- EUR/USD keeps the optimism well and sound near 0.9870.

- EMU, Germany Economic Sentiment surprised to the upside.

- US Industrial Production expanded 0.4% MoM in September.

The buying interest in the single currency gathers extra impulse and lifts EUR/USD to the area of multi-session highs past 0.9870 on Tuesday.

EUR/USD stronger on USD-selling, risk appetite

EUR/USD remains well bid in the upper-0.9800s as the selling pressure around the greenback seems to have picked extra pace on Tuesday.

In addition, the prevailing risk-on mood continues to support the pair’s upside bias despite German yields now give away initial gains and return to the negative territory, adding to Monday’s decline.

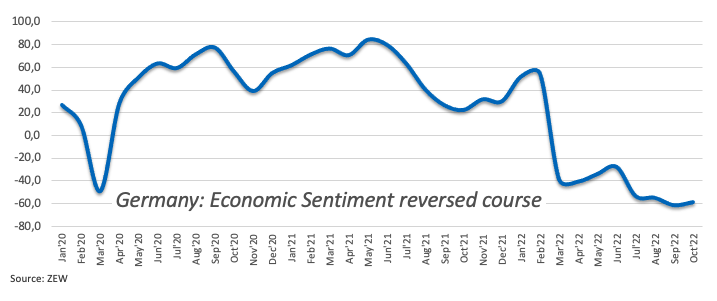

Extra support for the European currency also came after the Economic Sentiment measured by the ZEW institute in Germany and the Euroland unexpectedly came in above estimates in October, reversing at the same time the previous downtrend.

In the US, Industrial Production expanded at a monthly 0.4% in September and 5.3% from a year earlier. Next in the calendar comes the NAHB Index, TIC flows and the speech by Minneapolis Fed N.Kashkari (2023 voter, dove).

What to look for around EUR

EUR/USD remains in recovery-mode and now set sails to the 0.9900 neighbourhood amidst faltering price action surrounding the dollar.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. Following latest results from key economic indicators, the latter is expected to extend further amidst the ongoing resilience of the US economy.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: EMU, Germany ZEW Economic Sentiment (Tuesday) – EMU Final Inflation Rate, European Council Meeting (Thursday) - European Council Meeting, EMU Flash Consumer Confidence (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is gaining 0.23% at 0.9860 and expects the next resistance at 0.9875 (weekly high October 18) followed by 0.9999 (monthly high October 4) and finally 1.0050 (weekly high September 20). On the other hand, a breach of 0.9631 (monthly low October 13) would target 0.9535 (2022 low September 28) en route to 0.9411 (weekly low June 17 2002).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD declines toward 1.0850 after US data

EUR/USD extends its downward correction toward 1.0850 in the American session. The US Department of Labor reported that there were 222,000 first-time application for unemployment benefits last week, helping the USD hold its ground and causing the pair to stretch lower.

GBP/USD corrects to 1.2650 area on modest USD recovery

After touching its highest level in over a month at 1.2700, GBP/USD reversed its direction and declined toward 1.2650 on Thursday. The modest USD rebound seen following Wednesday's sharp decline makes it difficult for the pair to regain its traction.

Gold finds resistance near $2,400, retreats below $2,380

Gold advanced toward $2,400 on Wednesday as US Treasury bond yields pushed lower following the April inflation data. The recovery in US yields combined with the US Dollar's resilience after Jobless Claims data, however, causes XAU/USD to retreat toward $2,370 on Thursday.

Bitcoin likely to return to all-time high of $73,949, QCP Capital says

Bitcoin (BTC) price is likely to rally back to $74,000 in the coming weeks, it's all-time high reached in March, riding on three bullish catalysts, according to crypto trading firm QCP Capital.

BRICS, the West and the rest – global trade hubs and de-dollarization

World trade is fragmenting into opposing blocks, warns the IMF. The BRICS and their allies are distancing themselves from the West. BRICS are attempting to de-dollarize and replace SWIFT to circumvent the threat of sanctions.