EUR/USD extends the range bound theme in the low-1.1300s

- EUR/USD fails to advance further north of 1.1350 on Monday.

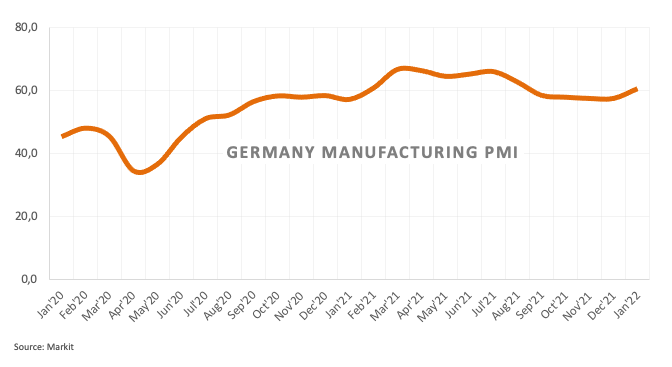

- Germany Flash Manufacturing PMI surprises to the upside in January.

- Advanced January PMIs also due across the pond later in the NA session.

EUR/USD trades on the defensive and leaves behind Friday’s decent gains on the back of the renewed buying interest around the US dollar.

EUR/USD remains supported by 1.1300 so far

EUR/USD maintains the consolidation well and sound at the beginning of the week, always underpinned by the 1.1300 neighbourhood amidst the better note in the greenback and despite another downtick in yields.

Indeed, the pair continues to look to dollar dynamics for price direction in the very near term, when the start of the Fed’s tightening cycle and the escalating effervescence in the Russia-Ukraine front keep dictating the sentiment among market participants.

In the domestic tap, Germany Flash Manufacturing PMI is expected to have improved to 60.5 for the current month, while the Services PMI is also seen bettering to 52.2. In the broader Euroland, the Manufacturing PMI came in at 59.0 and the Services gauge is predicted at 51.2.

Later in the NA docket, Markit will also publish its manufacturing and services gauges along with the Chicago Fed National Activity Index.

What to look for around EUR

EUR/USD seems to have met a tough barrier in the area below 1.1500 in mid-January, sparking a corrective downside soon afterwards in tandem with the strong recovery in the greenback. Moving forward, there is not much optimism around the pair, particularly in light of the Fed’s imminent start of the tightening cycle vs. the accommodative-for-longer stance in the ECB, despite the high inflation in the euro area is not giving any things of cooling down for the time being. On another front, the unabated advance of the coronavirus pandemic remains as the exclusive factor to look at when it comes to economic growth prospects and investors’ morale in the region.

Key events in the euro area this week: Flash PMIs in Germany, France and EMU (Monday) – Germany IFO Business Climate (Tuesday) – Germany GfK Consumer Confidence (Thursday) – Germany Advanced Q4 GDP, EMU Final Consumer Confidence.

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. ECB stance/potential reaction to the persistent elevated inflation in the region. ECB tapering speculation/rate path. Italy elects President of the Republic in late January. Presidential elections in France in April.

EUR/USD levels to watch

So far, spot is losing 0.16% at 1.1325 and faces the next up barrier at 1.1372 (10-day SMA) seconded 1.1482 (2022 high Jan.14) and finally 1.1505 (200-week SMA). On the other hand, a break below 1.1300 (weekly low Jan.21) would target 1.1272 (2022 low Jan.4) en route to 1.1221 (monthly low Dec.15 2021).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.