EUR/USD Price Analysis: Out of woods now as USD Index drops further, Eurozone Retail Sales eyed

- EUR/USD has come out of the woods after the USD Index extends its downside.

- Unlike US Manufacturing PMI, Services PMI has managed to maintain above the 50.0 threshold but landed lower at 50.3.

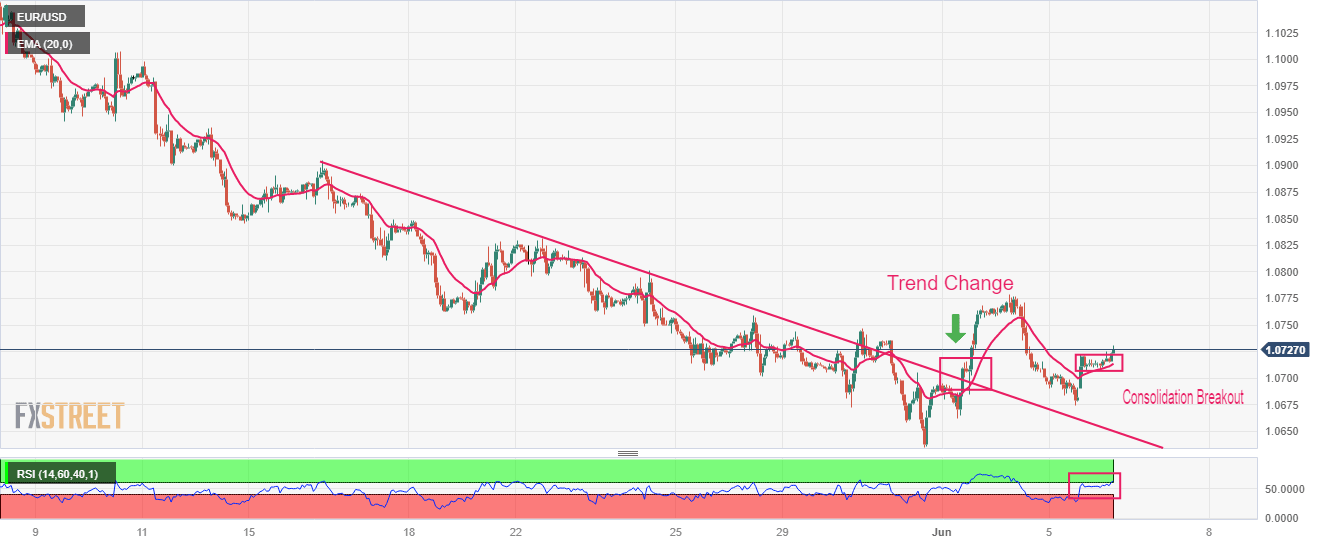

- EUR/USD has delivered a breakout of the consolidation formed in a narrow range of 1.0707-1.0724.

The EUR/USD pair has delivered an upside break of the consolidation formed in a narrow range below 1.0730 in the Asian session. The major currency pair has got strength as the US Dollar Index (DXY) has shifted its auction below 104.00.

The USD Index is attracting offers after the release of the downbeat United States ISM Services PMI. Unlike Manufacturing PMI, Services PMI has managed to maintain above the 50.0 threshold but landed lower at 50.3 than the expectation of 51.5.

Meanwhile, the Euro is expected to show a power-pack action amid the release of the Eurozone Retail Sales data (April). Monthly data is seen expanding by 0.2% vs. a contraction of 1.2% recorded last month. Annual data is seen contracting by 1.8% against a contraction of 3.8%.

On Monday, while speaking at the Hearing before the Committee on Economic and Monetary Affairs (ECON) of the European Parliament in Brussels, European Central Bank (ECB) President Christine Lagarde reiterated that price pressure remains strong in the Euro area.

EUR/USD has delivered a breakout of the consolidation formed in a narrow range of 1.0707-1.0724 on an hourly scale. Earlier, the shared currency pair delivered a break above the downward-sloping trendline from May 16 high at 1.0904, which resulted in a bullish reversal.

The 20-period Exponential Moving Average (EMA) at 1.0714 is providing a cushion to the Euro bulls.

Adding to that, the Relative Strength Index (RSI) (14) has jumped into the bullish range of 60.00-80.00, indicating more upside ahead.

Going forward, a decisive break above May 30 high at 1.0746 will drive the asset towards June 02 high at 1.0779 followed by the round-level resistance at 1.0800.

In an alternate scenario, the downside move will resume if the shared currency pair drops below the June 05 low at 1.0675. This will drag the asset towards May 31 low at 1.0635 followed by March 03 low at 1.0588.

EUR/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.