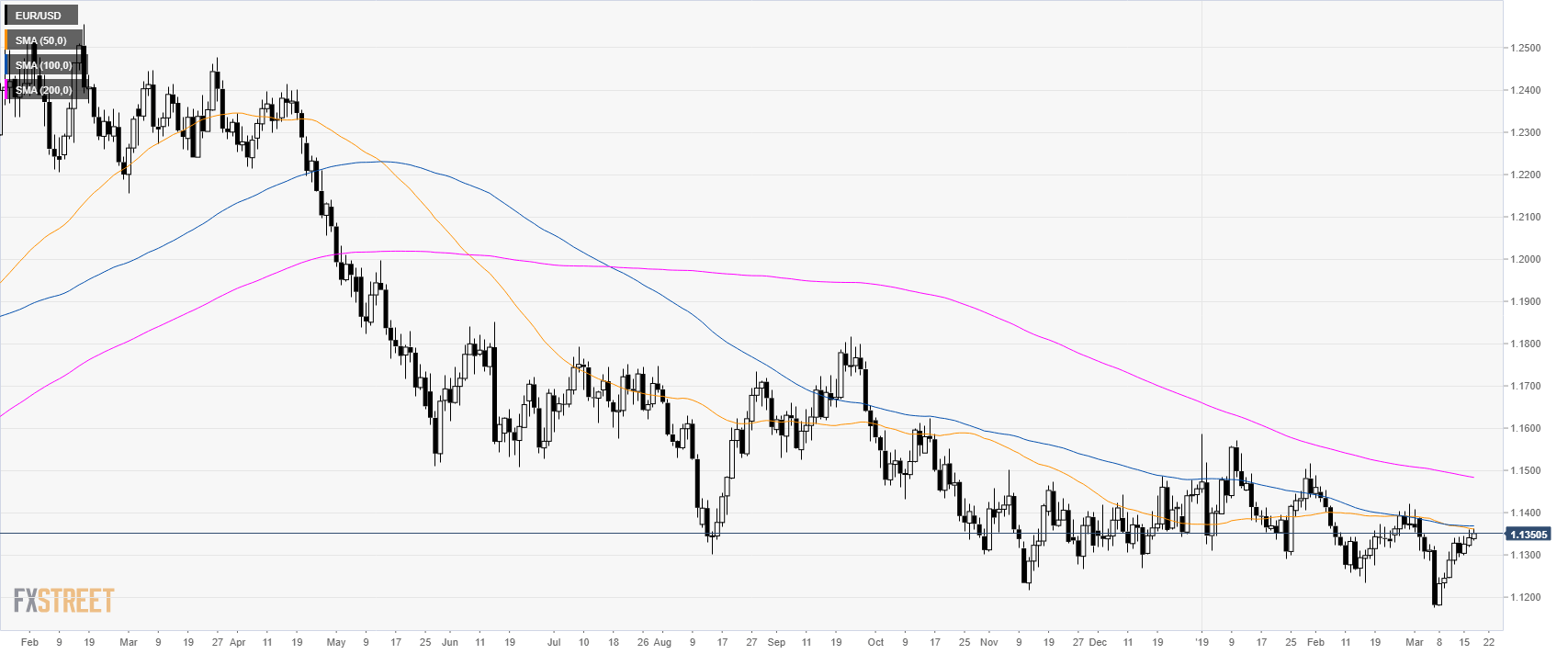

EUR/USD daily chart

- EUR/USD is trading in a bear trend below its main simple moving averages (SMAs).

- The 100 SMA is at 1.1368, a break above it would be seen as bullish.

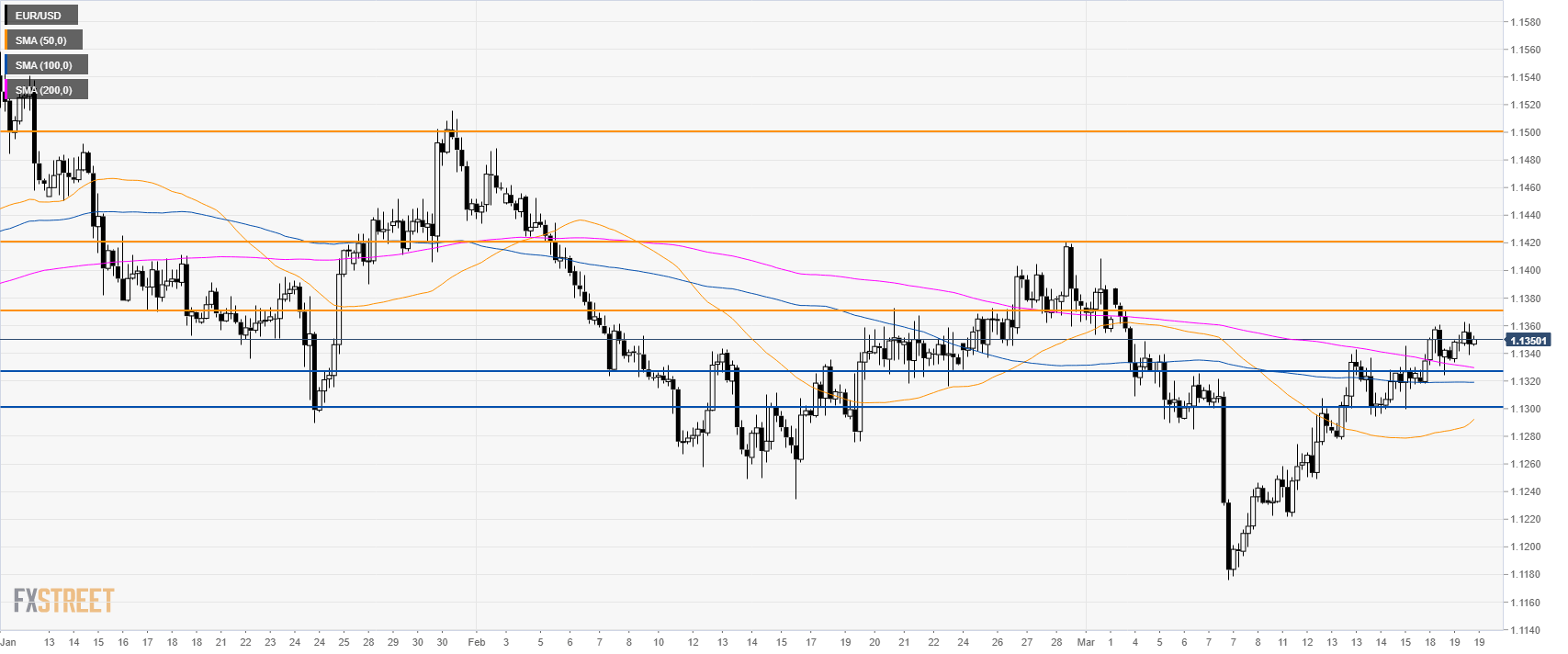

EUR/USD 4-hour chart

- EUR/USD is trading above its main SMAs suggesting bullish momentum in the medium-term.

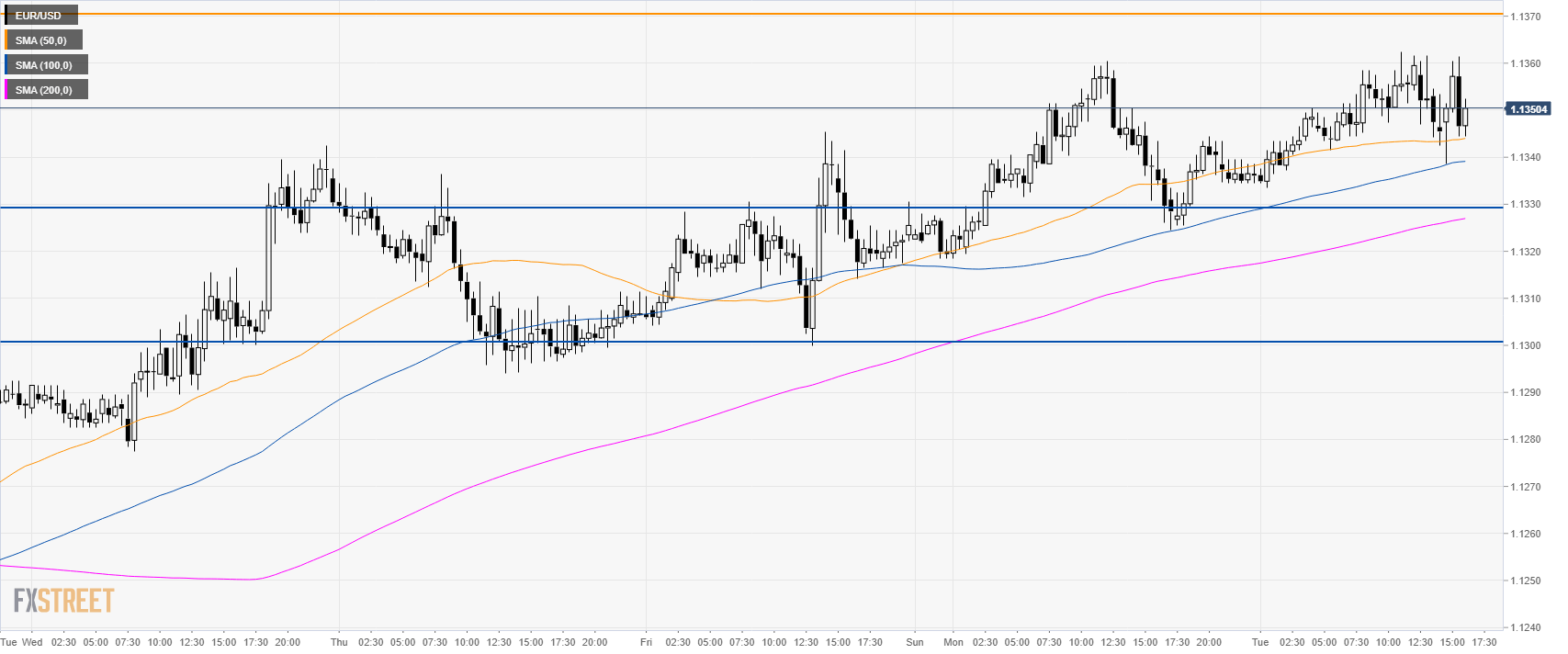

EUR/USD 30-minute chart

- EUR/USD is trading above its main SMAs suggesting bullish momentum in the short-term.

- A break above 1.1370 can lead to 1.1420 and 1.1500 figure.

- Looking to the downside, support is at 1.1330 and 1.1300 figure.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1346

Today Daily change: 6 pips

Today Daily change %: 0.05%

Today Daily Open: 1.134

Trends:

Daily SMA20: 1.1321

Daily SMA50: 1.1363

Daily SMA100: 1.1368

Daily SMA200: 1.1485

Levels:

Previous Daily High: 1.136

Previous Daily Low: 1.1318

Previous Weekly High: 1.1346

Previous Weekly Low: 1.1222

Previous Monthly High: 1.1489

Previous Monthly Low: 1.1234

Daily Fibonacci 38.2%: 1.1344

Daily Fibonacci 61.8%: 1.1335

Daily Pivot Point S1: 1.1319

Daily Pivot Point S2: 1.1298

Daily Pivot Point S3: 1.1277

Daily Pivot Point R1: 1.1361

Daily Pivot Point R2: 1.1382

Daily Pivot Point R3: 1.1403

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

UK CPI set to grow at stable 2.2% in August ahead of BoE meeting

The United Kingdom Office for National Statistics will release August Consumer Price Index figures on Wednesday. Inflation, as measured by the CPI, is one of the main factors on which the Bank of England bases its monetary policy decision, meaning the data is considered a major mover of the Pound Sterling.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.