leaning toward either White House economic adviser Kevin Hassett or former Fed Governor Kevin Warsh to lead the Federal Reserve. The WSJ also reported on Tuesday that Fed Governor Christopher Waller is set to be interviewed for the role.

- Governor Christopher Waller said on Wednesday that policymakers are in no rush to ease policy aggressively, noting that the Fed can proceed cautiously as inflation remains above target. He added that interest rates could be lowered gradually toward a neutral setting, which he estimates to be around 50-100 basis points below current levels.

Technical analysis: XAU/USD eyes record highs

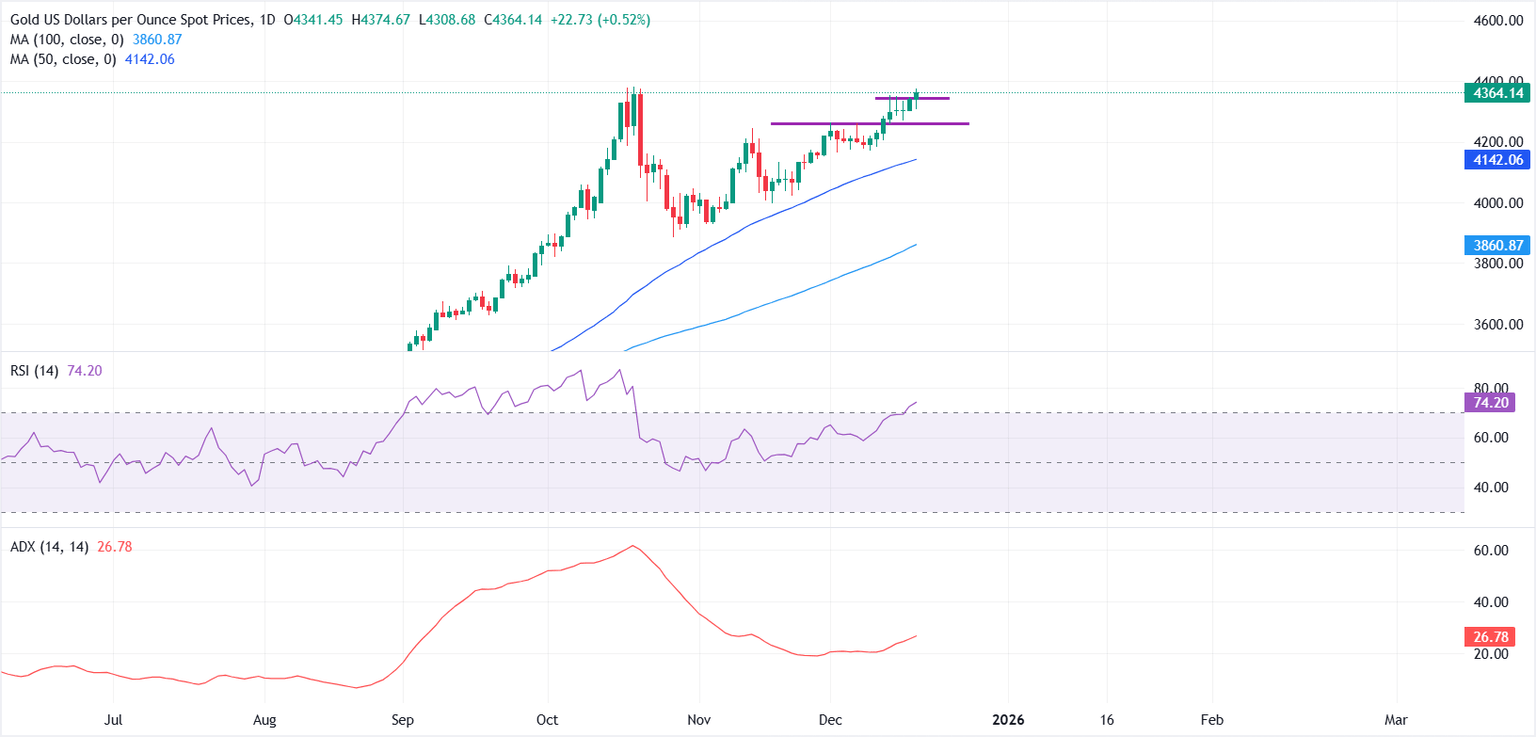

From a technical perspective, Gold (XAU/USD) has broken above the $4,350 resistance zone with bullish momentum now targeting the all-time high around $4,381.

On the daily timeframe, the 50-day Simple Moving Average (SMA) rises above the 100-day SMA, with both slopes advancing and price holding above them, preserving a bullish bias. The 50-day SMA currently stands at $4,142, offering nearby dynamic support. The Relative Strength Index (RSI) at 74.64 is overbought and signals strong momentum that could precede a brief corrective pause.

Trend strength builds as the Average Directional Index (ADX) ticks up to 26.49, reinforcing a directional market. A shallow pullback could be absorbed near dynamic support, while a break would expose the 100-day SMA at $3,860.49 as the next trend floor. A sustained hold above the 50-day average would keep the upside path open for bulls.

(The technical analysis of this story was written with the help of an AI tool)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.