EUR/USD remains weaker, approaches 1.2000

- EUR/USD stays on the defensive near the 1.20 key support.

- German, EMU Services PMI remain in the contraction territory in January.

- US ADP, ISM Non-Manufacturing next of relevance in the NA session.

The selling pressure around the European currency remains unabated for yet another session and forces EUR/USD to trade at shouting distance from the psychological support at 1.20 the figure on Wednesday.

EUR/USD focused on data, dollar

EUR/USD loses ground for the third consecutive session so far on Wednesday and approaches the key level at 1.20 on the back of the persistent soft tone in the risk complex vs. the firm demand for the greenback.

In fact, the dollar’s recovery finds extra legs in the move higher in US yields, with the 10-year benchmark hovering around the 1.11% area (from 1.06% on Monday).

In addition, the final January’s Services PMI in both Germany and the broader Euroland remained below the key 50 threshold in January, reinforcing the tough battle this sector is facing to leave behind the pandemic.

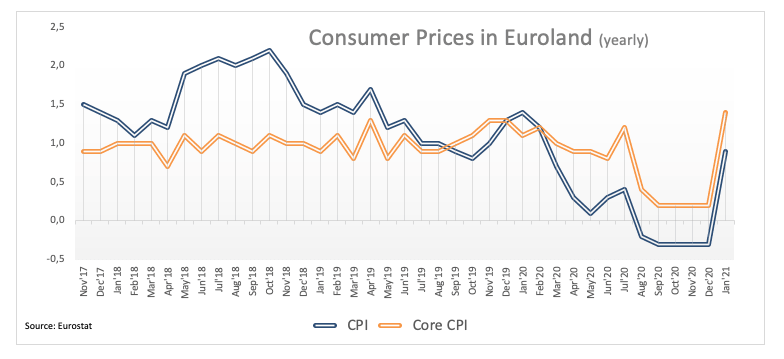

Further data in the region showed the inflation (stripping food and energy costs) – Core CPI - is expected to have gained 1.4% from a year earlier, while Producer Prices rose 0.8% MoM in December.

Across the pond, the monthly ADP report will take centre stage seconded by the Non-Manufacturing gauge by the ISM.

What to look for around EUR

The decline in EUR/USD is about to challenge the key 1.20 yardstick any time soon. While the outlook for the pair looks bearish in the very near-term, it remains constructive when comes to the longer run and is always supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is down 0.15% at 1.2024 and faces immediate contention at 1.2010 (2021 low Feb.3) seconded by 1.2000 (psychological mark) and finally 1.1976 (50% Fibo of the November-January rally). On the other hand, a breakout of 1.2173 (23.6% Fibo of the November-January rally) would target 1.2189 (weekly high Jan.22) en route to 1.2349 (2021 high Jan.6).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.