EUR/USD clings to gains just above 1.1900

- EUR/USD gives some signs of life around 1.1900.

- The pair rebounds from the earlier drop to the 1.1885 level.

- German Producer Prices rose 1.5% MoM, 7.2% YoY in May.

The single currency remains under pressure despite the recovery attempt on Friday, with EUR/USD hovering around the 1.1900 neighbourhood following the opening bell in Euroland.

EUR/USD looks to USD-dynamics

EUR/USD appears to have met some decent contention in the 1.1880 region so far and looks to reverse a nearly 2% drop since the FOMC delivered an unexpected hawkish message at its event late on Wednesday.

Indeed, the pair found some buying interest around the Fibo level (of the November-January rally) near 1.1885 earlier in the session. The rebound is so far accompanied by a better tone in German 10-year yields, which re-visit the -0.20% on Friday.

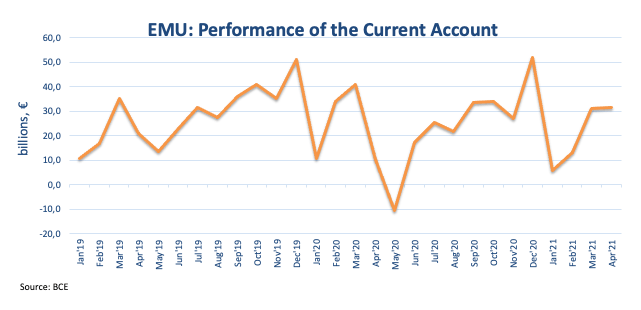

In the domestic calendar, German Producer Prices rose 1.5% MoM in May and 7.2% from a year earlier. additional data in the broader Euroland saw the Current Account surplus widening a tad to €31,4 billion (from €30,0 billion).

There are no data releases scheduled across the pond.

What to look for around EUR

EUR/USD plummets to fresh levels below the 1.1900 mark on Friday, always in response to the strong improvement in the sentiment surrounding the greenback exclusively following the FOMC event on Wednesday. In the meantime, support for the European currency comes in the form of auspicious results from fundamentals in the bloc coupled with higher morale, prospects of a strong rebound in the economic activity and the investors’ appetite for riskier assets.

Eminent issues on the back boiler: Asymmetric economic recovery in the region. Sustainability of the pick-up in inflation figures. Progress of the vaccine rollout. Probable political effervescence around the EU Recovery Fund. German elections. Investors’ shift to European equities.

EUR/USD levels to watch

So far, spot is gaining 0.10% at 1.1916 and faces the next up barrier at 1.1991 (200-day SMA) followed by 1.2035 (100-day SMA) and finally 1.2064 (38.2% Fibo retracement of the November-January rally). On the other hand, a breakdown of 1.1885 (monthly low Jun.18) would target 1.1835 (low Mar.9) and route to 1.1704 (2021 low Mar.31).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.