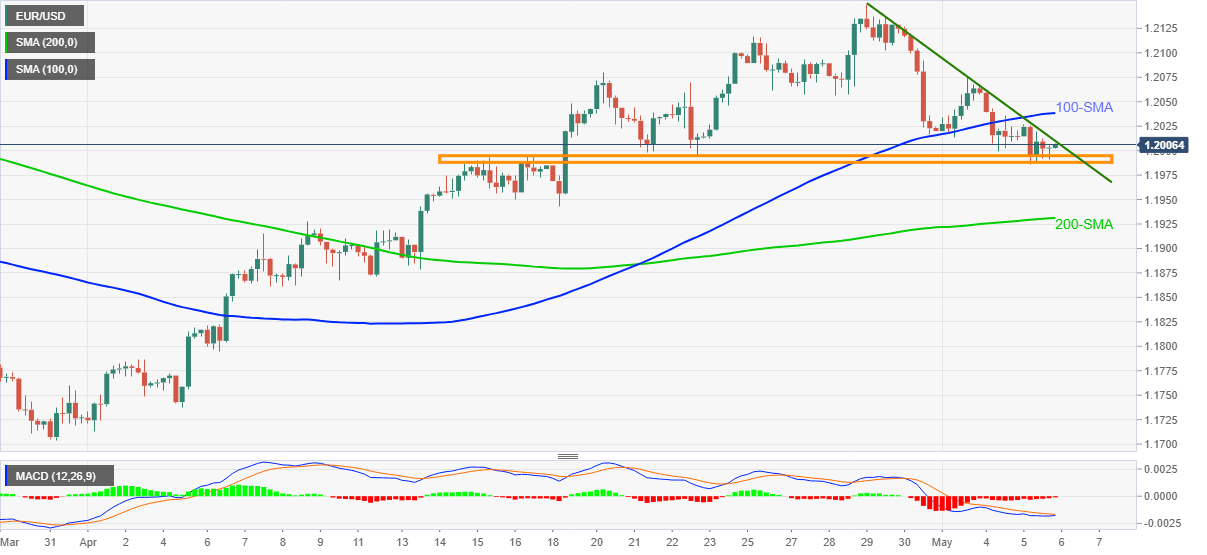

EUR/USD Price Analysis: Corrective pullback battles weekly resistance near 1.2000

- EUR/USD fades bounces off three-week-old horizontal support area.

- Sustained trading below 100-SMA, downbeat MACD keep sellers hopeful.

- 200-SMA adds to the downside filters, bumpy road to the north.

EUR/USD keeps rejecting the downside pressure from an immediate resistance line around short-term horizontal support, close to the 1.2000 threshold, amid early Asian session trading on Thursday.

The receding strength of the bearish MACD signals and the recent bounce off the key horizontal support keep EUR/USD buyers hopeful of breaking the adjacent resistance line close to 1.2010. However, sustained trading below 100-SMA and multiple hurdles to the north test the currency major pair’s short-term upside.

Among the resistances, 1.2055 and 1.2075-80 can immediately follow the 100-SMA level of 1.2040 to test the EUR/USD bulls. Also challenging further advances is the 1.2100 threshold and the previous month’s top near 1.2150.

Meanwhile, a downside break of 1.1990 will quickly fetch the quote to 1.1950 but a 200-SMA level of 1.1931 could test EUR/USD sellers afterward.

Overall, the EUR/USD prices remain vulnerable to the further downside but intermediate jitters can’t be ignored.

EUR/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.