EUR/USD Price Analysis: Further consolidation looks likely near-term

- EUR/USD reverses the initial optimism and fades the move to 1.1870.

- The pair met solid support in the vicinity of 1.1740 (Thursday).

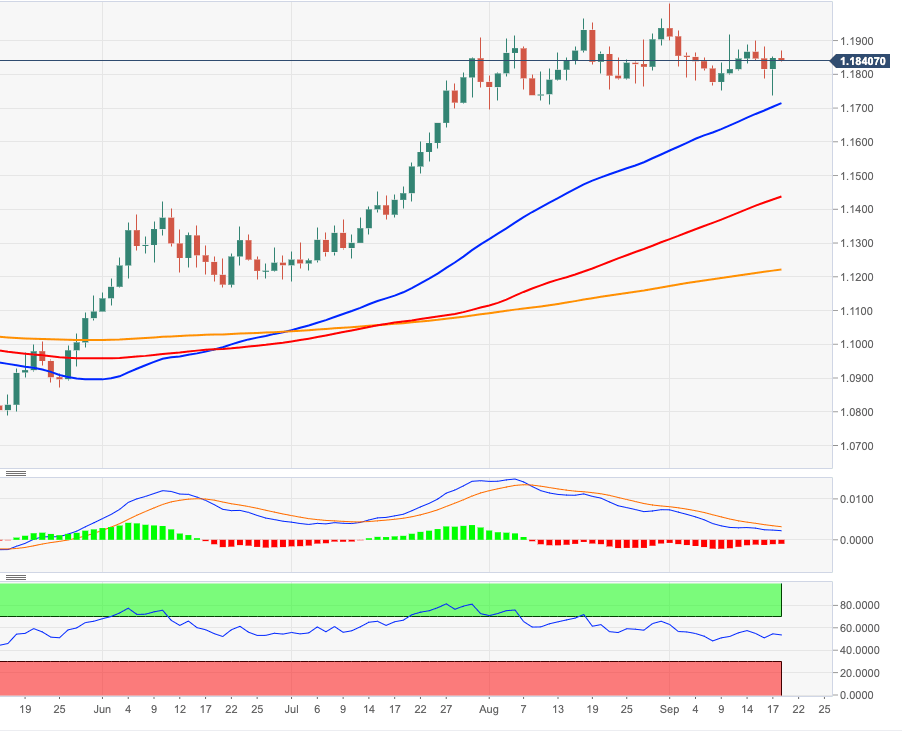

EUR/USD alternates gains with losses on Friday, now dropping to the negative territory after the failed attempt to advance beyond daily highs near 1.1870.

Next on the upside appears the 1.19 neighbourhood. If cleared, it could pave the wave for an initial test of recent peaks near 1.1920 ahead of the August top at 1.1965. On the flip side, the 1.1740 region, or monthly lows, remains the magnet for sellers ahead of the more relevant contention zone around 1.17, where converge late August lows and a Fibo level (of the 2017-2018 rally). The 55-day SMA, today at 1.1713, also reinforces this critical juncture.

Looking at the broader scenario, the bullish view on EUR/USD is expected to remain unchanged as long as the pair trades above the critical 200-day SMA, today at 1.1220.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.