Fed's Cook: Critical to stop inflationary psychology from taking hold

Federal Reserve governor Lisa Cook said in her first public remarks on monetary policy since joining the central bank's Washington-based board "inflation remains stubbornly and unacceptably high, and data over the past few months show that inflationary pressures remain broad-based."

"The widespread nature of the inflation pressures suggests that the overall economy is very tight," she said.

"The path of policy should depend on how quickly we make progress toward our inflation goal," Cook said.

Cook said she "fully supported" the large rate increases of three-quarter points approved at her first meetings as a governor, and she also agreed with the policy of "front-loading" monetary tightening to quicken its impact and felt changes in policy needed to be rooted in inflation actually falling, not on forecasts of it doing so.

Key comments

''Restoring price stability will likely require ongoing rate hikes, then the restrictive policy for some time.

Need to keep the restrictive policy until confident inflation is firmly on the path to 2%.

Inflation is too high, will keep at it until the job is done.

I fully supported the front-loading of policy over the past three FOMC meetings.

Front-loading puts restraint in place more quickly, and may rein in inflation expectations; this preemptive approach is appropriate.

At some point will be appropriate to slow the pace of rate hikes to assess the effects of tightening.

The labour market is 'very strong,' inflation remains 'stubbornly and unacceptably high, the overall economy is 'very tight'.

My focus is on bringing inflation back down to 2%.

Focused on the lag between signs of easing price pressures and actual inflation coming down.

Policy judgments must be based on inflation falling in the data, not just forecasts.

The risk management approach requires a strong focus on taming inflation.

Critical to preventing inflationary psychology from taking hold; I have revised up my assessment of the persistence of high inflation.

There are reasons to expect core goods inflation to slow in the coming months.

Cannot assume an improvement in supply constraints will be steady.

My colleagues and I are very attuned to foreign developments including monetary policy abroad.

Financial market spillovers are a two-way street, and there is substantial uncertainty about the size.''

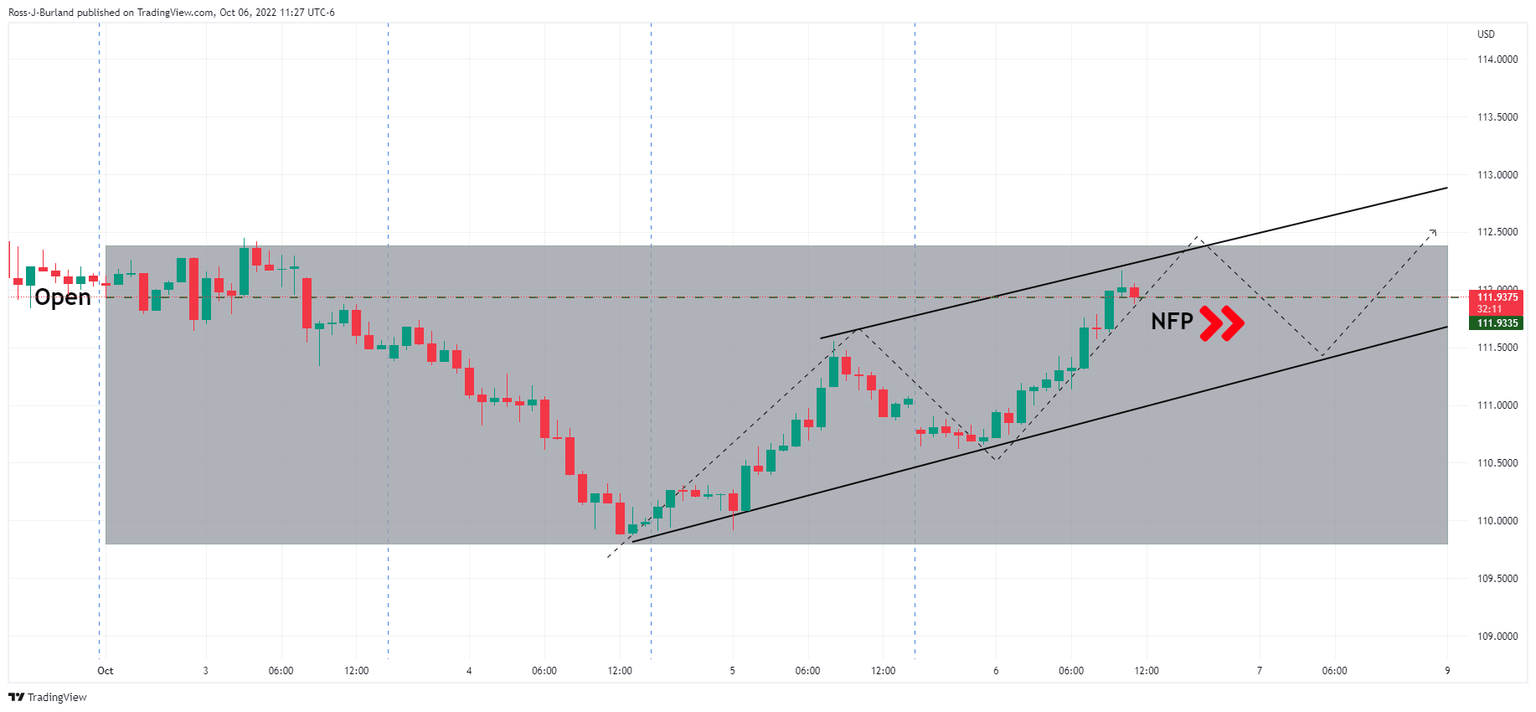

US dollar update

The focus is on the Nonfarm Payrolls tomorrow and then next week, the Fed receives the latest report on consumer inflation. On Thursday, despite downbeat Initial Jobless Claims, the US dollar rose, extending its gains from the previous day. All in all, forex has been volatile and the greenback has struggled to find a clear direction this week, following a dramatic third quarter. The dollar initially fell against most majors, before regaining ground:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.