EUR/USD sees a downside below 1.0660 as US CPI looks set to deliver a surprise upside

- EUR/USD is expected to deliver more weakness below 1.0660 amid the dismal market mood.

- A surprise upside in the US inflation will strengthen hawkish Fed bets.

- European Central Bank policymakers have been reiterating that Eurozone won’t face a deep recession.

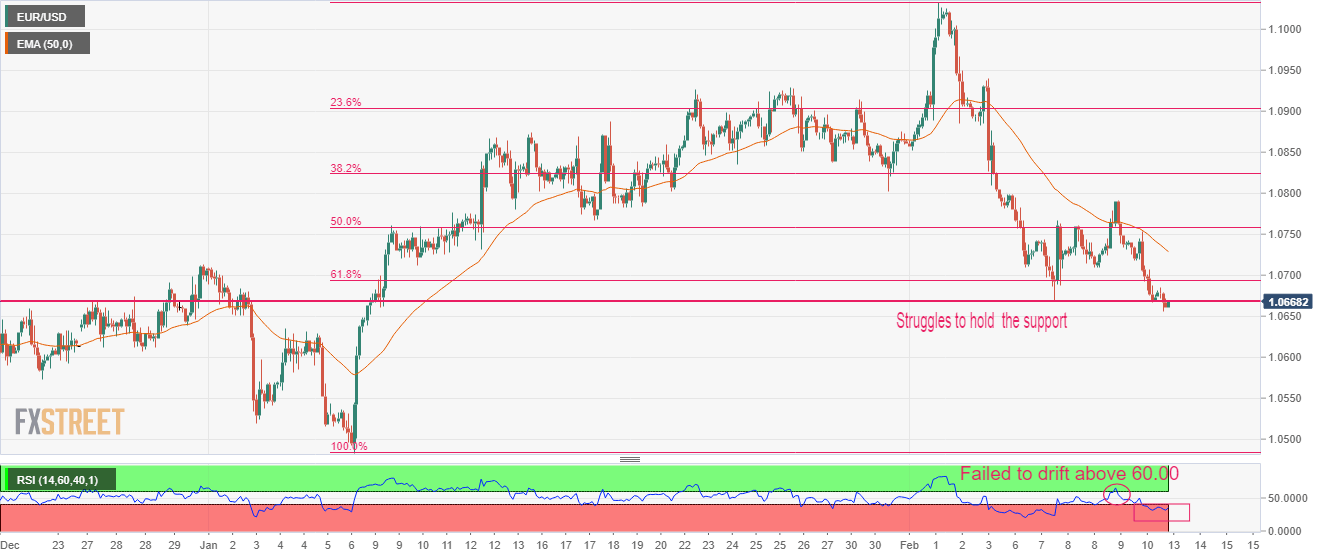

- EUR/USD has shifted its business below the 61.8% Fibo retracement placed below 1.0700.

EUR/USD is looking to build an intermediate cushion around 1.0660 in the early European session. The major currency is not expected to conquer the downside bias as the risk-off impulse is extremely solid amid the airborne threats to the United States and anxiety among the market participants ahead of the US Consumer Price Index (CPI) data, which will release on Tuesday.

After registering the biggest weekly loss since December, S&P500 futures have added further losses amid disappointing results by the US equities, portraying a sheer decline in the risk appetite of investors. The US Dollar Index (DXY) has shifted its business above 103.40 and is expected to add more gains as the weekend airborne threat on the US after the Chinese spy balloon event, which was later identified as a civilian by the Chinese economy, has turned investors risk averse.

Meanwhile, expectations of a higher US inflation rate on Tuesday are continuously strengthening the return generated on the US Treasury bonds. The 10-year US Treasury yields have scaled above 3.74%.

Upbeat labor market and a rebound in used car prices could propel US inflation

The US Inflation is demonstrating a declining trend for the past three months significantly, supported by lower energy and used car prices. From a whooping figure of 9.1%, the headline inflation has already corrected to 6.5% and the current consensus is favoring further decline to 5.8%. And, the core inflation that excludes oil and food prices is seen lower at 5.4% vs. the former release of 5.8%.

A strong labor market in the United States and a rebound in the prices of used cars are expected to propel the employment cost index as the shortage of labor will be offset by higher employment proposals from firms. This could trigger a rebound in the inflation projections as households with higher earnings in possession can lead to higher consumer spending. Bloomberg reported that average used-vehicle prices rose 2.5% in January according to data from Manheim.

Higher inflation rate to favor continuation of policy tightening by the Fed

The street started expecting that the decline in consumer spending and scale of economic activities will result in a pause in the policy tightening spell by the Federal Reserve (Fed). However, renewed concerns of a rebound in inflation projections have faded the policy tightening expectations. Fed chair Jerome Powell has vouched for further interest rate hikes last week as a consideration of tightening relaxations or rate cuts could be premature at the current stage.

Meanwhile, hawkish commentary from Philadelphia Fed President Patrick Harker has infused fresh blood into the US Dollar. Fed Harker reiterated his view that the central bank will continue hiking interest rates to above 5%. The Fed policymaker has favored a small interest rate hike and sees no recession ahead. Also, the expression of a rate cut is unlikely this year.

Eurozone GDP is in focus

After recording signs of softening inflation in the Eurozone, investors are shifting their focus towards the release of the Gross Domestic Product (GDP) (Q4) data, which will release on Tuesday. As per the consensus, the economic data for the quarterly and annual basis are seen similar to its former releases at 0.1% and 1.9% respectively. This indicates that the Eurozone economy has not seen a recession in CY2022. Also, European Central Bank (ECB) policymakers have been reiterating that Eurozone won’t face a deep recession, if it happens it would be shallow as the labor market is extremely solid.

EUR/USD technical outlook

EUR/USD has shifted its auction profile below the 61.8% Fibonacci retracement placed from January 6 low at 1.0483 to February 1 high at 1.1033) at 1.0694 on a two-hour scale. The major currency pair is expected to deliver more weakness as an auction shift below the 61.8% Fibo favors for a complete test of downside levels of Fibo placement. Also, the Euro is struggling to hold itself above the horizontal support placed from February 07 low at 1.0669.

The Euro bulls have faced barricades each time after encountering the 50-period Exponential Moving Average (EMA), which is at 1.0728, at the time of writing.

The Relative Strength Index (RSI) (14) witnessed hurdled around 60.00 and has now slipped into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.