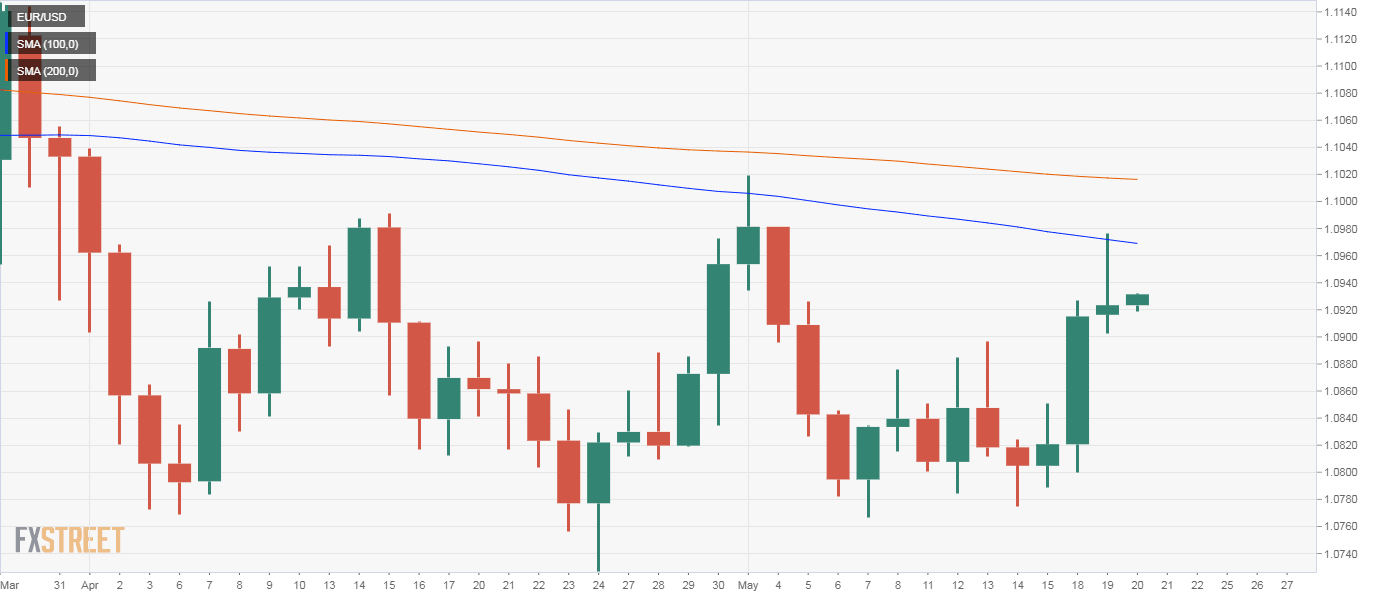

EUR/USD Price Analysis:100-day average again caps upside

- EUR/USD again faces rejection around the 100-day average hurdle.

- The immediate bias remains bullish with the pair holding above 1.0896.

EUR/USD is trading near 1.0930 at press time, having failed to keep gains above the 100-day average at 1.0968 on Tuesday.

The widely-tracked technical line was last put to test on May 1. On that day, buyers failed to absorb the selling pressure above the long-term average and the rejection proved costly. In the following four days, the spot reversed a major portion of the 1.0727 to 1.10 seen in the six trading days to May 1.

The latest rejection has so far failed to invite stronger selling pressure, leaving the pair mildly bid above the former resistance-turned-support at 1.0896 (May 13 high). That, alongside the bullish or above-50 reading on the 14-day relative strength index, suggests scop for a re-test of the average hurdle. A close higher could cause more buyers to join the market, leading to stronger gains, possibly to levels above the 200-day average at 1.1014.

However, if the pair drops below 1.0896, the buyer exhaustion signaled by Tuesday's candle with long upper wick would gain credence. In that case, stronger selling pressure may emerge, pushing the spot back to 1.08.

Daily chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.