EUR/USD flirting with daily highs post-IFO, around 1.0840

- EUR/USD stays bid and tests highs around the 1.0840 region.

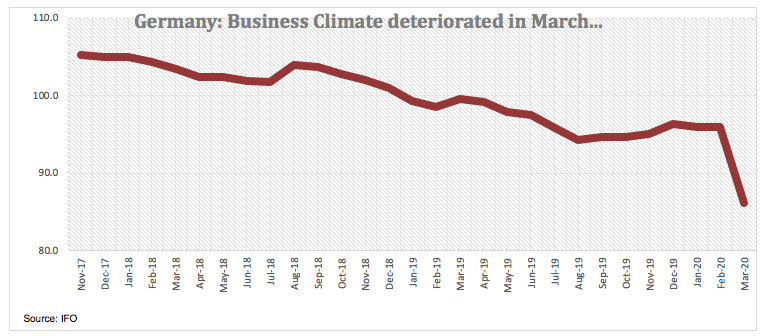

- German Business Climate debilitated to 86.1 during March.

- US Senate, Democrats and White House clinched stimulus deal.

The weekly recovery in the shared currency remains well and sound on Wednesday and is now pushing EUR/USD to the 1.0840/45 band, or daily highs.

EUR/USD bid on dollar weakness

EUR/USD is advancing for the fourth consecutive session on Wednesday, managing well to keep business above 1.0800 the figure always on the back of the persistent offered bias around the greenback.

In fact, the dollar stays on the defensive as market participants continue to gauge the looser monetary conditions following the Fed’s latest measures and after the White House, the US Senate and Democrats agreed on an extra stimulus package earlier in the session.

Data wise in Germany, the IFO survey reported that Business Climate dropped to 86.1 for the current month, along with the deterioration of Current Assessment (93.0) and Business Expectations (79.7), all components coming in below expectations.

Across the pond, the docket includes Durable Goods Orders, the House Price Index and the weekly report by the EIA.

What to look for around EUR

EUR/USD remains in recovery-mode at the beginning of the week, always following USD-dynamics, developments from the coronavirus and the response from central banks and governments. On the latter, the Fed’s latest round of stimulus plus the recently approved COVID-19 stimulus package have been collaborating further with the rebound in the pair via a weaker dollar. On the macro view, better-than-forecasted PMIs in both Germany and the broader Euroland opened the door to some respite in the prevailing downtrend of fundamentals in the region, although the underlying stance still remains well on the negative side.

EUR/USD levels to watch

At the moment, the pair is gaining 0.49% at 1.0839 and a breakout of 1.0881 (weekly high Mar.24) would target 1.0992 (monthly low Jan.29) en route to 1.1010 (55-day SMA). On the downside, the next support lines up at 1.0635 (2020 low Mar.23) seconded by 1.0569 (monthly low Apr.10 2017) and finally 1.0494 (monthly low Mar.2 2017).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.