EUR/USD loses the grip and tests 1.1830 post-NFP

- EUR/USD keeps the negative stance near the 1.1830/40 area.

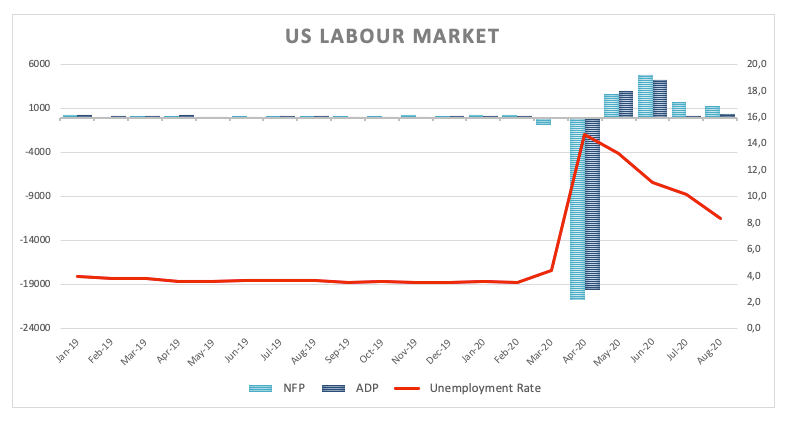

- US Nonfarm Payrolls rose by 1.371M jobs in August.

- The unemployment rate ticked lower to 8.4% from 10.2%.

The apathetic mood around the single currency remains well and sound, with EUR/USD hovering around the 1.1840 region in the wake of the US labour market report for the month of August.

EUR/USD stays capped by 1.1870 so far

EUR/USD keeps the neutral/bearish stance in the second half of the week after the US economy created 1.371 million jobs during last month, a tad below expectations for a gain of 1.4M jobs and down from July's 1.734M (revised from 1.763M).

Further data showed the jobless rate eased to 8.4% and the critical Average Hourly Earnings – a proxy for inflation via wages – expanded 0.4% MoM and expanded 4.7% over the last twelve months, both prints coming in above estimates.

What to look for around EUR

EUR/USD broke above the multi-day rangebound theme last week and managed to test the area just above 1.20 the figure on Tuesday. However, bulls failed to extend the rally further north, sparking a leg lower to the 1.1790 so far instead. In the broader picture, the bearish view on the dollar continues to sustain the underlying constructive bias in the pair, all accompanied by the improved sentiment in the risk-associated universe, auspicious results from domestic fundamentals – which have been in turn supporting further the view of a strong economic recovery following the coronavirus crisis – as well as US-China positive headlines. Also lending wings to the momentum around the euro appear the deal on the European Recovery Fund – which helped putting political fears within the bloc to rest (for now) – and the solid position of the current account in the region. In addition, the speculative community has supported the bullish stance on the euro for yet another week (as per the latest CFTC positioning report).

EUR/USD levels to watch

At the moment, the pair is losing 0.14% at 1.1834 and a move above 1.2011 (2020 high Sep.1) would target 1.2032 (23.6% Fibo of the 2017-2018 rally) en route to 1.2413 (monthly high Apr.17 2018). On the other hand, the next support aligns at 1.1789 (weekly low Sep.3) seconded by 1.1754 (weekly low Aug.21) and finally 1.1695 (monthly low Aug.3).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.