Euro remains offered in the sub-1.1100 zone

- Euro meets support around 1.1065 against the US Dollar on Monday.

- Stocks in Europe en route to a negative closing.

- EUR/USD remains offered near the 1.1100 yardstick.

- Disappointing Flash PMIs hurt the sentiment around the Euro.

- Advanced PMIs, Chicago Fed index come next in the US docket.

The Euro (EUR) has continued its decline against the US Dollar (USD) for yet another session on Monday, resulting in EUR/USD breaking below the important support level of 1.1100 and reaching fresh lows for the past two weeks. Spot, however, manages well to stage a decent rebound with the immediate target above 1.1100 so far at the beginning of the week.

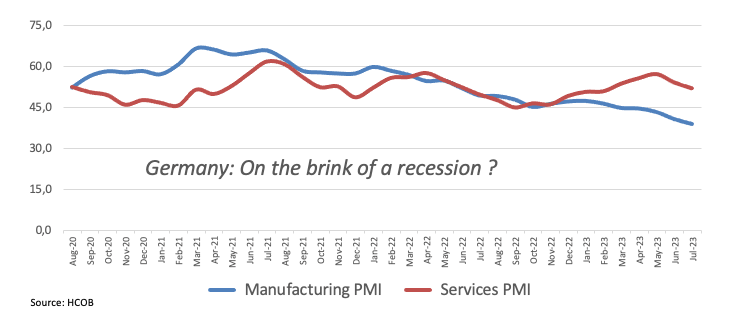

The drop in the pair's value is driven by the disappointing reports of preliminary Manufacturing and Services PMIs in Germany and the wider eurozone for July along with rising market chatter that a recession might by in the offing in the region.

Looking ahead, increased volatility in the pair is expected as crucial meetings by both the Federal Reserve and the European Central Bank (ECB) are scheduled later in the week. Both central banks are anticipated to raise interest rates by 25 bps. However, there is a growing divergence in their short-term plans for future tightening.

While the Federal Reserve appears to be nearing the end of its hiking cycle, indicating a potential pause or slowdown in future rate increases, some officials from the European Central Bank have recently expressed less-hawkish views on the likelihood of further rate hikes beyond the summer.

On another front, the speculative community increased their net longs in the euro to levels last seen in mid-May to nearly 180K contracts in the week ended on July 18 according to CFTC. The period under study saw a sharp pick-up in speculation over the end of the Fed's tightening cycle in response to another lower prints of US inflation during June, which morphed into fresh tops for EUR/USD north of 1.1200 the figure.

In the domestic calendar, flash Manufacturing PMI in Germany came in at 38.8 in July and 42.7 when it comes to the broader Eurozone, while the Services gauge stood at at 52.0 and 51.1, respectively.

In the US, the Chicago Fed National Activity Index worsened to -0.32 in June, while flash data saw the Manufacturing and Services PMIs at 49.0 and 52.4 for the month of July.

Daily digest market movers: Euro succumbs to poor data, recession chatter

- The EUR breaches the 1.1100 support against the USD.

- The USD Index extends the upside momentum above 101.00.

- Market chatter pointing to the end of the Fed’s hiking cycle looks subdued.

- Recession chatter hits the euro and stocks markets in Europe on Monday.

- US, German yields start the week on the defensive.

- The Fed starts its two-day meeting on Tuesday.

- The ECB is widely anticipated to raise rates by 25 bps on Thursday,

Technical Analysis: Euro risks a probable pullback to 1.1000

EUR/USD remains on the defensive and tests the area of two-week lows near 1.1060.

The ongoing corrective move in EUR/USD seems to have met some initial contention around 1.1065 (July 24) so far. The loss of this level could put a potential test of the psychological 1.1000 mark back on the radar ahead of provisional support at the 55-day and 100-day SMAs at 1.0898 and 1.0885, respectively. South from here emerges the July low of 1.0833 (July 6) prior to the key 200-day SMA at 1.0693 and the May low of 1.0635 (May 31). Further down aligns the March low of 1.0516 (March 15) before the 2023 low of 1.0481 on January 6.

On the upside, there are no resistance levels of note until the 2023 high at 1.1275 (July 18). Once this level is cleared, the next up-barrier of significance is expected at the 2022 peak of 1.1495 (February 10).

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.