EUR/USD prints fresh bull cycle highs, on course for 5-day rally

- EUR/USD bulls take on fresh bull cycle highs but bears are lurking.

- US CPI weakened the outlook for the US Dollar but a cohort of Fed speakers remain hawkish.

- Breakout traders could be feeling the heat of a sizeable correction in the coming sessions.

EUR/USD has popped to a fresh bull high following the day's Consumer Price Index data that inspired a breakout in the US Dollar to the downside. At the time of writing, EUR/USD is up by some 0.8% at the time of writing. The Single Currency has rallied from a low of 1.0726 to a high of 1.0867 so far.

Consumer Price Index data came in as expected on the whole, besides the one exception on a monthly basis in the headline number. The year-over-year CPI print landed at 6.5% or 0.6 of a percentage point cooler than the November number. The one exception was a positive surprise. On a monthly basis, the headline number actually decreased by a nominal 0.1% instead of remaining unchanged, as analysts expected.

However, St. Louis Federal Reserve leader James Bullard, following today's Consumer Price Index, stated that the most likely scenario is inflation remaining above 2%, so the policy rate will need to be higher for longer. Richmond Federal Reserve President Thomas Barkin said the last three months' inflation prints have been a "step in the right direction," but cautioned that while the average has dropped the median has stayed high.

EUR/USD correction on the cards?

While the move in the US Dollar has been strong, there are prospects of a correction and that spells danger for the in-the-money-EUR/USD longs. After all, today's data does not mean monetary policy can stop tightening just yet. Following the release of the latest inflation data, Philadelphia Fed President Patrick Harker said the central bank [Federal Reserve] should lift rates at 0.25% increments. The next Federal Reserve Rate announcement occurs on February 1. ''Several Federal Reserve officials have indicated they would like to see rates slightly above 5.0% which indicates a further three 25bp lifts,'' analysts at ANZ Bank noted.

Analysts at TD Securities said that they continue to think that the market is too optimistic on the pace of the decline in inflation, although they argued that ''an on-consensus print does not change the bigger picture narrative of a USD struggle. We are at a different point of the Fed and inflation cycle that makes USD upside a fade.''

On the other side of the spectrum, analysts at Brown Brothers Harriman argued that ''core PCE has largely been in a 4.5-5.5% range since November 2021 and we think the Fed needs to see further improvement before even contemplating any sort of pivot.''

''WIRP suggests a 25 bp hike February 1 is fully priced in, with nearly 30% odds of a larger 50 bp move. Another 25 bp hike March 22 is fully priced in, while one last 25 bp hike in Q2 is nearly 45% priced in that would take the Fed Funds rate ceiling up to 5.25%. However, the swaps market continues to price in an easing cycle by year-end and we just don’t see that happening.''

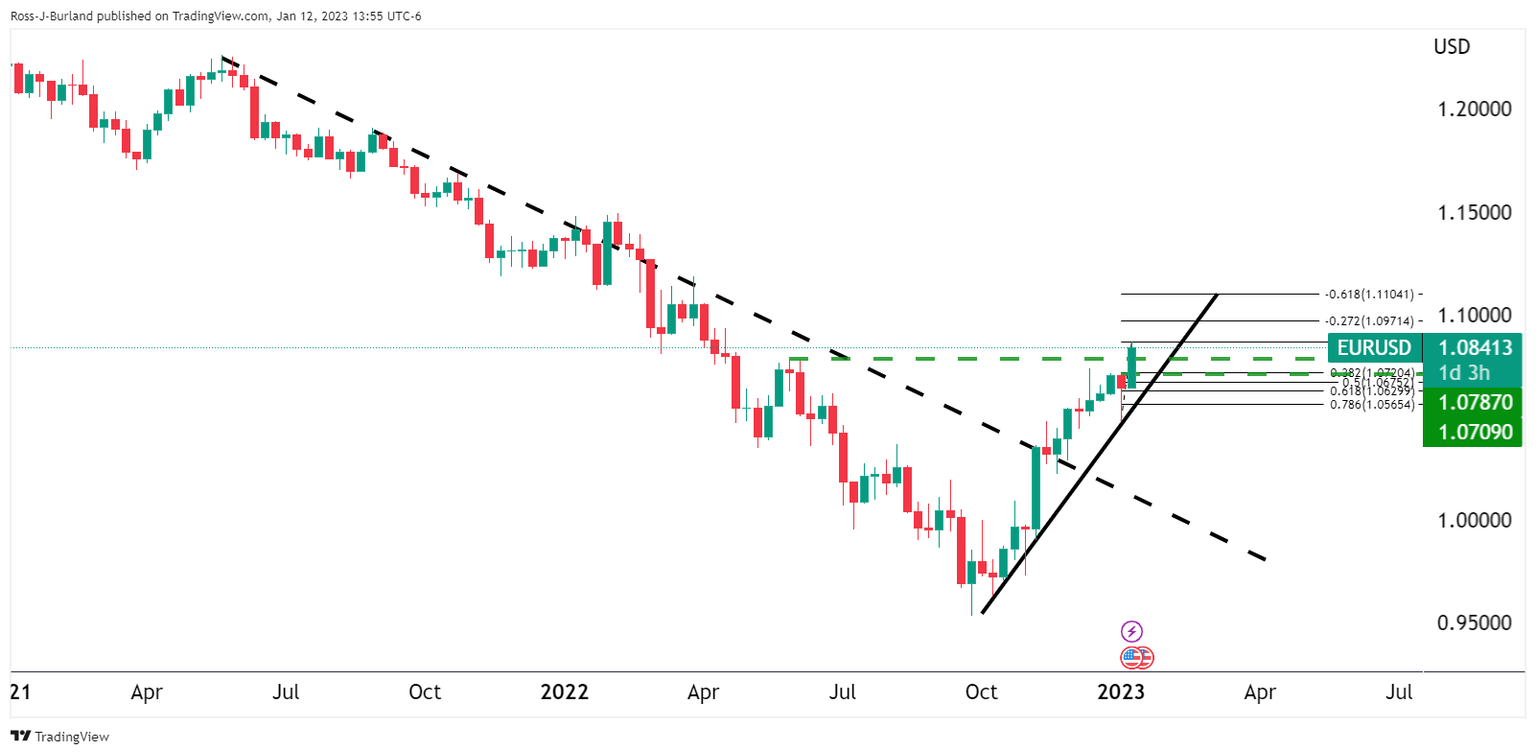

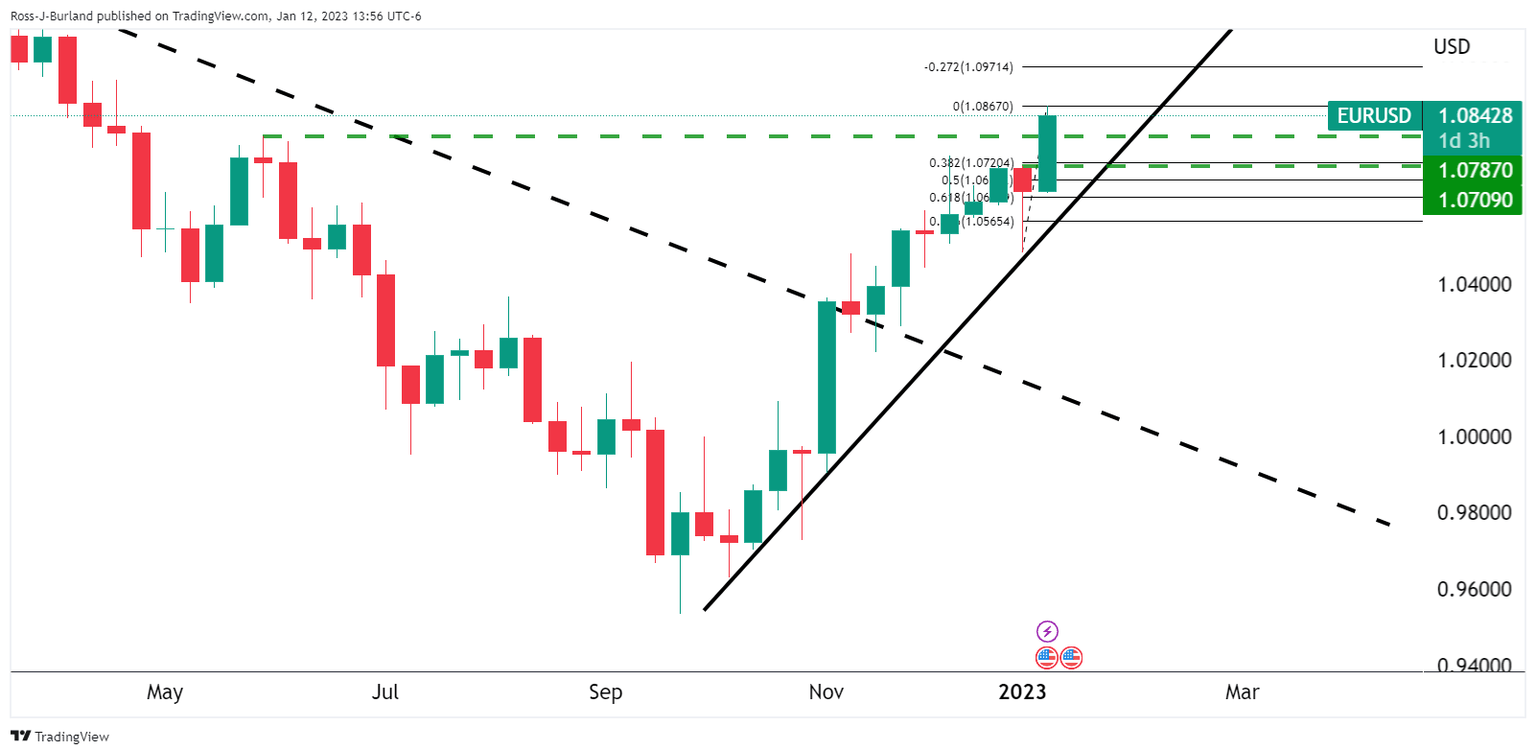

EUR/USD technical analysis

Breakout traders are triggered in and while there is scope for the upside, a correction could be on the cards that will tap into the in-the-money-longs and potentially ignite a capitulation of the bulls.

This puts the downside thesis into play as follows:

The W-formation, while overextended, is still within the parameters of being bearish and that puts the 1.0720s in focus for the meanwhile. A break there opens risk to the trendline support further ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.