- EUR/USD breaks below the 0.9900 mark to new lows.

- The dollar remains well bid ahead of the FOMC event on Wednesday.

- EMU Flash inflation rose more than expected in October.

The single currency remains mired in the negative territory and drags EUR/USD to fresh multi-session lows in the sub-0.9900 region at the beginning of the week.

EUR/USD weaker on USD-recovery

EUR/USD accelerates its losses on Monday and breaches the key support at 0.9900 the figure, that is more than 2 cents down from last week’s monthly highs just below the 1.0100 barrier (October 27).

Indeed, the continuation of the strong recovery in the greenback keeps undermining the sentiment around the euro and favours extra decline in the pair, as investors get ready for the FOMC gathering on Wednesday, which will be the salient event of the week.

The daily drop in the pair comes in tandem with the small rebound in the German 10-year bund yields, which add to Friday’s bounce beyond 2.10% at the same time.

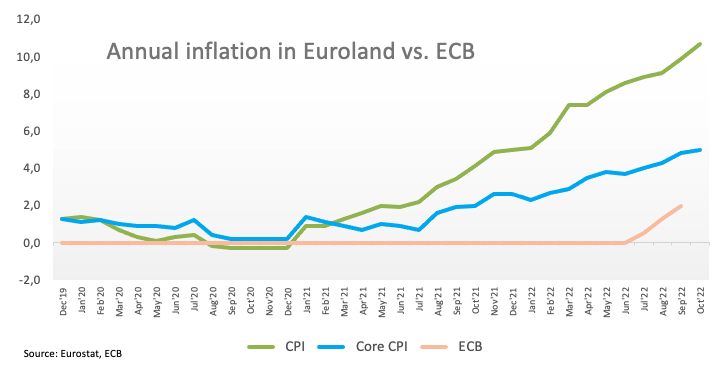

In the euro docket, advanced inflation figures in the euro area now see the CPI rising more than expected 10.7% in the year to October, while the Core CPI is seen gaining 5.0% from a year earlier.

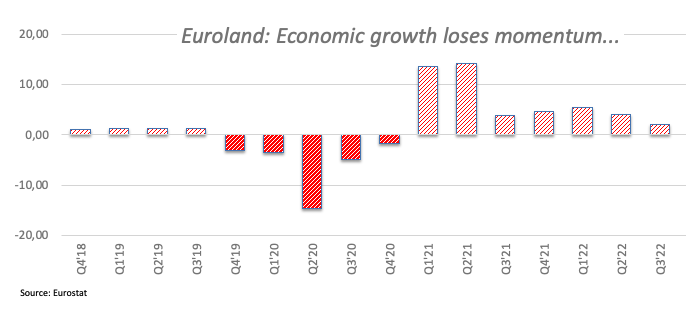

Still in the Euroland, the economy is predicted to expand 0.2% QoQ in Q3 and 2.1% on a yearly basis, according to preliminary results. In the first turn, German Retail Sales contracted 0.9% in September vs. the same month of 2021.

What to look for around EUR

EUR/USD extends a leg lower and breaks below the 0.9900 mark against the backdrop of persistent dollar strength on Monday.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The resurgence of speculation around a potential Fed’s pivot seems to have removed some strength from the latter, however.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the fragile sentiment around the euro in the longer run.

Key events in the euro area this week: Germany Retail Sales, EMU Flash Q3 GDP Growth Rate, Inflation Rate (Monday) – Germany Balance of Trade, Unemployment Change, Unemployment Rate, Final Manufacturing PMI, EMU Final Manufacturing PMI (Wednesday) – EMU Unemployment Rate (Thursday) – EMU/Germany Final Services PMI, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle vs. increasing recession risks. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.66% at 0.9899 and the breakdown of 0.9888 (weekly low October 31) would target 0.9704 (weekly low October 21) en route to 0.9631 (monthly low October 13). On the upside, there is an initial hurdle at 1.0093 (monthly high October 27) followed by 1.0197 (monthly high September 12) and finally 1.0368 (monthly high August 10).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD faces decent resistance near 0.6650

AUD/USD added to the positive tone seen on Monday and rose further north of 0.6600 the figure on the back of the weaker Dollar and positive developments in the commodity complex.

EUR/USD targets the 1.0880 zone ahead of US, EMU data

EUR/USD kept the bullish bias well in place for the second session in a row, leaving behind the 1.0800 barrier and the key 200-day SMA (1.0790) prior to key data releases in the EMU and US on Wednesday.

Gold regains its poise on broad US Dollar’s weakness

Following Monday's decline, Gold stages a rebound toward $2,350 on Tuesday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% after April producer inflation data, allowing XAU/USD to hold its ground.

Bitcoin price defends $61K with GameStop stock resurgence likely to generate renewed appetite for risk assets

Bitcoin (BTC) price tests the patience of traders as it glides along an ascending trendline on the four-hour time frame. Meanwhile, the GameStop saga that has resurfaced after three years distracts the market.

Is the US Dollar headed for a crash?

Ahead of the US CPI & Retail Sales report, I breakdown how to combine forex fundamentals with technicals to determine whether we've seen a US dollar top?