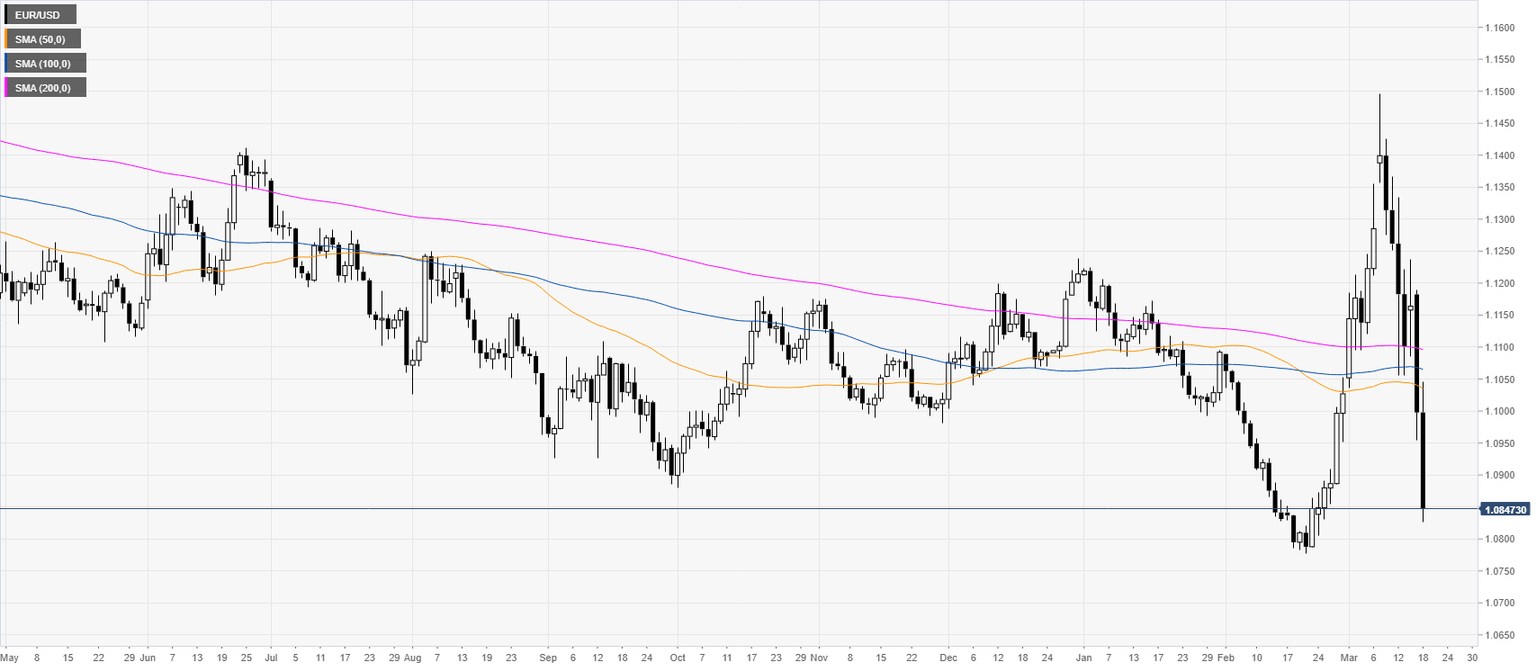

EUR/USD Price Analysis: Euro nearing 2020 lows, approaching 1.0800 figure

- EUR/USD is dropping on broad-based USD strength.

- EUR/USD is nearing the 2020 low currently located at the 1.0777 level.

EUR/USD daily chart

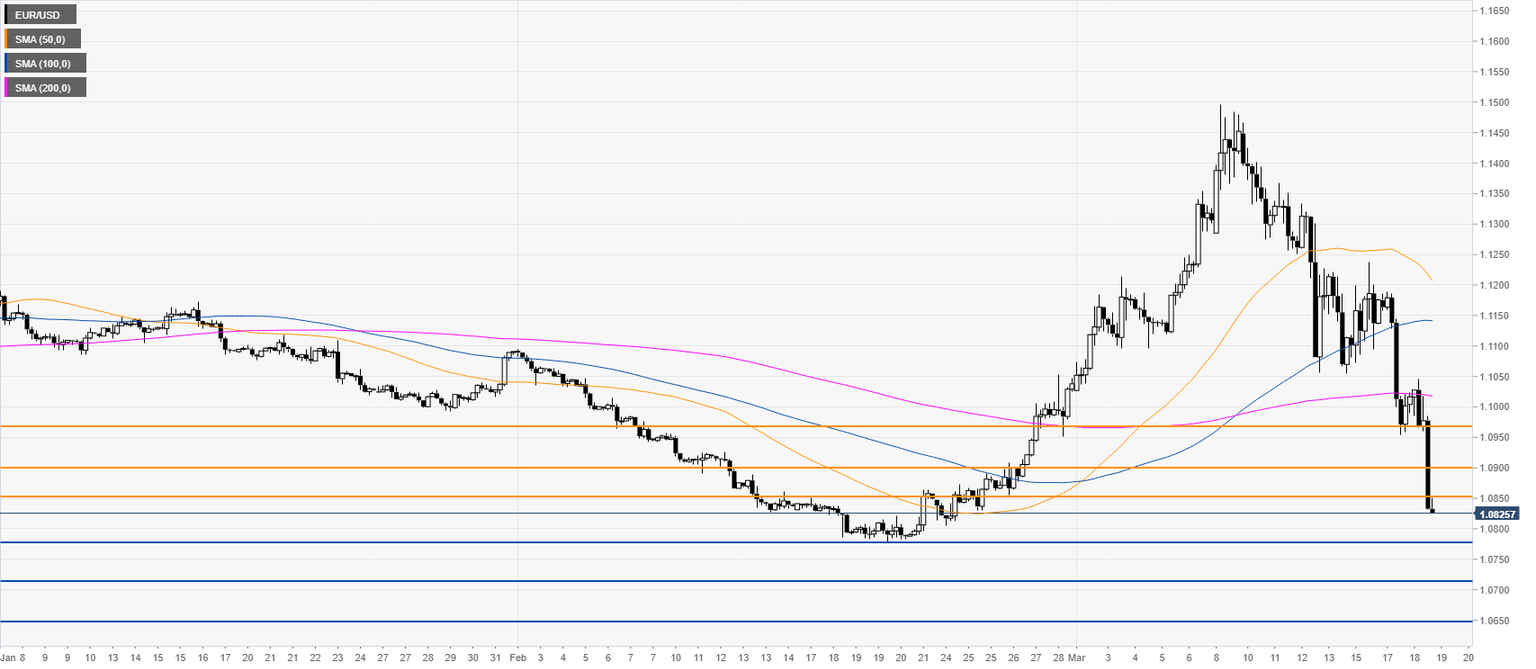

EUR/USD four-hour chart

Resistance: 1.0852, 1.0900, 1.0970

Support: 1.0784, 1.0716, 1.0650

Additional key levels

Author

Flavio Tosti

Independent Analyst