Euro keeps the bearish mood intact near 1.0700, focus shifts to US CPI

- The Euro trades close to 1.0700 vs. the US Dollar.

- Stocks in Europe en route to a mixed close on Tuesday.

- EUR/USD’s upside momentum falters ahead of 1.0770.

- The USD Index (DXY) regains some balance following Monday’s drop.

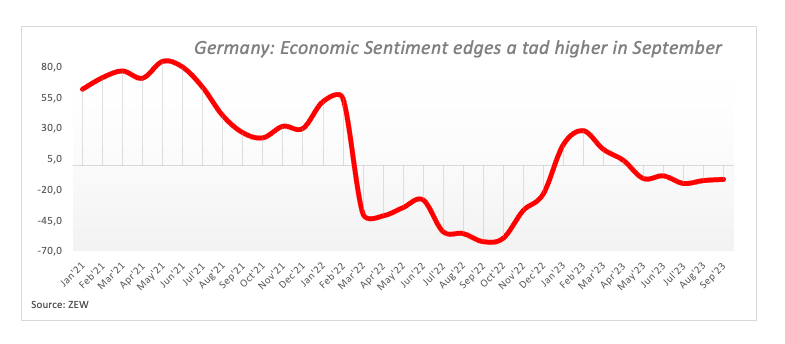

- Germany Economic Sentiment improves a tad in September.

- The NFIB index came in below estimates in August.

The Euro (EUR) fades the auspicious start of the week against the US Dollar (USD), prompting EUR/USD to return to negative territory and trade close to the 1.0700 neighbourhood after climbing to as high as the 1.0770 region earlier on Tuesday.

In the meantime, the Greenback reclaims some buying interest following Monday’s strong retracement and encourages the USD Index (DXY) to shift its attention to the key hurdle at 105.00 the figure so far.

In terms of monetary policy, the anticipation of a potential interest rate hike by the Federal Reserve (Fed) in November seems to have waned recently, while market participants persist in factoring in the likelihood of rate cuts taking place at some stage in the second quarter of 2024.

Turning our attention to the European Central Bank (ECB), market discussions seem to lean towards a pause at the September 14 meeting and a quarter-point rate raise by year’s end, given the current state of a somewhat divided Council.

Back to the euro calendar, the Economic Sentiment gauged by the ZEW Institute improved to -11.4 in September in Germany and worsened to -8.9 when it comes to the broader euro area. In the US, the NFIB Business Optimism Index receded to 91.3 during last month, while the usual weekly report on US crude oil supplies by the API is due later in the NA session.

Daily digest market movers: Euro remains depressed and looks at US CPI

- The EUR gives away part of Monday’s gains vs. the USD.

- The absence of direction prevails in the US, German yields so far.

- Markets see the ECB keeping the deposit rate unchanged this week.

- UK Unemployment Rate ticked higher to 4.3% in July.

- BoE's Sarah Breeden said the bank does not forecast a recession.

- Investors continue to price in Fed rate cuts in Q2 2024.

- Final inflation figures in Spain saw the headline CPI rise 2.6% YoY in August.

- Traders' now shift their attention to US inflation figures due on Wednesday.

Technical Analysis: Euro risks further losses below the 200-day SMA

EUR/USD resumes the downward bias and refocuses on the 1.0700 region and potentially below so far on Tuesday.

In case EUR/USD succeed in breaking below the September low at 1.0685 (September 7), it could undergo a retesting phase of the May low at 1.0635 (May 31) before potentially reaching the March low of 1.0516 (March 15). If the latter level is breached, it could initiate a possible examination of the 2023 low at 1.0481 (January 6).

On the contrary, regarding upward movement, the current emphasis is on targeting the crucial 200-day SMA at 1.0824. Beyond that point, a bullish momentum might lead to a challenge of the weekly peak at 1.0945 (August 30), further supported by the provisional 55-day SMA at 1.0937. Subsequently, this scenario could pave the way for an advance towards the psychological level of 1.1000 and the August high at 1.1064 (August 10). If spot clears this area, it could alleviate some of the bearish pressure and potentially aim for the weekly peak at 1.1149 (July 27), followed by the 2023 top at 1.1275 (July 18).

It's worth noting that as long as the EUR/USD remains below the 200-day SMA, there is a likelihood of a sustained decline in the pair.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.