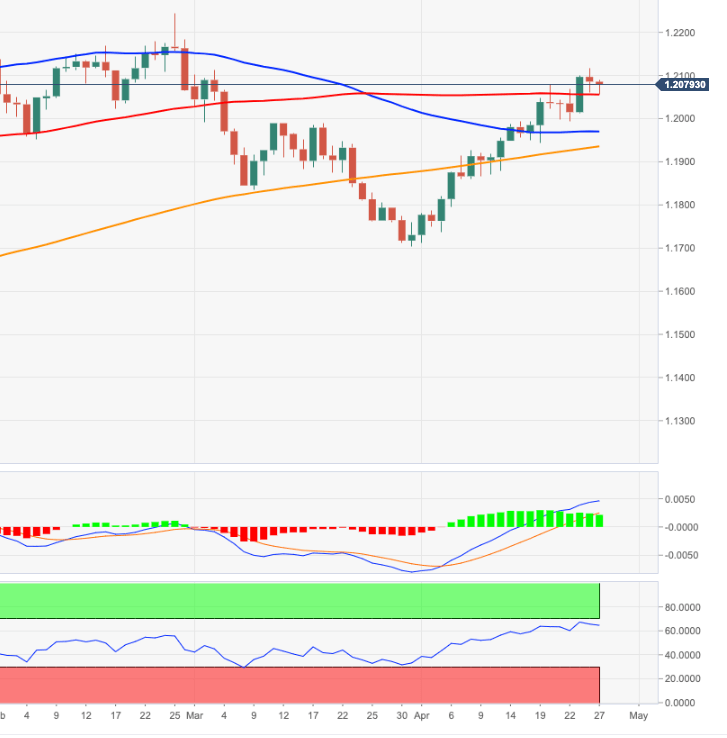

- EUR/USD stays volatile and below the 1.2100 mark on Tuesday.

- The resumption of the uptrend targets 1.2116.

EUR/USD briefly tested the 100-day SMA near 1.2050 before attempting a rebound to the vicinity of the 1.2100 hurdle so far on turnaround Tuesday.

In the near-term, a surpass of Monday’s monthly peaks in the 1.2115/20 band carries the potential to accelerate the upside to the February’s top at 1.2243.

Above the 200-day SMA (1.1926) the stance for EUR/USD is predicted to remain positive.

EUR/USD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates below 1.0900 following Wednesday's rally

EUR/USD trades in a tight range below 1.0900 after registering impressive gains on Wednesday. The US Dollar struggles to stage a rebound following the CPI-inspired selloff as investors await mid-tier data releases and comments from Fed officials.

GBP/USD corrects lower after testing 1.2700

Following Wednesday's upsurge, GBP/USD stretched higher and touched a fresh multi-week high at 1.2700 in the Asian session on Thursday. With the market focus shifting to US Jobless Claims data, the pair corrects lower in the European trading hours.

Gold price drifts higher as US CPI inflation fuels Fed rate cuts

The Gold price gains traction amid the weaker US Dollar on Thursday. The recent CPI report showed inflation in the US slowed in April, prompting market players to increase their bets on the US Fed rate cuts this year.

Bitcoin likely to return to all-time high of $73,949, QCP Capital says

Bitcoin (BTC) price is likely to rally back to $74,000 in the coming weeks, it's all-time high reached in March, riding on three bullish catalysts, according to crypto trading firm QCP Capital.

Dow Jones Industrial Average soars 350 points, sets new all-time high as rate cut hopes surge

The Dow Jones Industrial Average clipped into a fresh all-time high on Wednesday, gaining almost nine-tenths of a percent during the US market session after US Consumer Price Index inflation slipped further back.