EUR/USD plummets after US CPI data

- EUR/USD is trading a full percentage point lower after the release of US Consumer Price Index data for March.

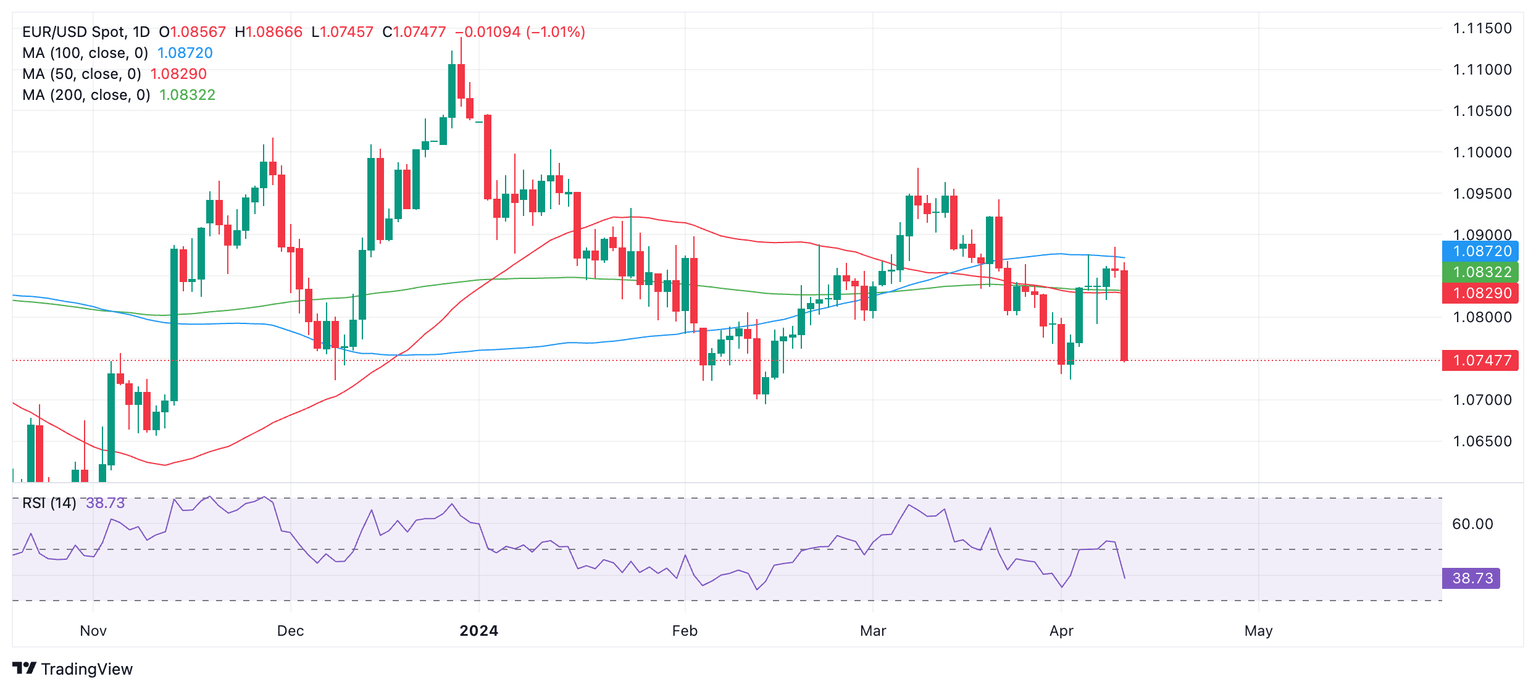

- The pair has broken out of the range it was trapped in between the 50, 100 and 200-day Simple Moving Averages.

- The ECB meeting on Thursday is likely to bring further volatility to EUR/USD.

EUR/USD is trading down a full percentage point in the upper 1.0700s, after the release of the US Consumer Price Index (CPI) data, on Wednesday.

The data showed warmer-than-expected inflation in March and lowers the probability that the US Federal Reserve (Fed) will implement an early interest-rate cut.

With interest rates expected to remain higher for longer the US Dollar (USD) gains a boost, as higher interest rates attract greater inflows of foreign capital.

The result is bearish, however for EUR/USD, however, as it measures the buying power of a single Euro in Dollar terms.

EUR/USD declines after US CPI data

EUR/USD is seeing volatility after the release of US CPI data which deviated significantly from expectations.

Data from the US Bureau of Labor Statistics showed prices in the US rose by 3.5% year-on-year in March when a 3.4% rise had been estimated. This comes after the 3.2% rise YoY in February.

CPI for core goods, which excludes volatile food and energy prices, rose by 3.8% YoY against 3.7% expected and 3.8% previous.

Both inflation metrics rose by 0.4% on a monthly basis in March, beating the 0.3% estimated.

The hotter-than-forecast inflation keeps price pressures well above the Federal Reserve’s (Fed) 2.0% target. It makes it even less likely the Fed will bring down interest rates from their current 5.5% level in June as had been predicted.

In contrast to the Fed, the European Central Bank (ECB) is seen as more likely to cut interest rates earlier amid more subdued growth and inflation expectations.

For EUR/USD, the maintenance of higher interest rates in the US compared to the Eurozone is a bearish factor. This is because relatively higher interest attracts foreign capital inflows, favoring the US Dollar in this case.

ECB meeting on the horizon

EUR/USD could experience further volatility on Thursday after the European Central Bank (ECB) holds its April policy meeting.

A few ECB members, such as the President of the Banque de France, François Villeroy de Galhau have mentioned April as a possible time for the ECB to implement a first interest-rate cut.

The majority of ECB members, however, think April is too early because the ECB will not yet have the latest wage data at hand, and wage inflation is seen as a critical input into their inflation models and decision-making process.

EUR/USD, however, could still be moved if the language in the accompanying statement suggests a higher probability of the ECB making an interest-rate cut in June.

Technical Analysis: EUR/USD crashes through 50 and 200-day SMAs

EUR/USD has broken out of the range it was previously trapped within by three significant Simple Moving Averages (SMA). The 50-day and 200-day Simple Moving Averages (SMA) were providing support and the 100-day SMA resistance just above.

EUR/USD has decisively broken below the lower cluster of MAs in the 1,0830s and is now moving down towards its downside target at support from the April 2 swing lows of 1.0725.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Apr 10, 2024 12:30

Frequency: Monthly

Actual: 3.8%

Consensus: 3.7%

Previous: 3.8%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.