EUR/USD Price Analysis: The focus shifted to the 1.0814 level

- EUR/USD remains under pressure around 1.0840.

- Further downside exposes the Fibo retracement at 1.0814.

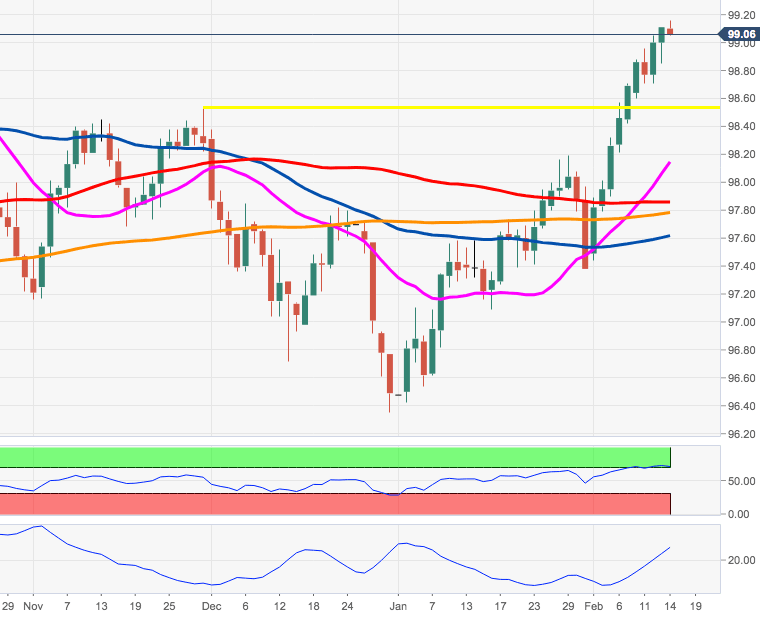

The sell-off in EUR/USD seems to have met some (lasting?) contention in the 1.0830/25 band, or new 2020 lows recorded during early trade.

The increasing selling bias has now opened the door to a potential visit to 1.0814, the 78.6% Fibo retracement of the 2017-2018 rally.

In the meantime, while below the 55-day SMA, today ay 1.1072, further downside should remain well on the table.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.