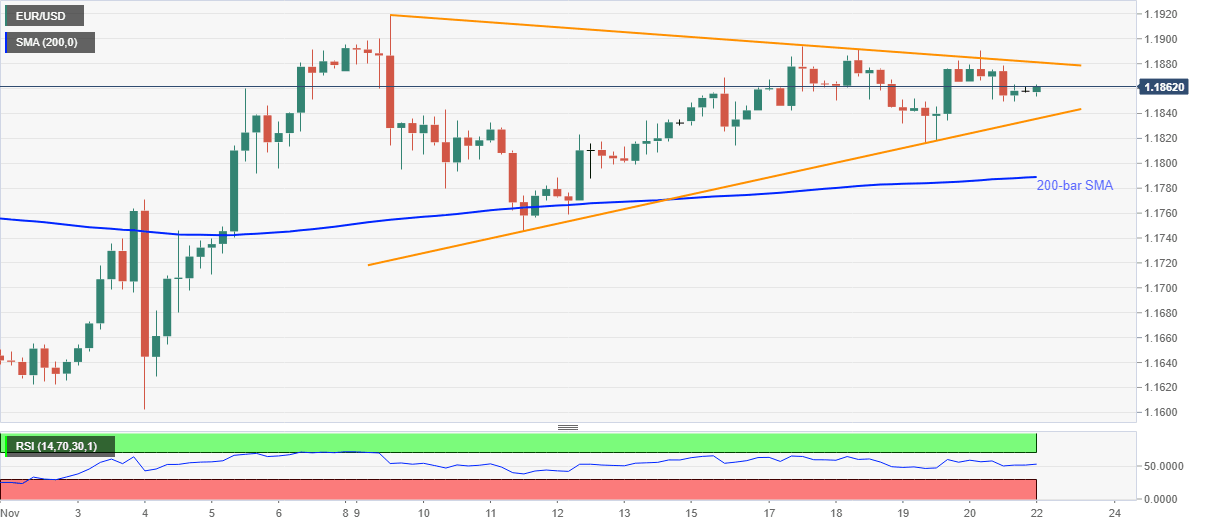

EUR/USD Price Analysis: Picks up bids inside two-week-old triangle around mid-1.1800s

- EUR/USD refreshes intraday high, stays inside short-term symmetrical triangle.

- Sustained trading above 200-bar SMA, normal RSI conditions favor bulls.

- November 04 high adds a filter to the downside, monthly high will offer additional resistance.

EUR/USD rises to 1.1860 during Monday’s Asian session. The major currency pair trades inside a symmetrical triangle since November 09 while keeping upside momentum beyond 200-bar SMA off-late.

With the RSI conditions not being oversold or overbought, the continuation of the latest recovery moves can be expected.

As a result, EUR/USD buyers currently eye the upper line of the stated triangle, at 1.1881 now, while targeting to refresh the monthly peak surrounding 1.1920.

It should, however, be noted that a clear break above 1.1920 will be enough for the bulls to challenge the yearly high marked in September around 1.2010.

Meanwhile, the pattern’s support line, at 1.1835 now, precedes a 200-bar SMA level of 1.1789 to probe the short-term downside. Also acting as a support is the November 04 high of 1.1770.

EUR/USD four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.