EUR/USD finally breaks above 1.0300 to print 5-week highs

- EUR/USD surpasses the key 1.0300 level post-US CPI.

- Germany Final CPI rose 7.5% YoY in July.

- US CPI surprised to the downside at 8.5% in July.

EUR/USD sees its upside gathers further traction and advance to new multi-week peaks past the 1.0300 level on Wednesday.

EUR/USD boosted by USD-weakness

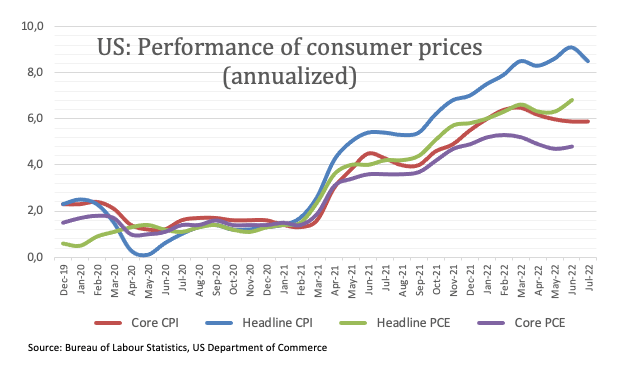

EUR/USD quickly left behind the key hurdle at 1.0300 the figure after US inflation figures tracked by the CPI disappointed expectations. Indeed, consumer prices rose 8.5% in the year to July, while the CPI excluding food and energy costs rose 5.9% from a year earlier, coming in also below initial estimates for a 6.1% YoY gain.

The pair’s sharp upside follows the equally abrupt – although in the opposite direction – decline in the greenback, as investors now perceive that the Federal Reserve might save a 75 bps rate hike for later and raise rates by half point instead at the September gathering.

On the latter, the probability of a 75 bps hike by the Fed in September shrank to around 27% from nearly 70% before the CPI data was published, according to CME Group’s FedWatch Tool.

What to look for around EUR

EUR/USD breaks above the 1.0300 hurdle with certain conviction helped by the intense drop in the dollar in the wake of lower-than-expected US CPI prints for the month of July.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

On the negatives for the single currency emerges the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Final Inflation Rate (Wednesday) – EMU Industrial Production (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is gaining 1.23% at 1.0340 and faces the next up barrier at 1.0346 (monthly high August 10) seconded by 1.0377 (55-day SMA) and finally 1.0615 (weekly high June 27). On the flip side, a break below 1.0096 (weekly low July 26) would target 1.0000 (psychological level) en route to 0.9952 (2022 low July 14).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.