European equities decline as heads of state kick off global Davos meet-and-greet

- European stocks broadly shed value on Monday, STOXX600 falls half a percent.

- Euro area Industrial Production fell once again in November.

- Rate movement hopes from the ECB continue to run into a hard wall from officials.

European shares broadly declined and major equity indexes shed weight to kick off the new trading week, walking back Friday’s gains.

With US markets shuttered for the Martin Luther King Day holiday, European shares backslid after euro area Industrial Production in December fell in-line with market forecasts at -0.3%, better than the previous period’s -0.7% but still another decline as economic conditions within Europe continue to deteriorate.

Germany’s Real Gross Domestic Product (GDP) Growth contracted by -0.3% in 2023, compared to the average yearly gain of 1.2% (2012 - 2022), adding further fuel to the fire and dragging the German DAX down half a percent on Monday.

European Central Bank (ECB) officials continue to talk down market expectations of rate cuts from the ECB as policymakers grapple with still-high inflation and wage pressures that make it difficult to justify rate cuts.

ECB officials and several euro area heads of state headed to Davos, Switzerland to kick off the World Economic Forum hosted at a luxury ski resort this week, which runs January 14 through 19.

This year’s WEF summit in Davos is titled “Rebuilding Trust”, and is set to focus on conversation topics including global trade, inflation, supply chains, AI technology, and Middle East geopolitical tensions.

The EUROSTOXX600 major equity index declined nearly 0.55% on Monday, falling 2.578 points to end at €474.19, while Germany’s DAX index shed 0.49% to end the day down 82.34 points at €16,622.22. France’s CAC 40 lost 53.46 points to close down 0.72% at €7,422.68, and London’s FTSE major index declined around 0.4% to end Monday’s trading at £7,594.91, down a hair over 30 points.

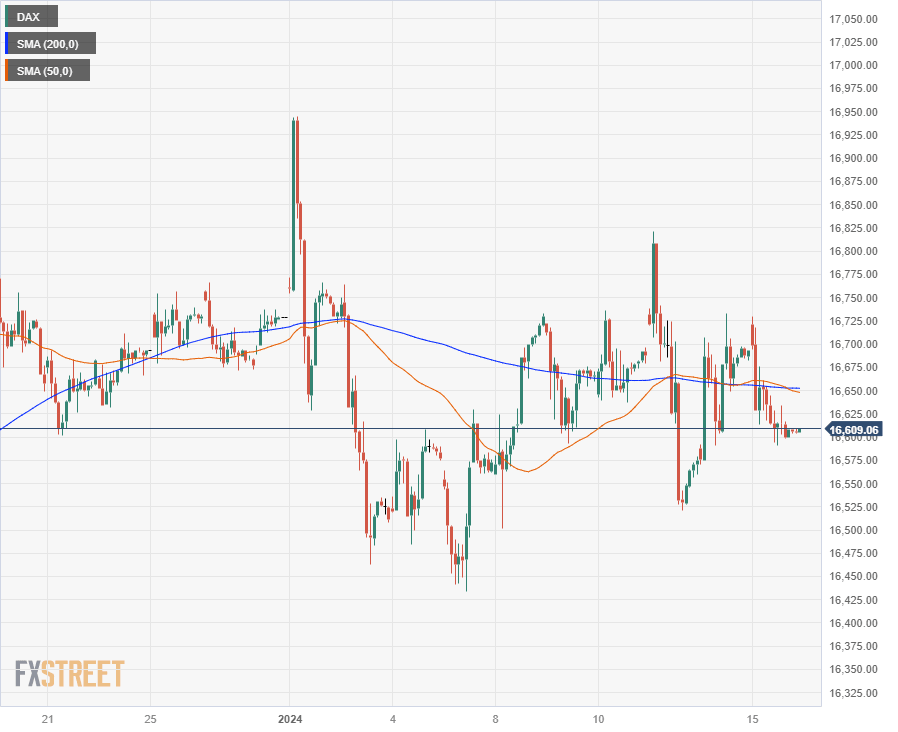

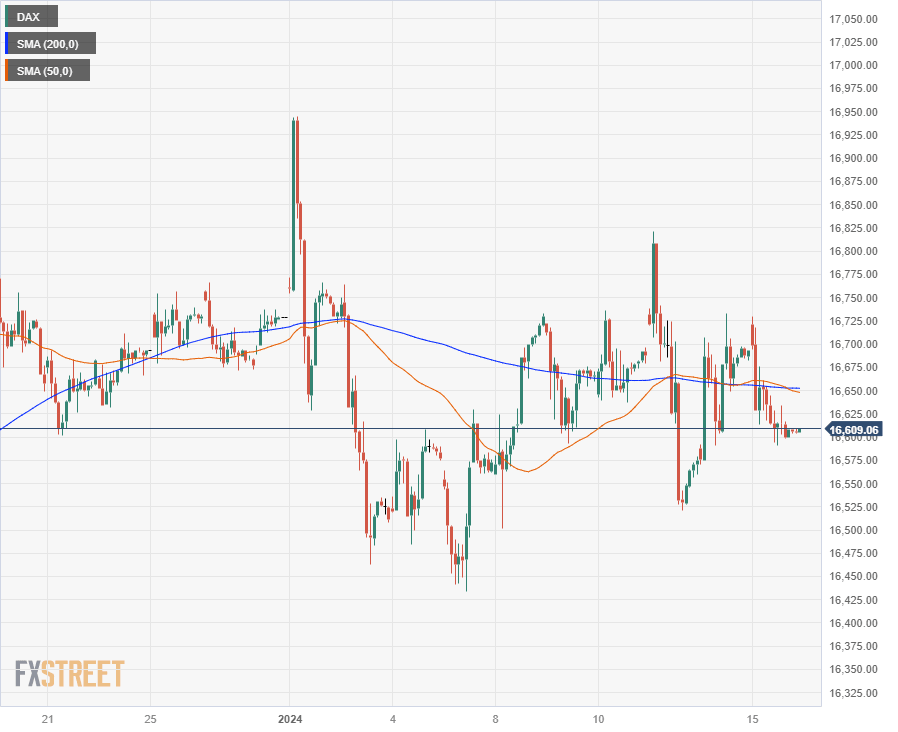

DAX Technical Outlook

The DAX backslid on Monday, walking back Friday’s gains and sending Germany’s major equity index back below the 200-hour Simple Moving Average, (SMA), keeping German equities hamstrung in a consolidation pattern that has plagued the index since December and is beginning to see downside pressure mounting.

Despite struggling to find further topside momentum, the DAX remains deep inside bull territory after rebounding from October’s bottoms near €14,600, climbing nearly 14% and remaining within striking distance of new all-time highs at the €17,000 major price handle.

DAX Hourly Chart

DAX Daily Chart

DAX Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.