EUR/USD Price Analysis: Rebounds firmly from above 1.0700 as focus shifts to US Employment

- EUR/USD has shown a decent recovery from 1.0700 after witnessing sheer volatility in the USD index.

- Eurozone headline and core inflation are seen declining to 6.3% and 5.5% respectively.

- EUR/USD is attempting a breakout of the Descending Triangle chart pattern.

The EUR/USD pair has shown a decent recovery after defending its immediate support around 1.0700 in the Asian session. A recovery move in the major currency pair is being supported by a sell-off in the US Dollar Index (DXY). The USD index has slipped firmly below 104.20 as a raise in the US debt-ceiling is weighing heavily.

This week, the USD Index will be guided by the US Employment-linked economic indicators. From job openings to hiring figures, the entire gamut will portray current labor market conditions.

Meanwhile, the Euro bulls will also remain in action amid the release of the preliminary Eurozone inflation data (May). As per the consensus, headline inflation is seen declining to 6.3% vs. the former release of 7.0%. Core inflation is expected to show a minor deceleration to 5.5% against the prior release of 5.6%.

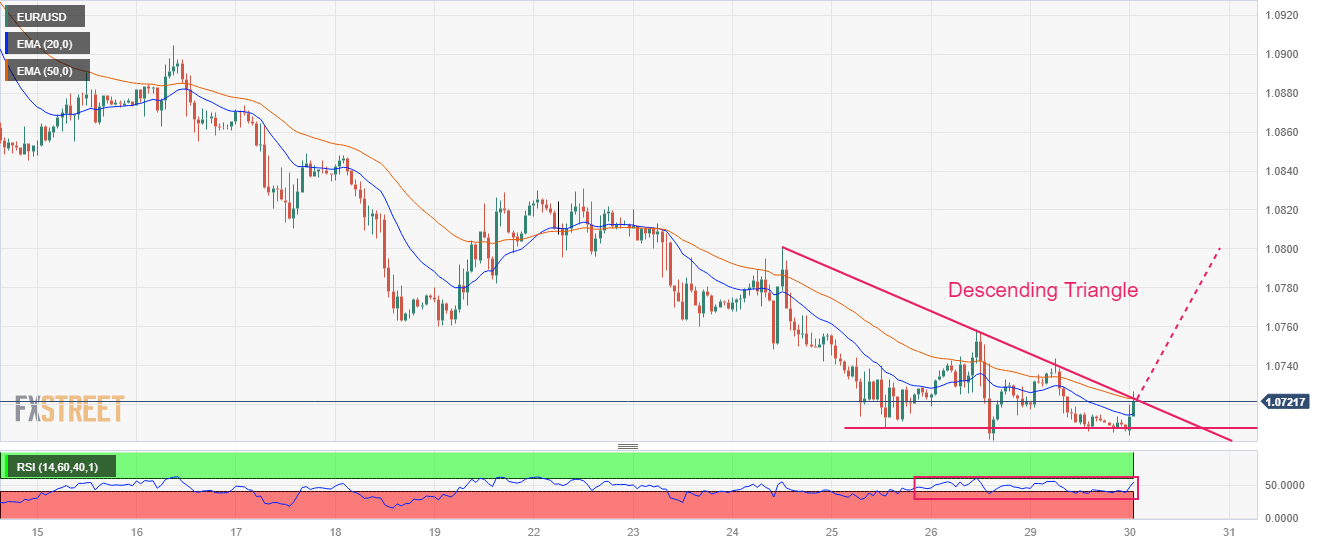

EUR/USD is attempting a breakout of the Descending Triangle chart pattern formed on an hourly scale. The downward-sloping trendline of the aforementioned chart pattern is potted from May 24 high around 1.0800. Horizontal support of the chart pattern is placed from May 25 low at 1.0707.

The shared currency pair has climbed above the 20-period Exponential Moving Average (EMA) at 1.0715 and is aiming to shift auction above the 50-EMA at 1.0724.

A break into the 60.00-80.00 range by the Relative Strength Index (RSI) (14) will trigger the upside momentum.

Should the asset break above the day’s high at 1.0726, Euro bulls would drive the major currency pair toward May 19 low at 1.0760. and the round-level resistance at 1.0800.

In an alternate scenario, the downside move will resume if the shared currency pair drops below the round-level support of 1.0700. This will drag the asset toward March 13 low at 1.0650 followed by March 03 low at 1.0588.

EUR/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.