EUR/USD continues to oscillate above 1.0700 as investors prepare for Fed policy

- EUR/USD is displaying a sideways auction around 1.0720 as investors await Fed policy for fresh guidance.

- Federal Reserve could remain shy of hiking rates further to tame the consequences of the banking sector debacle.

- European Central Bank is likely to remain stick to bigger rates spell as inflation would remain higher for a longer period.

- EUR/USD is marching towards the potential resistance plotted from March around 1.0740.

EUR/USD is continuously juggling in a narrow range above the round-level support of 1.0700 in the Asian session. It seems that investors have been sidelined ahead of the interest rate decision by the Federal Reserve (Fed). Therefore, the major currency pair is mimicking the pre-Fed policy period and is likely to continue its sideways performance.

S&P500 futures are adding further gains, carry forwarding the recovery performance on Monday as investors cheered liquidity assistance from various financial institutions to First Republic Bank after solvency issues. It seems that investors are showing maturity in efforts made for easing financial instability, portraying a recovery in the risk appetite theme.

The US Dollar Index (DXY) is also demonstrating a lackluster performance around 103.30 as the street looks confused about the Federal Reserve’s monetary policy. The commentary has come from Futuristic carmaker Elon Musk that the Federal Reserve should cut interest rates by at least 50 basis points (bps). The rationale behind the commentary could be an expected recession due to sheer policy tightening.

Meanwhile, demand for US government bonds still looks weak as the return offered looks solid at higher levels. The 10-year US Treasury yields have been recorded at 3.5%, at the time of writing. Yields have been supported after the promise of a liquidity influx of $30 billion by various financial institutions to support the First Republic Bank.

Investors look ambiguous over Fed policy

Inflation in the United States is still stubborn despite the case of the declining trend for the past few months. Therefore, the Federal Reserve (Fed) is expected to continue its policy-tightening cycle to bring down inflationary pressures to the desired levels. However, fresh evidence of banking sector shakedown has alarmed that the United States economy could face a deep recession. Higher inflationary pressures would join hands with the banking sector fiasco, which would impact the scales of economic activities dramatically.

Apart from the interest rate policy, Federal Reserve chair Jerome Powell would also deliver the dot plot plan, a roadmap dictating further rate hikes to achieve price stability. The Federal Reserve is still sticking to its prior terminal rate projection of around 5.25%, therefore, no surprises are expected for the interest rate guidance.

ECB Lagarde escalates fears of higher inflation projections

The Euro remained extremely active on Monday amid the commentary from European Central Bank (ECB) President Christine Lagarde. European Central Bank Lagarde confirmed that Eurozone inflation would remain higher for a longer period and shifted the blame to rising wage pressures. She reiterated that wage pressures have strengthened on the back of robust labor markets and added that employees are aiming to recoup some of the purchasing power.

Upward guidance on Eurozone inflation has strengthened the case for the continuation of bigger rates from the European Central Bank. Investors should be aware that the European Central Bank hiked its interest rates by 50 bps to 3.5% last week despite the demise of Credit Suisse.

Apart from that, investors were curious about the exposure of Eurozone banks to the Credit Suisse debacle. On which, European Central Bank Lagarde claimed that Eurozone banks' exposure to Credit Suisse was in Euro millions, not billions, per Reuters.

EUR/USD technical outlook

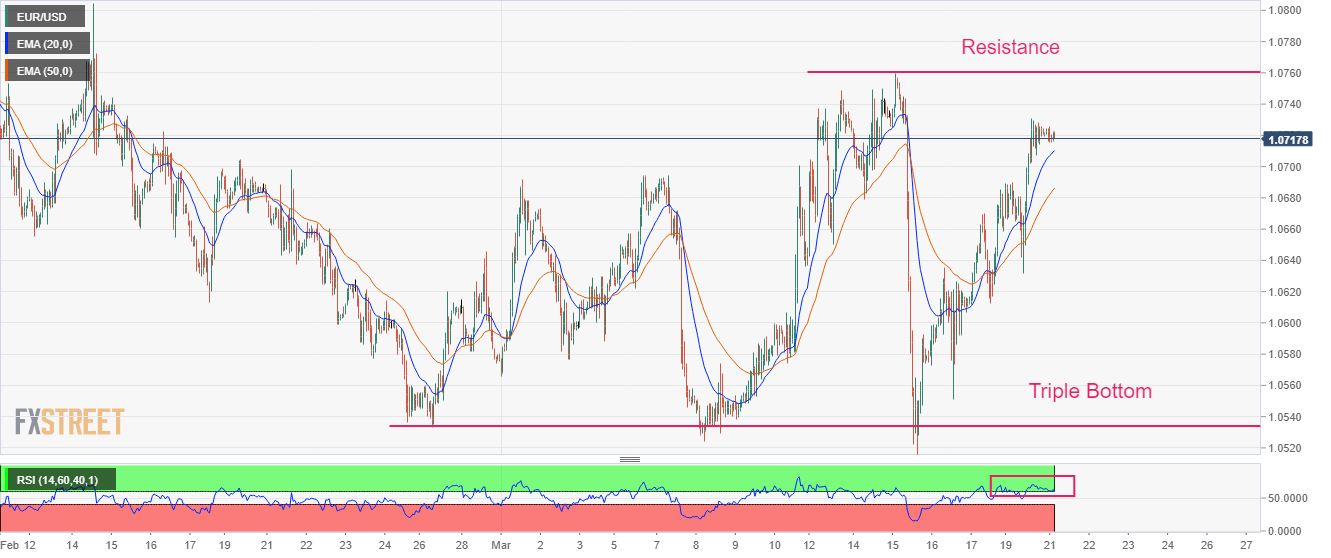

EUR/USD has displayed sheer strength after a Triple Bottom formation on an hourly scale. A Triple Bottom is a bullish reversal chart pattern that indicates an absence of selling pressure in the major currency pair while testing previous lows. The shared currency pair is marching towards the potential resistance plotted from March 15 high at 1.0740.

Upward-sloping 20-and 50-period Exponential Moving Averages (EMAs) at 1.0710 and 1.0687 respectively add to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.