EUR/USD Price Analysis: Eyes pullback after failure to beat macro trendline hurdle

- EUR/USD fails to take out a 12-year-long bearish trendline.

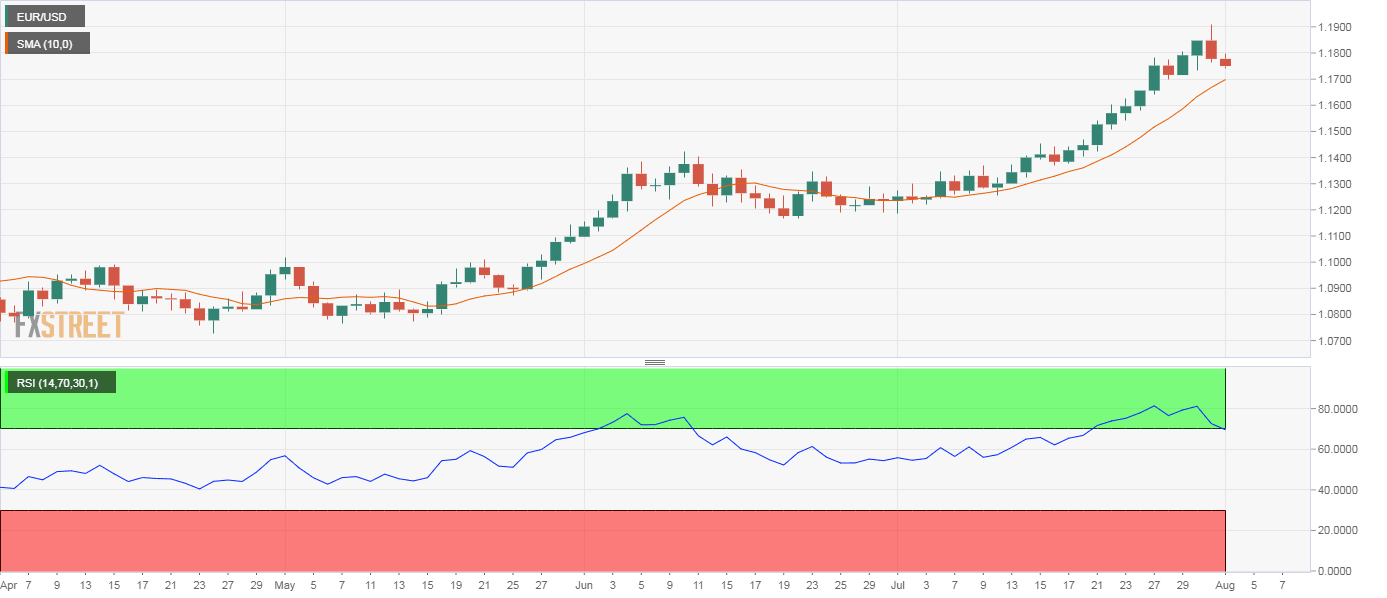

- Daily RSI continues to show overbought conditions for the euro.

EUR/USD is trading in the red near 1.1755 at press time, having hit a 26-month high of 1.1909 on Friday.

Notably, on Friday, the pair fell 0.60% and failed to close above the resistance of trendline falling from 2008 and 2014 highs.

That, alongside an overbought or above-70 reading on the relative strength index is indicative of ebbing of bullish momentum.

As such, the pair may test dip demand by testing the 10-day simple moving average (SMA), which is currently located at 1.1698.

Acceptance under that level could cause some buyers to exit the market, leading to a deeper decline toward 1.1495 (March 9 high).

Alternatively, the immediate bullish bias would be revived if the 10-day SMA support holds ground.

Daily chart

Weekly chart

Trend: Pullback underway

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.